The Biden administration is inclined to oppose any move to lower the price cap on exports of Russian crude oil, despite a push by some European countries to squeeze Moscow’s revenues even more, according to people familiar with the matter.

(Bloomberg) — The Biden administration is inclined to oppose any move to lower the price cap on exports of Russian crude oil, despite a push by some European countries to squeeze Moscow’s revenues even more, according to people familiar with the matter.

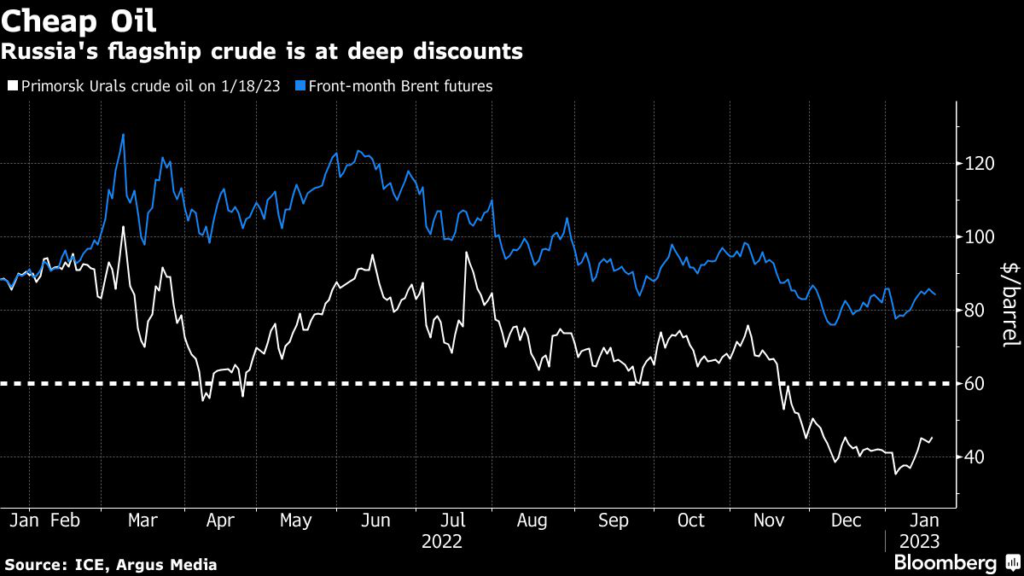

Russia’s flagship oil Urals is trading far below international prices — and the Group of Seven’s $60 per barrel cap that came into effect on Dec. 5. The European Union agreed to review the price cap every two months, starting in mid-January, with an aim to keep the threshold at least 5% below the average market price.

The US wants to wait until additional G-7 price caps on refined Russian fuels like diesel are in place next month before reevaluating the price for crude, according to a person familiar with US thinking, who added that Washington believes the caps will interact. Since unanimity is required to alter the threshold, the US stance makes it more likely the price for crude will remain at $60.

A number of EU members, particularly Poland and Estonia, have pushed for a lower cap to hit Moscow’s revenues, but others angled for a higher level, fearing the impact on their economies. Germany has told other EU nations that any price review should be done under a timeline that doesn’t risk confusing markets, according to people familiar with the discussions.

The EU’s price review discussion is expected to begin next week.

The price cap so far has been helping to tamp down the price Russia is getting for much of its oil. The Urals grade stood at $45.55 a barrel on Wednesday at the Baltic Sea port of Primorsk in the west of the country, according to data provided by Argus Media. The main Brent crude contract was at about $85.

Soaring shipping costs have been a major contributor to the price of Russian barrels sinking. The cargoes had to be discounted at the point of export in order to compete with Middle East producers for buyers in Asia.

The EU’s executive arm is expected to set out its position on the price cap review soon. Sweden’s foreign minister, Tobias Billström, said this week that the bloc should view that report before reaching a conclusion.

It is obvious that the cap is functioning and it is also obvious that we are now seeing a decrease in prices, he told Bloomberg during an interview in Davos, Switzerland. “But I would like to see the report before I make any final conclusions,” he said, adding that “at least there needs to be a debate on this.”

Changing the price would require unanimity among G-7 and EU nations.

The two groups are also due to discuss thresholds to set for Russian petroleum products before a related EU embargo kicks in early next month. The coalition is aiming to propose a price range for the caps in the coming days and EU ambassadors plan to discuss specific figures at a meeting next week.

G-7 Eyes Two Price Caps for Russian Refined Petroleum Products

That debate could provide governments who want to push for changes to the $60 price with an opportunity to do so. Any adjustment to the crude price cap could also affect the plan for refined products.

The cap on petroleum products would work similarly to the crude one, banning companies from the G-7 and European nations from providing shipping and essential services needed to transport the goods when they’ve been sold above the agreed levels.

An official from a G-7 government said the US was the leading force behind the price cap, and if it doesn’t want a revision, there won’t be one.

–With assistance from Alaric Nightingale and Jorge Valero.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.