Investors are flocking to emerging market funds like never before, while European stocks have seen their first inflows in almost a year as optimism abounds around China’s reopening, Bank of America Corp. strategists said.

(Bloomberg) — Investors are flocking to emerging market funds like never before, while European stocks have seen their first inflows in almost a year as optimism abounds around China’s reopening, Bank of America Corp. strategists said.

Developing market bond and equity funds had inflows of $12.7 billion in the week through Jan. 18, the biggest on record, according to a note from the bank citing EPFR Global data. European stocks had inflows of $200 million, their first in 49 weeks, while US equities had outflows of $5.8 billion.

The inflows came as “the world capitulates into China reopening,” strategists led by Michael Hartnett wrote, adding that market optimism has further to run. China’s Hang Seng Index has surged 50% since hitting a low in October.

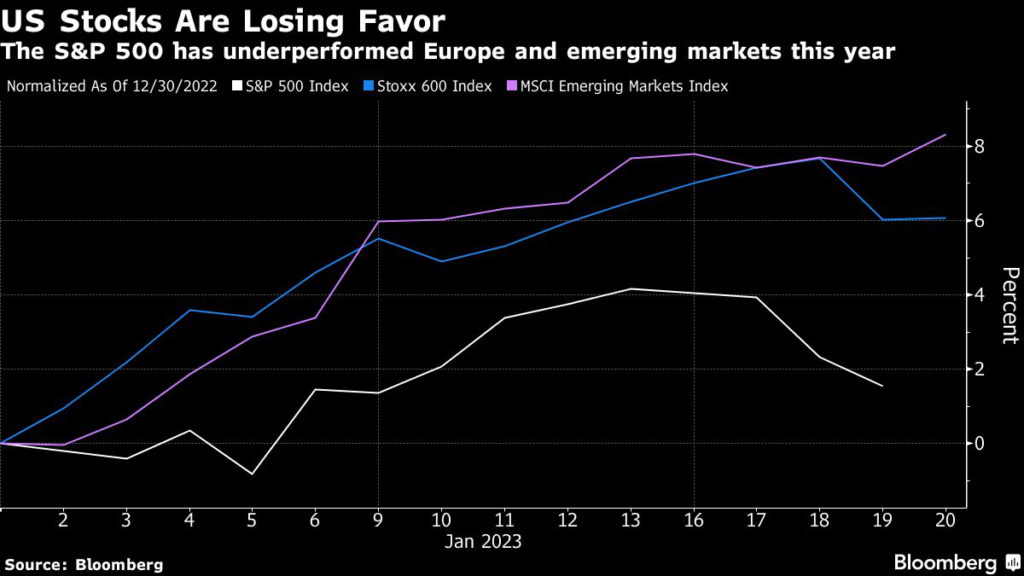

Global stocks have rallied this year as China’s pullback from its strict Covid Zero policy brightened the economic outlook, while a milder winter in Europe has spurred bets the bloc could still avoid a recession. US stocks, on the other hand, have underperformed as valuations remain relatively expensive against the backdrop of higher interest rates.

Hartnett said the market is “in the trickiest part of the investment cycle” as central banks approach the end of aggressive rate hikes while policy easing is not yet in sight. Meanwhile, the peak in inflation has passed but a recession hasn’t set in, and the prospect of economic expansion in China is taking hold at the same time as fears of a US recession abound.

It’s “little wonder Wall Street narratives are changing quicker than a TikTok video,” the strategist wrote.

Investor sentiment on US equities has soured in 2023, with top market strategists warning that record underperformance against Europe will continue.

“We have a starting point in Europe that’s cheap and an earnings backdrop that’s potentially a bit stronger,” Kasper Elmgreen, head of equities at Amundi SA, said in an interview in London on Thursday. “When we look at valuations versus bonds, its own history or the rest of the world, Europe still looks more attractive.”

Separately, UBS Global Wealth Management raised emerging market equities to “most preferred” and maintained a “least preferred” view on US equities in their asset allocation in a note dated Jan. 19.

Overall, global equity funds had inflows of $7.5 billion in the week, according to Bank of America’s note, while $14.4 billion was added to bond funds. By style, US small caps had additions, while large caps, growth and value funds saw outflows. Among sectors, materials had the biggest inflows as tech and financials saw redemptions.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.