Carlyle Group Inc. Co-founder David Rubenstein predicted that the pace of deals will pick up this year after a slow 2022, while Fidelity International CEO Anne Richards said the mood has lifted as the global elite in Davos digests the latest economic data.

(Bloomberg) — Carlyle Group Inc. Co-founder David Rubenstein predicted that the pace of deals will pick up this year after a slow 2022, while Fidelity International CEO Anne Richards said the mood has lifted as the global elite in Davos digests the latest economic data.

“People are probably leaving a little bit more positive than they came in,” Richards said in an interview with Bloomberg Television on the final day of the World Economic Forum.

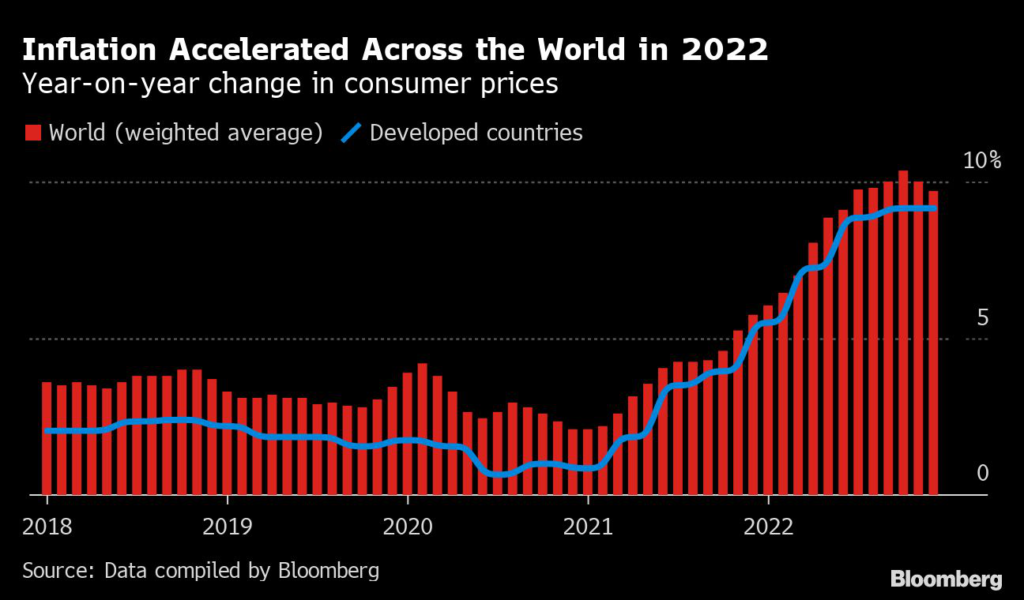

They were the latest voices expressing guarded optimism about the economic outlook, though central bankers also cautioned that the fight to get inflation back under control is far from over and IMF Managing Director Kristalina Georgieva said people shouldn’t get carried away.

Key Developments

- SNB’s Jordan Says Returning Inflation to 2% Is Not That Easy

- Summers Warns of 1970s Crisis If Central Banks Relent on Rates

- Davos Has It All Again, Except World’s Most Powerful Person

- Wall Street Spreads New Year Cheer With Upbeat Outlook at Davos

- The Cleantech Arms Race has Begun. Can it Save the Planet?

(All times CET)

‘Stay the Course’ Is Lagarde’s Policy Mantra (11:45 a.m.)

European Central Bank President Christine Lagarde said policymakers mustn’t let up in their battle with inflation — even as the spike in prices appears to have peaked.

Read more: ECB’s Lagarde Says ‘Stay the Course’ Is Her Policy Mantra

“We have to also stay that course of resilience that we observed in 2022,” she told a panel. “‘Stay the course’ is my mantra for monetary-policy purposes.”

Georgieva Cautions Against Excessive Optimism (11:30 a.m.)

Georgieva described the outlook for the world economy as “less bad than we feared a couple of months ago,” while stressing that “less bad doesn’t mean good.”

She noted improvements stemming from easing inflation and China’s Covid reopening, contributing to potential global growth of 2.7% this year. “Why should we be cautious? First, 2.7% by far is not fabulous. It’s the third-lowest growth rate in last decades. It’s not great.”

“Be careful not to get on the other side of the spectrum from being too pessimistic to being too optimistic,” Georgieva warned.

Rubenstein Expects More Deals (10:50 a.m.)

“There were fewer deals getting done last year than we would’ve liked,” Rubenstein told Bloomberg TV, noting that reflected caution among buyers given worries about potential recessions. “This year, I suspect, will be better.”

He said there was plenty of dry powder in the private equity industry and that difficult economic times are “the best time to invest.”

Staff Accepting Bonus Cuts, Richards Says (9:50 a.m.)

Fidelity’s Richards added to the general gloom around financiers’ wages, saying the latest pay round “was a tougher year for compensation than the previous year.”

Staff understand they share in the investment manager’s profit, “so in general I think our compensation round was well taken,” the CEO told Bloomberg TV. She said “the attrition environment has improved” as the economic outlook palls, which “means you don’t need to hire as many people.” She said the overall mood at Davos wasn’t exactly bubbly, but there’s a growing sense that “maybe we’re avoiding the really bad scenarios, the really deep recession risk.”

SNB’s Jordan Says 2% Inflation Is Tough (9:45 a.m.)

There was a debate on a Davos panel about whether inflation targets are realistic. Swiss National Bank President Thomas Jordan warned it may prove hard to keep price increases to the 2% goal because it’s difficult to break out of a wage-price spiral.

“Once inflation is high, pressure from wages is here,” he said, adding that companies are more aggressive about raising prices. The consequence is that it will be very hard to bring inflation from 4% to the target of 2% persistently.

But former US Treasury Secretary Larry Summers urged central banks to stick to the goal. Revising central bank inflation targets above 2% “would be a costly error that would have adverse effects for real economies and working people everywhere,” Summers said.

Summers Urges Central Banks to Stick to Data (9:25 a.m.)

Summers also urged central banks to avoid “excessive forecasting” of their policy trajectory or risk putting “their credibility at risk.” Instead, they should respond to the data.

He warned that spending is becoming “less sensitive to interest rates” as companies increasingly invest in intangible assets. That dynamic raises the question of whether “fiscal policy should be used more actively in stabilization policy.”

Algebris Sees ‘Sense of Relief’ on Inflation (9:20 a.m.)

Algebris Chief Executive Officer Davide Serra said that inflation has peaked and China’s reopening will be crucial for the world economy.

“In a world with so much debt, some inflation might be useful. But the pace of inflation is decelerating fast,” Serra said in a Bloomberg TV interview.

Given the slowdown in global banking, the biggest lenders are able to easily retain talent. “There is nothing to worry about” on staffing, Serra said.

Jordan Says Monetary Policy Got Too Loose (9:15 a.m.)

SNB’s Jordan said that with hindsight, global central banks kept policy too loose before last year’s consumer-price shock.

“We probably all underestimated inflationary pressures in 2021,” Jordan said on a panel. “Monetary policy was all in all a bit too expansionary.”

France Wants US Concessions on Climate Law (7:45 a.m.)

French Finance Minister Bruno Le Maire said the US must offer concessions to mitigate the impact of subsidies for American businesses in the Inflation Reduction Act, even as the European Union develops its own version of the legislation.

Read more: Le Maire Says US Wants to Oppose China, EU Wants to Engage It

Speaking to Bloomberg TV, he said Europe has a “two-track approach” in its response to the climate legislation, which he has in the past called a threat to fair competition.

“We are expecting some concessions from our American friends, but there is also another way which is to put in place a kind of European Inflation Reduction Act,” he said, adding that Europe needs to invest more in strategic sectors including electric car batteries, hydrogen and solar panels.

Congo Demands More From China Deal (6:40 a.m.)

Democratic Republic of Congo President Felix Tshisekedi criticized a $6.2 billion minerals-for-infrastructure contract with China, saying the world’s largest producer of a key battery metal hasn’t benefited from the deal.

Read more: Congo President Demands More From $6.2 Billion China Deal

“The Chinese, they’ve made a lot of money and made a lot of profit from this contract,” he said in an interview. “Now our need is simply to re-balance things in a way that it becomes win-win.” Most of Congo’s minerals end up in China, which signed a landmark deal with Tshisekedi’s predecessor in 2008 to trade roads and buildings for the two metals.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.