Nigeria is refusing to join an overhaul of the global taxation system it says is skewed to the interests of rich nations and could actually hurt the country’s tax revenues, Finance Minister Zainab Shamsuna Ahmed said.

(Bloomberg) — Nigeria is refusing to join an overhaul of the global taxation system it says is skewed to the interests of rich nations and could actually hurt the country’s tax revenues, Finance Minister Zainab Shamsuna Ahmed said.

The negotiations were not conducted on an equal footing, favored wealthy economies and created rules that are too complex for Nigeria to effectively implement, she told a panel at the World Economic Forum in Davos.

“If we sign up to this, it means we’re excluded from getting taxes from medium-sized companies that we now actually, by our own laws, have an opportunity to collect taxes from,” she said on Thursday.

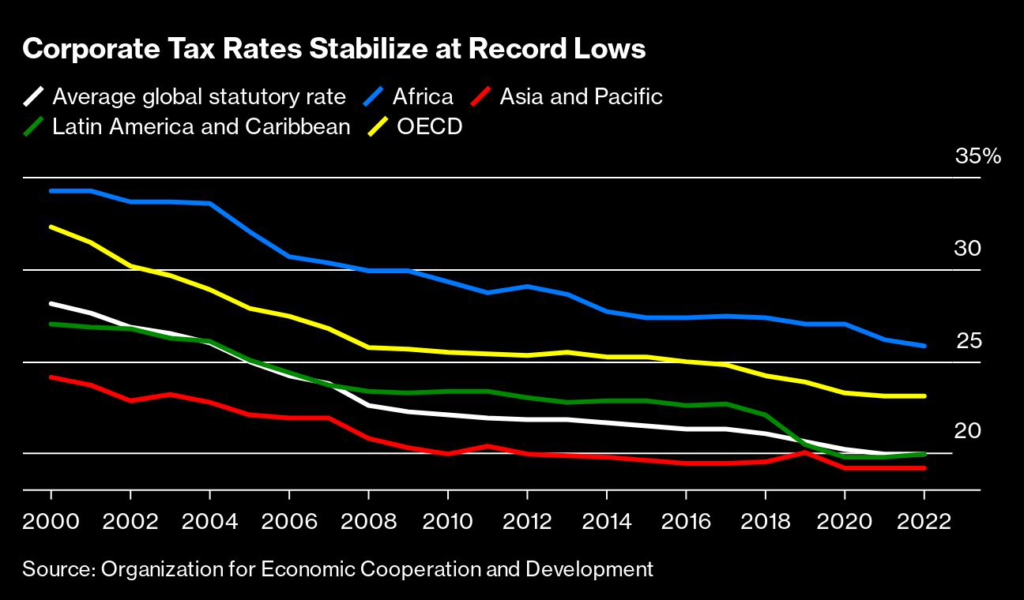

Nigeria’s continued holding out casts a shadow over the OECD-led initiative, which aims to set a minimum corporate tax rate at 15% and share out rights to tax the world’s biggest firms more fairly. Analysis released Wednesday by the Paris-based organization showed governments around the world could gain around $250 billion a year in extra revenue by enacting the two-part deal.

Speaking on the same panel, OECD Secretary General Mathias Cormann said the organization estimates that Nigeria could get substantially more revenue if it joins the deal, which has been signed by around 135 countries. He added that Nigeria has one of the lowest tax-to-GDP ratios in the world, at 5.6% compared to about 16% among its African peers.

“Will everybody unanimously say this is the best thing since sliced bread?” Cormann said. “No, but is it substantially better than what we currently have? Yes.”

(Updates with Nigeria tax-to-GDP ratio in fifth paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.