Forecasters now expect US economic activity to contract over consecutive quarters in the middle of this year as steep interest-rate hikes from the Federal Reserve cascade more broadly across the economy.

(Bloomberg) — Forecasters now expect US economic activity to contract over consecutive quarters in the middle of this year as steep interest-rate hikes from the Federal Reserve cascade more broadly across the economy.

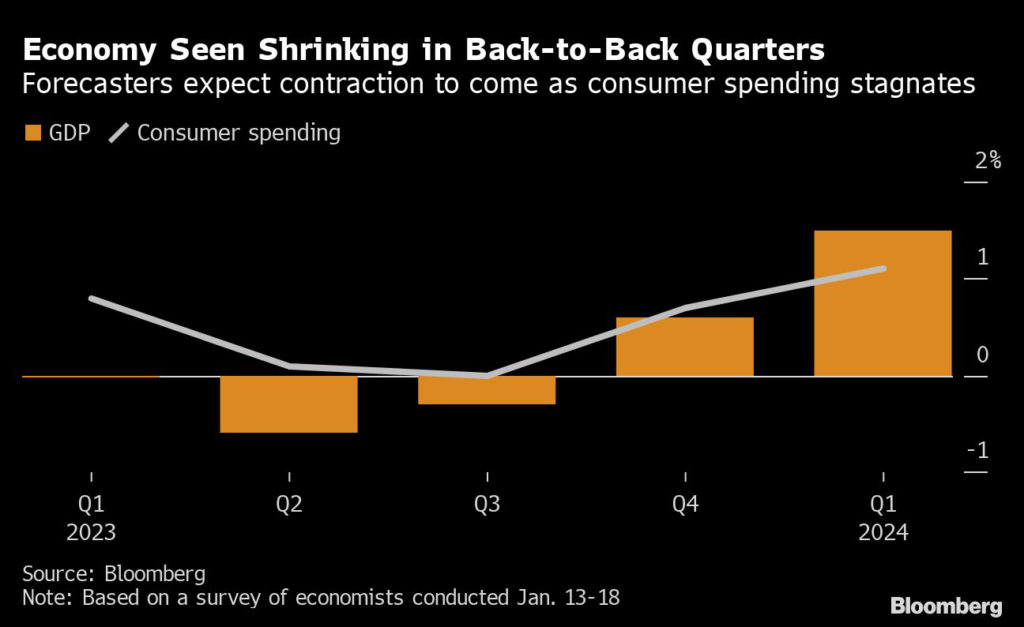

Gross domestic product is seen falling at a 0.6% annualized rate in the second quarter and 0.3% in the third as consumer spending stagnates, business investment wanes and industrial production weakens, according to a Bloomberg survey of 73 economists conducted Jan. 13-18.

Forecasters put the probability of a recession over the next year at 65%.

“Recession worries are mounting in the US as the Federal Reserve continues hiking interest rates,” said James Knightley, chief international economist at ING. “With more companies adopting a defensive posture we expect to see hiring and investment plans cut back aggressively.”

Economists forecast the unemployment rate to climb from a five-decade low of 3.5% to nearly 5% by the end of the year as businesses reduce headcount to control costs. Payrolls are expected to fall 45,000 a month on average in the second quarter and then by 104,000 in the July-September time frame.

That would represent a big shift for a labor market that has so far shown few signs of weakening. Employers added nearly a quarter million jobs in December and applications for unemployment insurance remain historically low.

A resilient job market helps explain why some economists are betting the US will be able to skirt a recession.

Indeed, wages are still expected to grow at a solid pace through much of this year, according to the Bloomberg survey. While economists did revise down their expectations for the personal consumption expenditures price index — the Fed’s preferred gauge — and the consumer price index, inflation is expected to end the year well above the Fed’s 2% target.

Thus, while price pressures are seen notably cooling this year, the Fed is expected to keep its benchmark interest rate elevated for quite some time. Economists surveyed see the federal funds rate in a 4.75%-5% range through year-end.

Estimates for the so-called core PCE price index, which strips out the volatile food and energy components, were little changed from the prior month’s survey. The gauge is expected to be up 2.5% year-over-year by mid-2024.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.