After a year that brought a surprise surge in interest rates, the biggest stock drop since 2008 and a halt to major deals, plenty of finance executives lined up at the World Economic Forum’s annual meeting to say they now see reasons to be upbeat.

(Bloomberg) — After a year that brought a surprise surge in interest rates, the biggest stock drop since 2008 and a halt to major deals, plenty of finance executives lined up at the World Economic Forum’s annual meeting to say they now see reasons to be upbeat.

Bankers from JPMorgan Chase & Co.’s Mary Erdoes to Morgan Stanley’s James Gorman and Citigroup Inc.’s Jane Fraser were among those identifying an easing of inflation and the reopening of China as grounds for cautious optimism at this week’s gathering in the Swiss ski resort of Davos.

While the annual event is often ridiculed as a reverse indicator for the coming year’s economic fortunes, the hopefulness of Wall Street was echoed by business leaders and policy makers as the forum returned to its traditional January setting for the first time in three years.

“The tone here, having come here for the past decade, is less depressed than it often is,” Erdoes told Bloomberg Television. “That’s a good sign.”

Fraser cited the strength of the balance sheets of banks, consumers and companies as reasons to bet any recessions will prove mild. Gorman said there is “clear evidence” inflation has peaked and also welcomed signs China is taking steps to revive relations with the rest of the world.

Finance chiefs spent much of the last year warning of coming clouds. That makes their budding hope for 2023 stand out all the more, even though it was guarded.

Inflation is still to be beaten, rates continue to rise, unemployment is ticking up, Russia’s war in Ukraine endures, property markets are wobbling and there is a brewing battle among lawmakers over the US debt limit.

“Participants are trying very hard to be optimistic about the world economy,” said Christopher Willcox, head of wholesale banking at Nomura Holdings Inc. “Participants are worried about missing out on the upside potential, but I do not think they have full conviction yet that all the risks that are still out there can be ignored.”

Hope Over Experience

Former US Treasury Secretary Lawrence Summers, a contributor to Bloomberg Television, said he was also feeling more positive.

“Soft landings are the triumph of hope over experience, but sometimes hope does triumph over expectation,” he said. “The figures are better than what someone like me would have expected three months ago.”

The reopening of China was a key driver of the turn in mood as Vice Premier Liu He used the Davos stage to express confidence the world’s second largest economy will most likely “return to its normal trend” this year and that the peak of coronavirus infections has peaked.

“The lockdown of the last three years has created pent-up demand domestically, so I would see increased domestic consumption and of course the manufacturing sector will pick up,”said Laura Cha, chair of Hong Kong’s exchange. “All those will be good factors for global growth.”

German Growth

After a warmer than feared winter, German Chancellor Olaf Scholz told Bloomberg he is “absolutely convinced” Europe’s largest economy will avoid a recession this year.

Still, few were prepared to be completely unabashedly positive, especially as inflation could stay sticky, forcing central bankers to hike even more and risk tipping economies into recession.

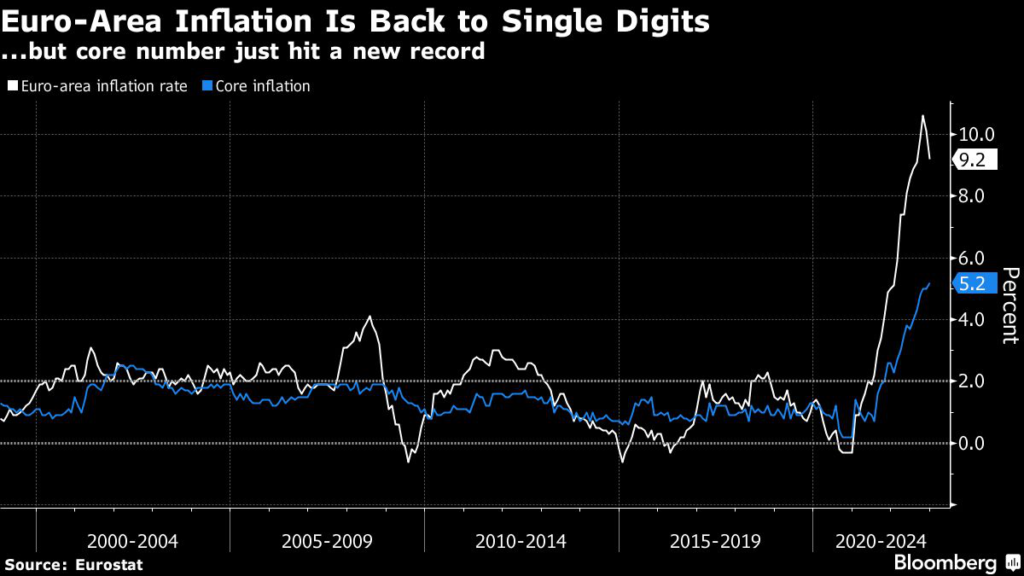

Deutsche Bank AG Chief Executive Officer Christian Sewing said he also anticipated a brightening outlook, but warned against underestimating the danger posed by inflation, calling it “poison.”

Central Bankers

Indeed, the message from the central bankers present was that rates likely have higher to go.

“Inflation by all accounts, whichever way you look at it, is way too high,” European Central Bank President Christine Lagarde told a panel on Thursday. “We shall stay the course.”

Job losses could cast a pall over any recovery too, even if looser labor markets could help weaken price pressures. Just this week, Microsoft Corp. said it plans to cut 10,000 positions and Bank of America Corp. has started telling executives to pause hiring.

“We went past our target headcount,” Chief Executive Officer Brian Moynihan said Thursday. “Now we can do a slowdown in hiring.”

Read More: Microsoft Joins Wave of Tech Layoffs as Slowdown Spreads

“What we can say is that the next shoe to drop has to be a decline in the economy, in particular, a contraction in the labor markets,” said Bob Prince, the co-chief investment officer of Bridgewater Associates.

The International Monetary Fund also counseled caution as it prepares to revise its forecasts for global growth in coming weeks.

Gita Gopinath, the fund’s No. 2 official, said while the world economy should improve as 2023 goes on it will still be “a tough year.”

Her boss was more forthright about the challenges ahead.

“My fear is that we are sleepwalking into this world,” Kristalina Georgieva, managing director of the IMF told Bloomberg. “But hey, here is Davos! Wake up! Do the right thing!”

–With assistance from Steven Arons, Philip Aldrick, David Westin, Francine Lacqua, Marion Dakers, Jeff Black and Dale Crofts.

(Adds BofA CEO comments in 19th paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.