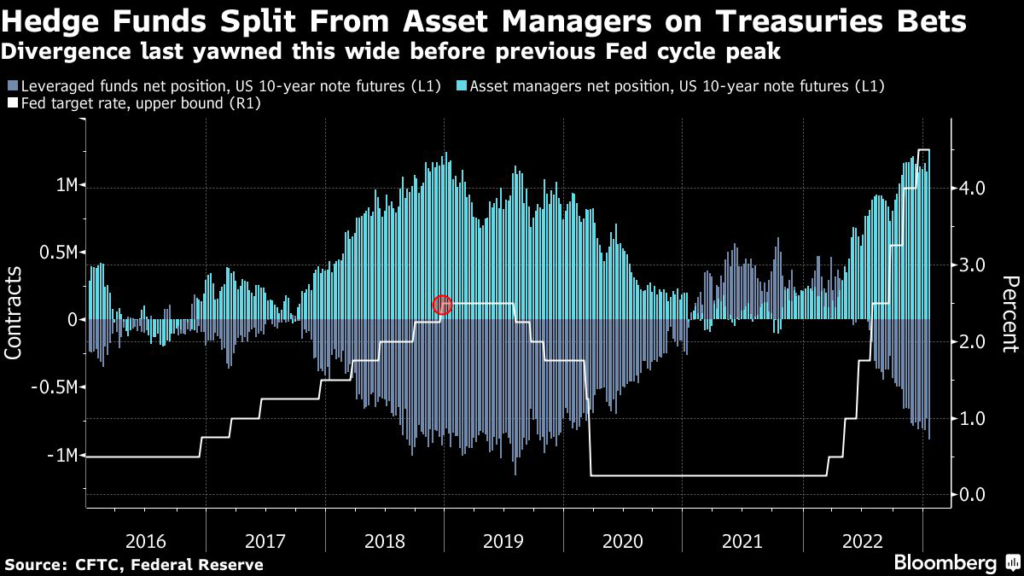

The last time hedge funds and asset managers were this split on the future for benchmark Treasuries was when the Federal Reserve’s tightening cycle was about to peak in late 2018.

(Bloomberg) — The last time hedge funds and asset managers were this split on the future for benchmark Treasuries was when the Federal Reserve’s tightening cycle was about to peak in late 2018.

Net-short leveraged fund positions in 10-year futures have grown to the biggest since 2019, according to the latest data from the Commodity Futures Trading Commission. Their more bullish institutional investor counterparts however, have seen net long positions climb to a record, in data going back to 2006.

Treasuries have rebounded this year on bets that the Fed will soon call an end to the harshest rate hikes in a generation. That may be fueling fast-money funds to short 10-year notes against their shorter-dated counterparts on expectations the deeply-inverted yield curve will soon begin to steepen.

At the same time, buy and hold investors like asset managers are being lured by the highest interest payments on benchmark notes in more than a decade.

“A bullish theme has been building in rates markets, with a growing consensus that the Fed is close to done with rate hikes,” said Andrew Ticehurst, a rates strategist in Sydney at Nomura Inc. “The perception is that its future actions might not be as hawkish as current communications might suggest, that is, its bark is worse than its bite.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.