Humana Inc., UnitedHealth Group Inc. and other big insurers are set for a clash with US officials over up to $3 billion in potential penalties for the industry threatened by an obscure, years-late regulation.

(Bloomberg) — Humana Inc., UnitedHealth Group Inc. and other big insurers are set for a clash with US officials over up to $3 billion in potential penalties for the industry threatened by an obscure, years-late regulation.

Cigna Corp., CVS Health Corp. and Centene Corp. also face potential clawbacks of Medicare payments booked a decade or longer ago, according to a report from the research firm Veda Partners. Insurers say they’re preparing to go to court if administrators for the senior-health program don’t make the final version of the rule expected by the beginning of February more lenient than a draft proposed more than four years ago.

The government has been developing a way to recoup funds from companies that overcharge for administering health-care plans for the elderly, called Medicare Advantage, that constitute a big, growing source of industry profit. Insurers have fought the 2018 proposal, which details how the Centers for Medicare and Medicaid Services would determine whether companies are exaggerating how sick their members are and, if so, reclaim payouts.

But even as the government prepares to finalize its rule, the ultimate impact still isn’t clear, said Veda’s Spencer Perlman, who wrote the analysis.

“The biggest issue here is just the lack of clarity on what’s coming and what it means,” Perlman said in an interview. His analysis draws from government data and reporting from Kaiser Health News. Veda, a Bethesda, Maryland-based policy research firm that doesn’t make stock recommendations, estimated what plans might pay if the proposed rule was finalized without changes.

America’s Health Insurance Plans, an industry group, called the 2018 proposed rule “fatally flawed” and argued in a comment letter that it should be withdrawn. The companies didn’t comment on projected impacts of the rule.

The impact for insurers could be minimal — a 10-basis-point impact to their medical loss ratio, a key metric of medical expenses, though an unlikely worst-case scenario could be as much as 300 basis points, analysts from Morgan Stanley Research wrote Tuesday. They put the odds of the worst-case outcome at 1% to 2%.

Relatively Aggressive

CMS is committed to safeguarding public funds and the audits are the primary way to correct for improper payments in Medicare Advantage, a spokesperson said. The agency hasn’t finalized audit results from 2011 to 2015 and declined to estimate how much money might be recovered.

Humana, which gets about 80% of its revenue from Medicare Advantage, faces an unusually high risk from the clawbacks — as much as 17% of its 2023 earnings before interest, taxes, depreciation and amortization in Veda’s analysis, compared to less than 3% for most other insurers. A recent note from Wells Fargo Securities analysts also showed Humana having the the greatest potential earnings headwind from the rule.

If the proposed regulation doesn’t change, Humana alone might face penalties of more than $900 million, according to Veda Partners. While Perlman expects modifications will reduce plans’ exposure, he wrote in a Jan. 23 note that the final rule is likely to be “relatively aggressive” and disappointing to the industry.

The stakes are huge: Medicare Advantage covers about 29 million people, and the private plans collected $350 billion in federal payments in 2021. In the 2018 version of the audit rule, CMS estimated that it would recover $650 million in improper payments for a three-year period, and about $400 million a year after that. But there’s no telling what the impact of lawsuits challenging the rule or other policy changes might be, according to RBC Capital Markets analyst Ben Hendrix.

“We would be skeptical of any knee-jerk selling activity” in response to the rule being published, he wrote in a Jan. 17 research note.

Insurers’ Objections

Medicare Advantage insurers receive a set monthly fee for each person enrolled in their plans, and the government pays more for sicker patients who need more care. However, whistleblowers and the Department of Justice have accused several major insurers of fraudulently inflating Medicare charges by exaggerating how ill their patients are. The companies dispute the allegations.

To calculate the payments, plans submit data to CMS about patient diagnoses. Under the rule, CMS can audit that data and, if isn’t backed up by medical records, try to recover a portion of the payments.

Implementing the rule, called risk-adjustment data validation or RADV, has been held up by industry opposition, CMS’s inaction, and the sheer complexity involved, Perlman said. CMS hasn’t collected payments for audits from 2011 to 2013; it hasn’t even started reviewing more recent data.

Friction Point

In its proposed rule, CMS planned to audit a sample group of payments to companies, see whether they were justified by patients’ medical records, and then extrapolate those results to a broader population. The industry objects to that plan, and to applying the methodology to audits for past years, going back as far as 2011.

The biggest point of friction, though, is over how lenient audits should be regarding insurers’ mistakes in recording patients’ diagnoses. The standard, government-run Medicare program makes errors in patient diagnoses, and companies say they shouldn’t be penalized if they make mistakes at a similar rate.

Medicare’s proposed approach “could lead to flawed audit results and have a somewhat random impact” on plans, Tim Noel, who leads UnitedHealthcare’s Medicare business, said on a call Tuesday with reporters. “We are still very comfortable with what our 2011 to 2013 audit results will show,” he said, but added that the adjustment was needed to compare audit results fairly.

When CMS proposed eliminating the adjustment in 2018, insurers protested. They have threatened to sue if Medicare’s final rule doesn’t include an adjustment.

“If they take a position that an adjuster is not necessary, like they did in the proposed rule,” Humana Chief Financial Officer Susan Diamond said at the JPMorgan Healthcare Conference earlier in January, “the industry is likely to resort to litigation as a way to ultimately resolve it, which will tie us all up in litigation probably for a number of years.”

Overpayments Observed

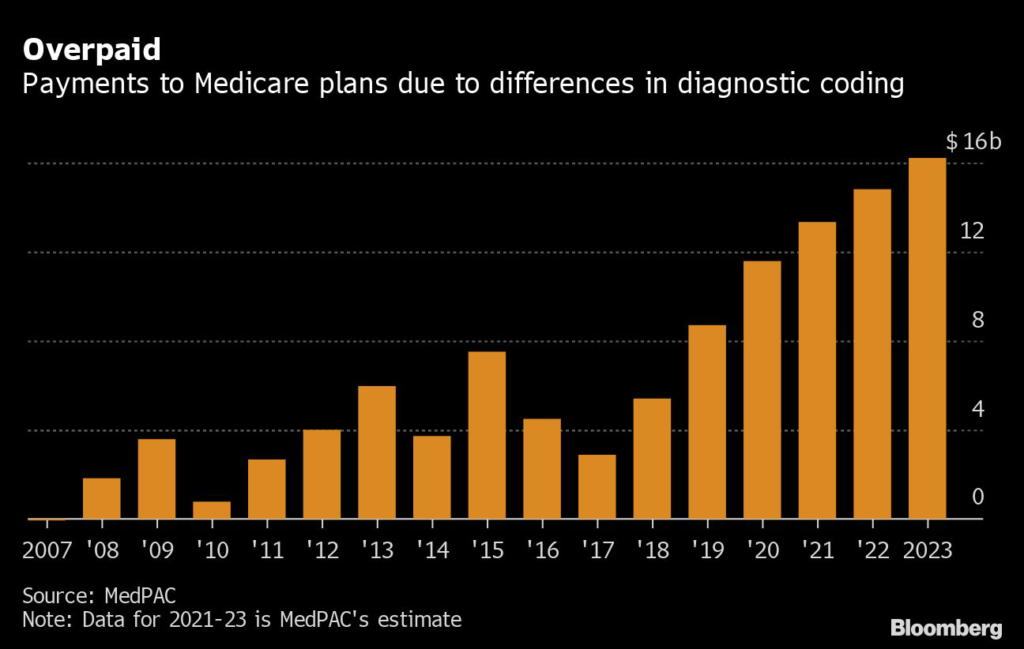

Outside overseers have warned for years that the program is paying too much money to private health plans. The way Medicare Advantage plans code for patients’ diagnoses has resulted in $91 billion more in cumulative payments to the private plans since 2007, relative to what the traditional Medicare program would have paid to cover the same patients, according to the Medicare Payment Advisory Commission, which counsels Congress. The figure in 2023 is expected to be $16 billion.

Medicare plans take issue with the numbers and argue that the payments should be calibrated to the risk they take on.

“So what are we lobbying for?” Elevance Health Inc. Chief Financial Officer John Gallina said at a conference in November. “At the 10,000-foot level, a fair and appropriate reimbursement methodology that puts us on an equal playing field.”

Even outside of litigation, Medicare plans can challenge the audit results through administrative appeals. And that could spell trouble for recovering any funds, said Perlman, the Veda analyst.

“This thing can get dragged out forever and ever and ever,” he said.

(Updates with Morgan Stanley research in seventh paragraph, UnitedHealth comments in 18th paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.