Canada’s oil-sands industry is examining how many workers it will need to build the carbon capture system that’s key to its emissions-reductions pledges, and leaders already are warning that scarce skilled labor may hinder projects.

(Bloomberg) — Canada’s oil-sands industry is examining how many workers it will need to build the carbon capture system that’s key to its emissions-reductions pledges, and leaders already are warning that scarce skilled labor may hinder projects.

The Pathways Alliance — which includes major producers Suncor Energy Inc., Canadian Natural Resources Ltd. and Cenovus Energy Inc. — is studying the labor issue with other organizations, and the results should be available in coming months, Pathways President Kendall Dilling said in an interview.

Canada’s oil-sands industry plans to spend C$24 billion ($18 billion) by 2030 to build a carbon capture and storage system to reduce its carbon dioxide emissions by 22 million metric tons. Some of that money is expected to come from government. The plan includes a 400-kilometer (250-mile) pipeline and equipment to strip the greenhouse gas from emissions.

The endeavor will require more trained tradespeople than are available now, and the group may seek adjustments to Canada’s immigration rules to bring in the welders and skilled labor that’s needed, MEG Energy Corp. Chief Executive Officer Derek Evans said. Contractors already are fretting that they’re short of the workers needed to complete annual maintenance activities at sites around Alberta this year, Evans said.

“I don’t know what it’s going to look like, but I can tell you we are already in a deficit and we need to do more training,” Evans said.

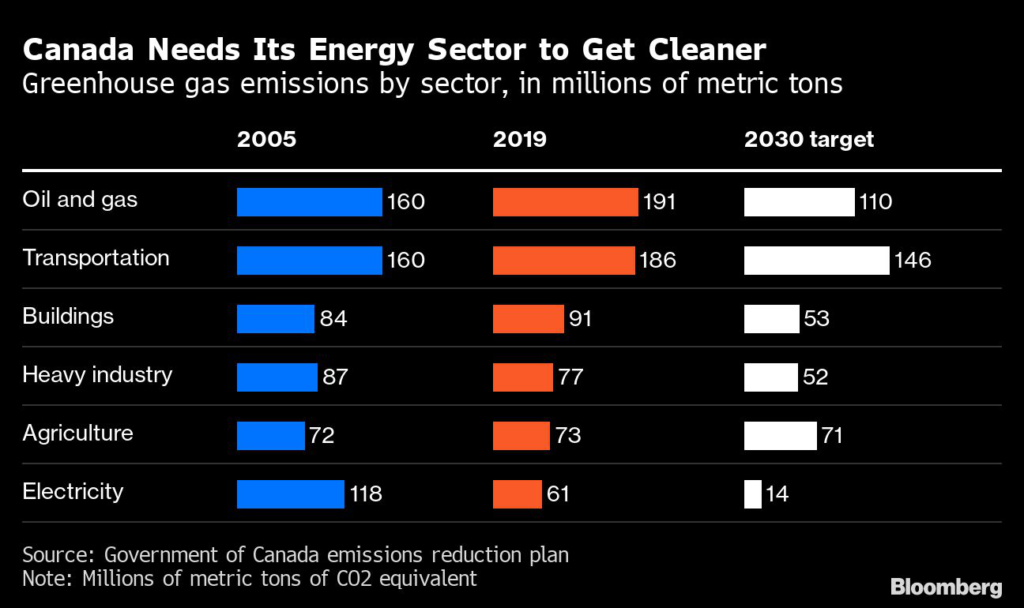

The labor issue is another reason that Pathways is pushing back at government plans to reduce emissions even faster. Canada’s government, which set out a new emissions-reductions plan last year, sees the potential for oil and gas producers to cut greenhouse gas pollution to 42% below 2019 levels, by the end of this decade.

The oil-sands industry says it can trim them by 30% at most in that time.

“Our worries are we need more staff to accomplish this,” said Alex Pourbaix, CEO of Cenovus. “In order to execute on that level of capital, that is a huge staffing up that needs to occur.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.