Germany’s business outlook brightened further as the recession many had feared after Russia attacked Ukraine looks increasingly likely to be avoided.

(Bloomberg) — Germany’s business outlook brightened further as the recession many had feared after Russia attacked Ukraine looks increasingly likely to be avoided.

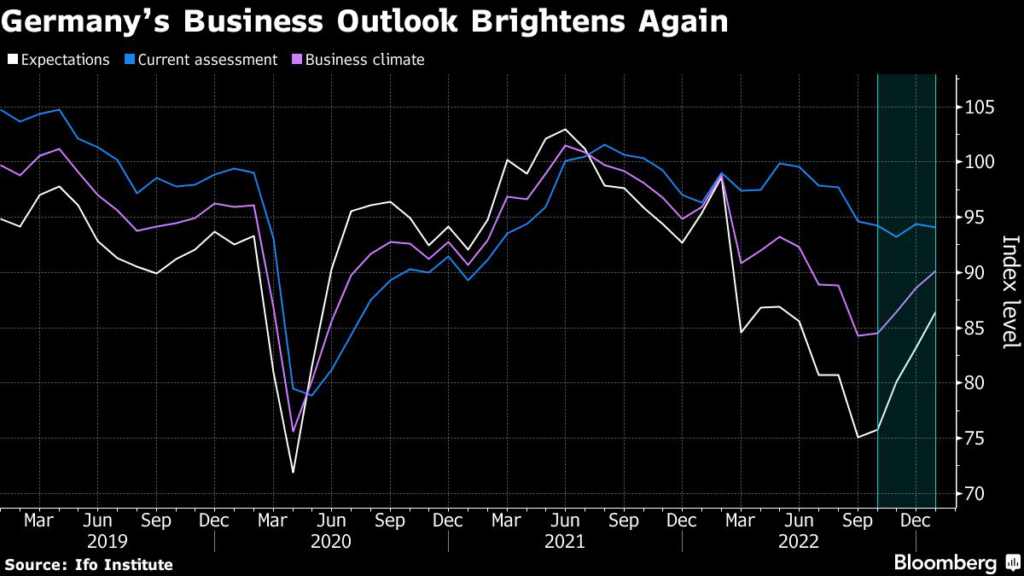

A gauge of expectations by the Ifo institute rose to 86.4 in January from 83.2 the previous month. That’s the fourth consecutive improvement and a bigger increase than economists had anticipated. A measure of current conditions slipped, however.

“Companies are telling us they are optimistic regarding the next six months, and that suggests overall we will avoid a technical recession,” Ifo President Clemens Fuest told Bloomberg TV’s Tom Mackenzie on Wednesday.

Fuest expects a shrinking economy in the first quarter, followed by an improvement toward the summer.

“The most important risk for the German economy was a gas-rationing scenario,” he said. “That risk is off the table now due to the mild weather and gas storages being full.”

The survey is the latest evidence signaling a better near-term outlook for the euro area’s largest economy. Natural gas prices have fallen from record levels, raising hope that the hottest inflation in decades may ease sooner than previously anticipated.

The government in Berlin now sees gross domestic product growing 0.2% this year, rather than the 0.4% contraction predicted in October.

The Bundesbank has also said output more or less stagnated, rather than shrank, in the final three months of 2022. Fourth-quarter figures are due Jan. 31.

Surveys of purchasing managers by S&P Global also revealed that the service sector returned to expansion in January for the first time since June, while inflation pressure eased. Manufacturing, however, continued to endure falling demand.

–With assistance from Joel Rinneby and Kristian Siedenburg.

(Updates with German government forecast in seventh paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.