A short-seller report is drawing attention to the multifold gains of the Adani Group of stocks — a potential blow to the empire of Asia’s richest man and the personal wealth he has amassed.

(Bloomberg) — A short-seller report is drawing attention to the multifold gains of the Adani Group of stocks — a potential blow to the empire of Asia’s richest man and the personal wealth he has amassed.

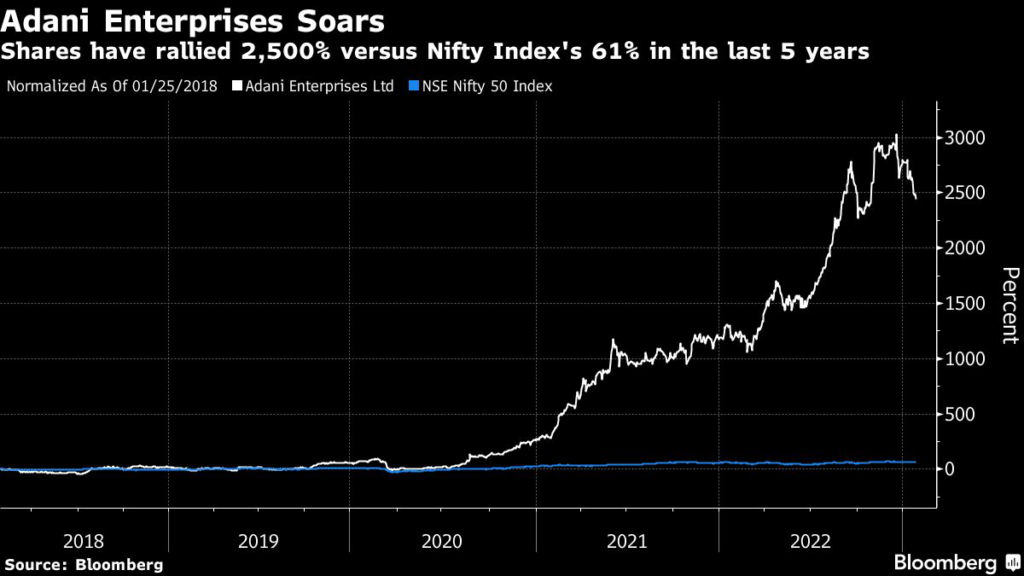

The conglomerate’s stocks figure among the most expensive names in Asia by several measures, including the closely-watched earnings multiples and price-to-book value. What’s more, the flagship company Adani Enterprises Ltd. has jumped about 2,500% in the last five years, trumping even the likes of Elon Musk’s Tesla Inc.

Hindenburg Research said Tuesday that it is shorting the conglomerate’s stocks, and sees “85% downside purely on a fundamental basis owing to sky-high valuations.” Trading at 90 times forward earnings, Adani Enterprises is the most expensive stock on India’s key NSE Nifty 50 Index.

Adani Power Ltd., Adani Green Energy Ltd., Adani Transmission Ltd., Adani Ports & Special Economic Zone Ltd., Adani Total Gas Ltd. and Adani Wilmar Ltd. are among the stocks under Gautam Adani’s swelling business empire. Adani Green and Adani Transmission trade at 200 to 300 times forward earnings and are among the 10 priciest stocks out of the nearly 1,500 constituents of the MSCI Asia Pacific Index.

Hindenburg, the US short-selling firm run by Nate Anderson, made wide-ranging allegations of purported corporate malpractice in an almost 100-page report on the Adani Group, sending shares of the Indian group’s companies tumbling Wednesday. Hindenburg said it is short Adani securities via derivatives and US-traded bonds. Adani Group rejected the accusations as “baseless” and “selective misinformation.”

Indian stocks tend to be expensive and that’s been exemplified by the Adani group, said Kamil Dimmich, partner at North of South Capital, a London-based Emerging Market Equity Manager. He said the firm has no exposure to India as “valuations will have to normalize before it makes sense to re-enter the market.”

Here are three charts that show Adani’s meteoric stock-market rise and expensive valuations:

An All-Adani Show in Asia

Extreme Earnings Multiples

Adani’s companies trade at high premiums compared to Indian stock markets — Adani Enterprises is nearly trading five times more than the Nifty 50 Index.

Key Scorecard

Here are some core valuation methods where Adani Enterprises appears expensive:

- Enterprise Value to Ebit, or sales ratio, is used to determine the fair value of a business by dividing it by sales or operating profits. Enterprise value includes total debt, whereas market capitalization is the share price multiplied by total outstanding shares.

- Forward price-to-book value is a measure used to compare a company’s market capitalization to the book value of its equity.

–With assistance from Selcuk Gokoluk, Ashutosh Joshi and Akshay Chinchalkar.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.