Thailand delivered its fourth straight interest-rate increase and signaled sustained monetary tightening ahead to ward off lingering price pressures as the economic recovery gathers pace from a tourism rebound.

(Bloomberg) — Thailand delivered its fourth straight interest-rate increase and signaled sustained monetary tightening ahead to ward off lingering price pressures as the economic recovery gathers pace from a tourism rebound.

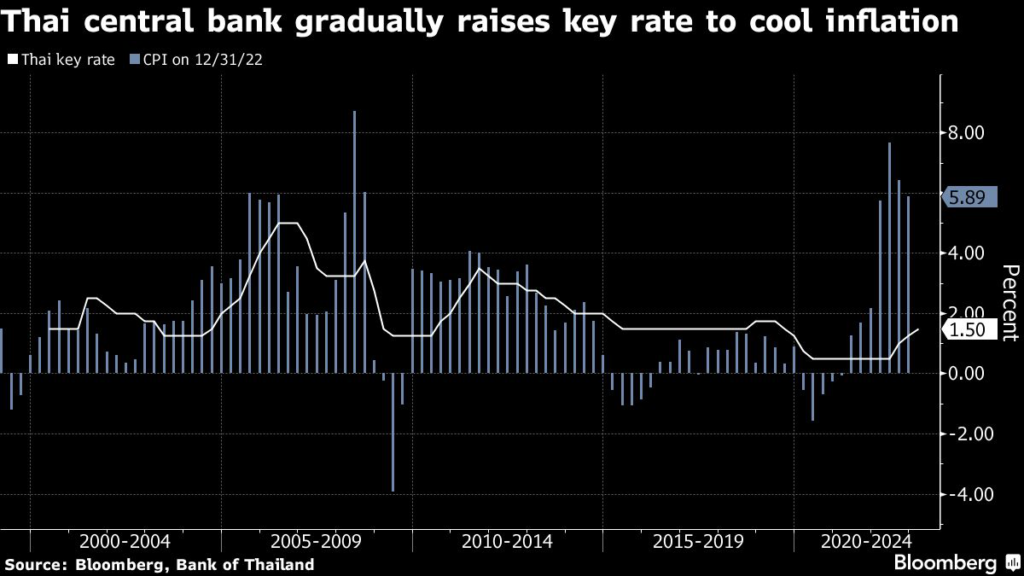

The Bank of Thailand’s monetary policy committee voted unanimously to raise the one-day repurchase rate by 25 basis points to 1.50% on Wednesday, as seen by 19 of 20 economists in a Bloomberg survey, with one predicting no change. Output is already back to pre-pandemic levels, Assistant Governor Piti Disyatat said at a briefing.

“The economy is taking off so it’s still appropriate to raise the rate for a while. But how far we will go is the key task for the following meetings,” Piti said when asked about the rate outlook. Unlike neighbors that already paused or signaled that they’re at the tail end of rate hikes, Thailand looks poised to carry on with its “gradual and measured” tightening.

Tourism recovery, which spurs jobs and consumption, could fan demand-side inflation, BOT said in a statement. Currency fluctuations won’t influence monetary policy decision, for now, and there’s no need for any extraordinary measure on the baht, said Piti.

The baht, which has rallied in the past two months, swung between gains and losses after the decision. Movement in the currency has been “reasonable, not disorderly,” Piti said, while adding that BOT will continue to closely monitor volatilities in the exchange rate.

“There is a risk that core inflation would remain high for longer than expected owing to a potential increase in pass-through given elevated costs,” BOT said. “Risks of rising demand-side inflationary pressures must be monitored.”

While Thailand’s headline inflation is off the peak, the core gauge remains the fastest since 2008.

On tourism, BOT forecasts 25.5 million arrivals this year, more than doubling from 11.2 million in 2022, before rising further to 34 million in 2024, it said Wednesday. Meanwhile, exports are expected to moderate this year and pick up in 2024.

“Downside risks to the global economy have decreased given the improving outlook in both advanced economies and China,” the central bank said.

About 28% of Thailand’s 40 million annual visitors before the pandemic were from China. Tourism typically accounts for at least 12% of the economy and a fifth of jobs while private consumption, which also benefits from travelers spending, makes up 50% of GDP.

What Bloomberg Economics says

BOT “is showing no desire to pause its tightening after Wednesday’s hike — and that makes good sense. BOT signaled more hikes are likely in the pipeline, noting that the recovery is gaining momentum and core inflation is expected to remain high for some time. We expect another 25-basis-point hike at the BOT’s next meeting in late March.”

— Tamara Mast Henderson, Asean economist

For the full note, click here

The baht near a 10-month high is helping damp imported prices but the rally is hurting the competitiveness of exporters. Weakening exports, which make up more than half of Thailand’s output, are the dark clouds that loom in the horizon. Overseas shipments fell 14.6% in December, a third straight month of contraction.

Analysts from Goldman Sachs Group and Australia & New Zealand Banking Group said before Wednesday’s decision that BOT may make a few more hikes. Goldman expects BOT to increase in quarter-point increments until the rate reaches 2.5% by the third quarter while ANZ sees the terminal rate at 2.25%.

–With assistance from Tomoko Sato, Cecilia Yap, Ditas Lopez and Thomas Kutty Abraham.

(Updates with comments from briefing and statement throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.