A selloff in dollar bonds tied to Indian billionaire Gautam Adani intensified Thursday as a short seller’s accusation of stock manipulation and accounting fraud revived concerns about the conglomerate’s debt woes.

(Bloomberg) — A selloff in dollar bonds tied to Indian billionaire Gautam Adani intensified Thursday as a short seller’s accusation of stock manipulation and accounting fraud revived concerns about the conglomerate’s debt woes.

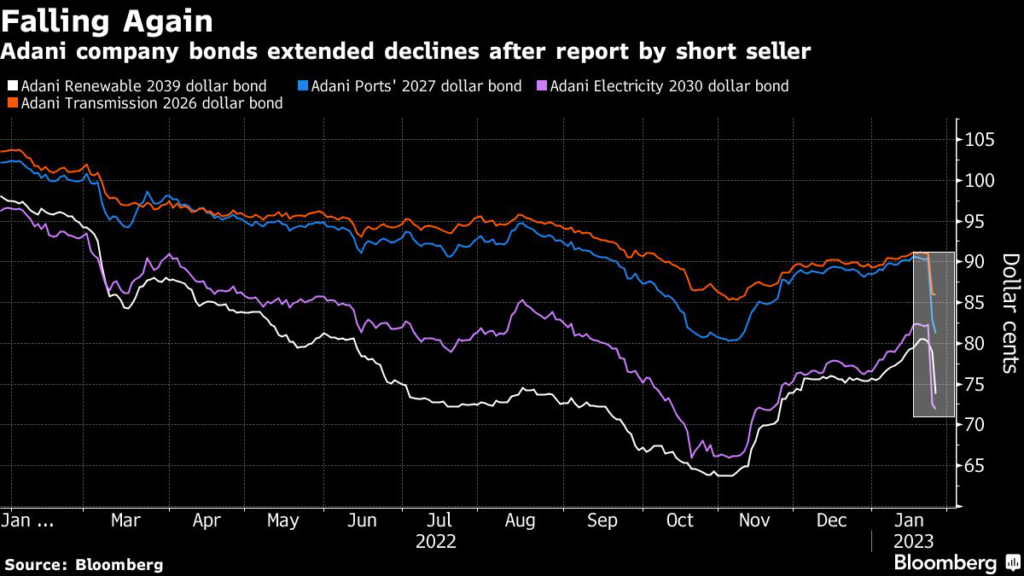

At least eight notes issued by Adani group companies were indicated lower as of 2:35 p.m. in Hong Kong, with losses from 0.3 cent to about 5 cents on the dollar, Bloomberg-compiled prices show. The declines, which started Wednesday, came after Nathan Anderson’s Hindenburg Research said it has taken a short position via US-traded notes and derivative instruments traded outside India.

Hindenburg’s attack comes at a critical time for Adani, an industrialist seen to enjoy a close relationship with Indian Prime Minister Narendra Modi, as he seeks to raise his international profile and is aggressively branching into new businesses. The broadside, which has wiped $12 billion off the conglomerate’s stocks, also coincides with a key share sale from Adani’s flagship company.

While some of Hindenburg’s allegations against Adani aren’t new, including bubbly stock valuations and concentrated holdings by Mauritius-based investors, the short seller’s bets are an ominous reminder of long-held concerns about the group’s elevated debt load.

“A lot of the negatives and uncertainties surrounding Adani Group entities like leverage and corporate governance that the report focused on were already known, but the detail and extent of the research and timing of the release, with several Asian markets still out, saw a large impact,” said Kaveh Namazie, a credit analyst at Australia & New Zealand Banking Group Ltd.

Among the biggest losers are Adani Ports and Special Economic Zone’s 2024 notes that fell by 3.7 cents on the dollar, the biggest single-day drop since April 2020, Bloomberg-compiled prices show. Adani Group entities saw their bond prices fall anywhere between about 1 and 14 cents on the dollar Wednesday, according to Bloomberg’s BVAL valuation service.

In an approximately 100-page report, Hindenburg Research alleges a web of Adani-family controlled shell entities in tax havens in the Caribbean, Mauritius and the United Arab Emirates. It says these were used to facilitate corruption, money laundering and taxpayer theft, while siphoning money from the group’s listed companies, whose businesses range from ports to power.

Adani Enterprises Ltd. is seeking to raise 200 billion rupees ($2.5 billion), with the flagship saying on Wednesday that it allocated 18.27 billion shares to investors.

Adani Group is “evaluating the relevant provisions under US and Indian laws for remedial and punitive action against Hindenburg Research,” Adani Group’s legal head Jatin Jalundhwala said in a statement Thursday. The Hindenburg report is an “intentional and reckless attempt by a foreign entity to mislead the investor community and the general public, undermine the goodwill and reputation of the Adani Group and its leaders, and sabotage the FPO (Follow-on Public Offering) from Adani Enterprises,” it added.

Hindenburg’s accusations and disclosure of its short positions in Adani’s US-traded bonds are adding to existing worries about the group’s debt pile, which helped fuel an aggressive expansion into new businesses from cement and media.

In September, Fitch Group unit CreditSights described the Adani business empire’s leverage as “elevated” and “a matter of concern.”

But as investors further digest the news and its fallout, selling in the bonds associated with the conglomerate may become less indiscriminate.

“I would expect more differential between the various Adani Group USD issuers, with Adani Ports’ fundamental value, positive cash generation and profitability, larger unrestricted cash reserves, making it more attractive than its sister companies,” Namazie said.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.