A record share of Londoners are shunning property portals and opting to sell their homes on their own terms — which are increasingly negotiated over WhatsApp.

(Bloomberg) — A record share of Londoners are shunning property portals and opting to sell their homes on their own terms — which are increasingly negotiated over WhatsApp.

Almost a quarter of London homes were sold off-market in the final three months of last year, according to broker Hamptons International. That’s more than double compared to the same period of 2019 — the final quarter before the pandemic — when under-the-table sales claimed 11% of total market share. It is also the highest quarterly figure since Hamptons began recording data in 2007.

The trend is particularly pronounced among Londoners with more expensive offerings. “Tougher conditions have increased the number of £1 million-plus ($1.2 million) homes being marketed quietly,” said David Fell, a senior analyst at Hamptons.

Almost a third of homes sold for £1 million or more were traded off-market in the final three months of last year, the highest quarterly share since 2017.

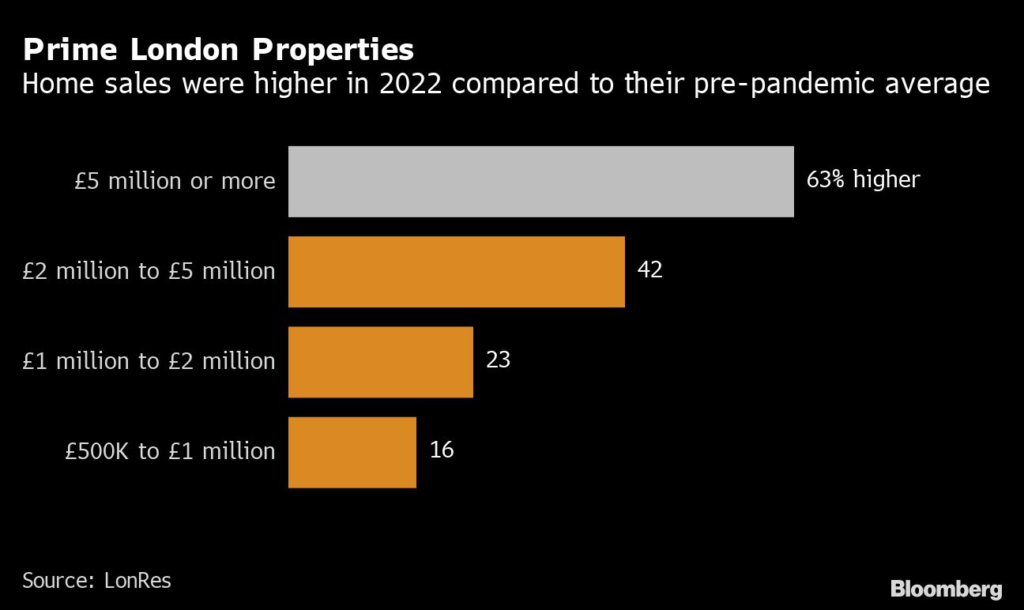

The rise in luxury off-market sales is partly due to a surge in activity at the top of London’s real estate market. New sales of homes priced at £5 million or more were 74% higher in the final quarter of 2022 compared with the pre-Covid average, according to data compiled by researcher LonRes. The dollar’s strong position against the pound is also drawing more international buyers to London’s luxury market.

Real estate broker Charles McDowell, whose Charles McDowell Properties firm advises wealthy clients on London real estate, says high-end buyers and sellers value privacy over anything else, and prefer to not showcase their homes on public portals. As such, he said, most negotiations have migrated to other spaces, and namely, WhatsApp.

“The need for internet sales is reducing, providing the agent has a strong network,” said McDowell, who sold four homes under the counter between October and December, including a £45 million property in Holland Park. “Our clients like WhatsApp because it is more instant and secure, as well as fast-becoming the preferred method of communication.”

Anthony Payne, managing director at LonRes, echoed that point. “This is a discrete sector,” he said, adding that homes will be “just as quietly withdrawn if they fail to meet their asking price.”

Fell, the Hamptons analyst, singled out another benefit of off-market transactions: they allow sellers to experiment with pricing “without leaving a digital footprint,” meaning they won’t be at a disadvantage “if they chose to take their home off the market with a view to trying again in six or 12 months’ time.”

Fell anticipates that strong off-market sales will continue through 2023. “Prime and super-prime sellers will look to quietly test the water to see if they can get the price they’re looking for,” he said.

That, however, doesn’t mean that available high-end properties will disappear from public view entirely. “We’ll also likely see more sellers start life off-market before deciding to market their home more widely if reaction from ‘black book’ buyers was favorable but they still weren’t quite able to secure a sale.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.