Scrutiny of the debts of Adani Group companies has intensified following a report by short seller Hindenburg Research, fixing investor attention in the months ahead on a string of bond interest deadlines.

(Bloomberg) — Scrutiny of the debts of Adani Group companies has intensified following a report by short seller Hindenburg Research, fixing investor attention in the months ahead on a string of bond interest deadlines.

The conglomerate, backed by Asia’s richest person, has at least $289 million worth of dollar note coupon payments due in 2023, according to data compiled by Bloomberg. The first deadline is on Thursday, when Adani Ports & Special Economic Zone Ltd. must pay a combined $24.7 million of interest for three bonds.

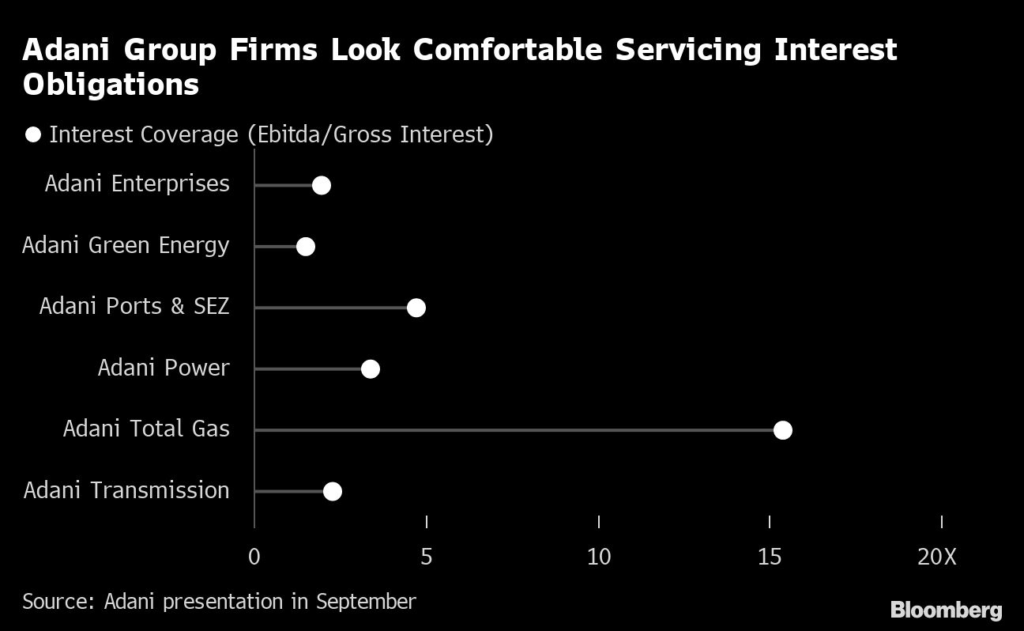

There’s been no suggestion that the Adani entities would struggle to make these payments, and Adani has flagged interest coverage ratios that show it has the wherewithal to meet such obligations.

But Hindenburg’s report last week alleging “accounting fraud” along with its short position in Adani’s US-traded bonds and non-Indian-traded derivatives has put the debt in the spotlight. Some of the notes have fallen to distressed levels below 70 cents on the dollar that generally show mounting concern about creditworthiness. The securities extended declines Monday after a rebuttal by the Indian conglomerate and as Hindenburg followed with its own response.

Here’s a calendar of the upcoming dollar bond interest payments. While this list isn’t exhaustive, and excludes rupee securities, it gives a picture of some of the key dates that global investors are watching for major entities like Adani Green Energy Ltd., Adani Ports and Adani Transmission Ltd. The yields are based on prices compiled by Bloomberg for the entities’ Reg S notes.

“We believe it could take only one serious liquidity event at a single entity to trigger a negative cascade of events at other group entities which could affect the entire Adani Group,” Hindenburg wrote in its Jan. 24 publication.

Adani Group has said it’s exploring legal action over what it called a “maliciously mischievous, unresearched” report. A spokesman for the Adani Group didn’t immediately have comment about the company’s coupon payments when contacted by Bloomberg on Monday.

When it comes to bond principal repayments, Adani companies have rupee notes maturing this year in the local credit market, where price moves have been more muted. The entities mentioned above don’t have any dollar bond maturities until 2024, when Adani Ports and Adani Green are due to repay a combined $1.9 billion.

Here’s the calendar for some of those dollar note deadlines in coming years:

Already in August, the conglomerate’s financial situation made headlines after CreditSights, a Fitch Group unit, termed it “deeply overleveraged.” Adani Group denied that assessment, saying its companies had progressively reduced their debt load.

A presentation the conglomerate made in September included metrics on its ability to service interest payments that should offer investors some comfort on the looming coupon payments. The interest coverage ratio — Ebitda divided by interest expenses — ranges from about 2 to over 15 times for these entities. Typically, an interest coverage ratio of minimum two times is seen as good by credit assessors.

Broader concerns about longer-term management of the conglomerate’s debt loads, though, persist. In its September presentation, Adani listed leverage ratios for six of its firms. Five of those companies had a ratio that’s higher than the average of firms in India’s Nifty 50 index, according to Bloomberg-compiled data. Adani Total Gas Ltd. was the only one in that group that was lower.

The ratio of net debt to earnings before interest, taxes, depreciation and amortization ranged from 0.7 to 10.3 times for the six entities, compared with the Nifty 50 average of about 1.3 times.

That same report showed total cash at Adani Ports & Special Economic Zone Ltd., which Hindenburg said is “the only listed entity with significant reserves,” stood at about 40% of its net debt. Other members of the group had less favorable ratios.

–With assistance from Caroline Chu, Jacqueline Poh, P R Sanjai and Tasos Vossos.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.