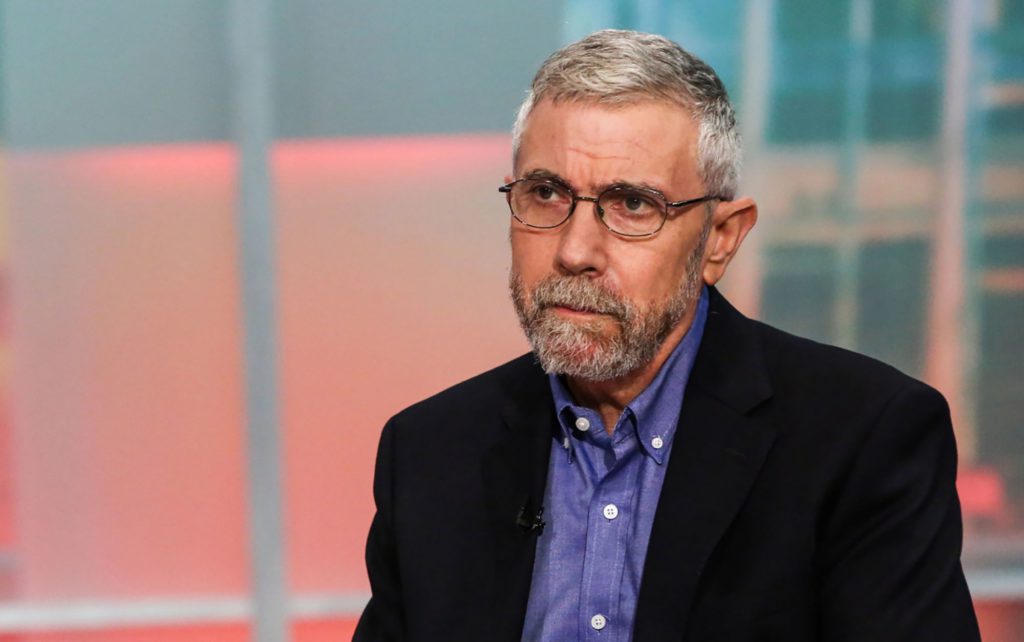

Nobel laureate Paul Krugman said he’s concerned investors have put inflation risk in the rear-view mirror too soon, and that easing financial conditions could spark it again.

(Bloomberg) — Nobel laureate Paul Krugman said he’s concerned investors have put inflation risk in the rear-view mirror too soon, and that easing financial conditions could spark it again.

“I’m a little worried that the markets may be getting ahead of themselves,” Krugman said Monday on Bloomberg Television’s “Balance of Power” with David Westin. “The markets are pricing in that inflation is over. That could be a self-denying prophecy.”

There are increasing signs that the Federal Reserve is successfully taming the highest price growth in a generation, with inflation falling across a range of indicators in December. The consumer price index rose at the slowest pace since October 2021 and the Fed’s preferred inflation measure — core personal consumption expenditures — eased to the slowest annual pace in over a year.

‘Disordered Time’

Krugman said that while inflation is “coming down fairly fast” and will likely continue cooling, the risk is that there’s too high a “degree of certainty” that the fight is over.

“If financial markets ease a lot based on the perception that the inflation threat is behind, that could actually to some extent reignite inflation,” said Krugman, an economist who now teaches at City University of New York.

There are signs of lingering price pressures. While energy costs have fallen, food prices remain elevated. Also, rising wages underscore a persistently strong labor market that the Fed wants to see cooled. The unemployment rate remains at a half-century low and job openings are plentiful, signaling high demand for labor.

Fed policymakers are expected to increase interest rates by 25 basis points at their meeting Wednesday, a slowdown in pace from last year. Economists broadly expect a brief recession in 2023, after which the Fed is seen cutting interest rates to spur growth.

Data is pointing to a lot of crosscurrents in the US economy and tends to come with significant lag, Krugman said, making a clear reading on current conditions tougher than usual.

“We’re in this very disordered time,” Krugman said. “There’s a lot of unknowns.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.