Four-week average flows of Russian crude highest since June with new EU curbs looming

(Bloomberg) — Russia’s seaborne oil flows look as if they are moving higher. Two possible explanations: the nation is pushing more cargoes onto the water after Germany and Poland all but halted piped imports, and Moscow has one eye on an impending ban on fuel purchases by the European Union.Russia’s crude exports rebounded in the seven days to Jan. 27, recovering most of the previous week’s loss. Aggregate volumes rose by 480,000 barrels a day, or 16%, to 3.6 million in the week. Shipments from Baltic and Pacific ports were both up by 310,000 barrels a day from the previous week, with the increase partly offset by a decline in volumes from the Arctic.Russia has already lost its key European market for crude and is about to do the same for refined products — an EU import ban is due to come into force on Feb. 5. Like the earlier embargo on crude, it will be accompanied by a price cap mechanism, intended to allow flows to continue to non-European buyers as long as cargoes are purchased below yet-to-be agreed prices. Some analysts question whether Russia will be able to find buyers for the fuel cargoes Europe doesn’t take, creating questions about where that would leave the nation’s refining industry.

The week-on-week increase in crude flows drove up the country’s four-week average, which smooths out peaks and troughs in what are noisy weekly data, affected by the timings of when individual shipments depart and things like weather conditions and work at ports. By that measure, seaborne flows from Russia, at 3.34 million barrels a day, were the highest since June.Inflows to the Kremlin’s war-chest from crude export duties rose in line with flows, but the 16% increase in revenues was worth just $8 million, with the burden of taxes on Russian oil shifting from exports to production.

While Russian oil companies have successfully diverted crude shunned by traditional European customers to willing new buyers, predominantly in India, it is unclear yet whether they will find it so easy to redirect refined products to markets that are well supplied from their own refineries.

Tankers hauling Russian crude are becoming more cagey about their final destinations. Vessels carrying more than 33 million barrels of Russian crude, the equivalent of 1.19 million barrels a day of exports, left port showing no clear final destination in the four weeks to Jan. 27.

Crude Flows by Destination:

On a four-week average basis, overall seaborne exports rose by 237,000 barrels a day from a revised figure for the period to Jan. 20. Shipments to Asia — plus those cargoes likely to confirm Asia as their destination when the ships update their signals — soared, while those to Europe have dried up almost completely.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export through Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since the invasion of Ukraine by Russia, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from the EU sanctions.

The volume of crude on vessels heading to China, India and Turkey, the three countries that emerged as the only significant buyers of displaced Russian supplies, plus the quantities on ships that are yet to show a final destination, jumped in the four weeks to Jan. 27 to average 3.12 million barrels a day. That’s up by 267,000 barrels a day from the period to Jan. 20, and the highest since Bloomberg began monitoring the flows in detail at the start of 2022.

-

Asia

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final destination, which typically end up in either India or China, jumped to a new high of 3.03 million barrels a day in the four-week period to Jan. 27.

While the volume heading to India appears to have slumped, history shows that most of the cargoes on ships initially showing no final destination end up there.

The equivalent of more than 681,000 barrels a day was on vessels showing destinations as either Port Said or Suez, or which have already been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Unknown” volumes, running at 510,000 barrels a day in the four weeks to Jan. 27, are those on tankers showing a destination of Ceuta, Kalamata or no destination at all. Most of those cargoes go on to Asia, but some could end up in Turkey. An increasing number are being transferred from one vessel to another in the Mediterranean for onward journeys through the Suez Canal or on larger vessels around Africa.

-

Europe

Russia’s seaborne crude exports to European countries edged higher to 146,000 barrels a day in the 28 days to Jan. 27, with Bulgaria the sole European destination. These figures do not include shipments to Turkey.

A market that consumed more than 1.5 million barrels a day of short-haul crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to Jan. 27.

Exports to Mediterranean countries were almost unchanged from the previous week on a four-week average basis.

Turkey was the only destination for Russian seaborne crude into the Mediterranean. While flows there have edged higher in recent weeks, they remain well below the levels seen for much of last year. Turkey was one of the countries that boosted imports after the war began and it is surprising to see flows so subdued, as the country is not a party to the EU’s import ban and had been seen as a key market for the country’s crude after European buyers shunned Russian crude.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, regained half of the previous week’s loss, rising to 146,000 barrels a day.

Bulgaria appears to be taking full advantage of a partial exemption that it secured from the EU import ban. The Black Sea nation is importing more than three times as much Russian crude since the embargo came into effect as it was during the first eight weeks of 2022.

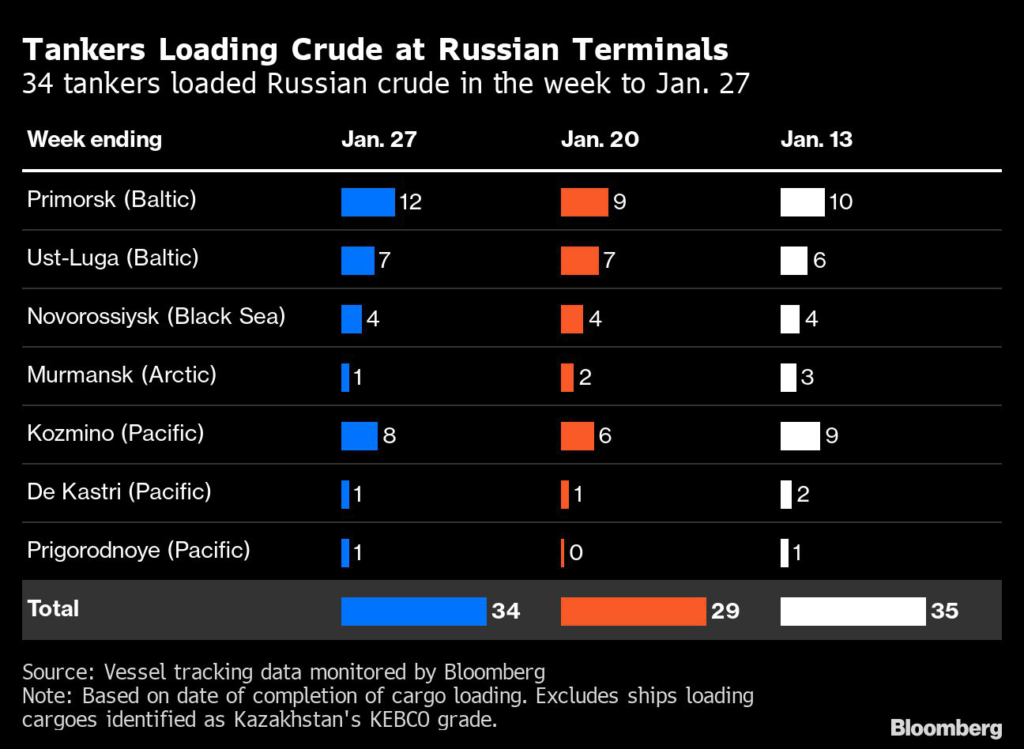

Flows by Export Location

Aggregate flows of Russian crude rose by 480,000 barrels a day, or 16%, in the seven days to Jan. 27, recovering much of the previous week’s loss. The biggest increases were seen in flows from the Baltic and Pacific ports, which were partly offset by a drop Arctic exports. Shipments from the Black Sea were unchanged from the previous week.

Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Export Revenue

Inflows to the Kremlin’s war chest from its crude-export duty rose by $8 million, or 16%, to $57 million in the seven days to Jan. 27, while the four-week average income moved in the opposite direction, falling by $13 million to $56 million.

Russia introduced a new formula to calculate per-barrel export duty rates at the beginning of January, halving the rate of duty payable at any given crude price. Four-week average receipts have fallen sharply as successive December periods have dropped out of the calculation. A separate line in the chart below shows what the Kremlin’s receipts from crude export duty would have been had the 2022 formula continued to apply.

President Putin has demanded his government come up with a plan for re-jigging Russia’s oil levies to offset the effects of sanctions on the nation’s budget revenues. Officials were asked to prepare suggestions for a new method of assessing prices of Russian crude and products, used to set duty rates, by March 1.

The January duty rate is $2.28 a barrel, based on an average Urals price of $57.5 a barrel, according to figures from the Russian Ministry of Finance. The per barrel rate for February will be even lower, at $1.75 a barrel. That’s down by 23% from January and the lowest per barrel rate since June 2020, during the depths of the Covid 19 pandemic. The drop is the result of a decline in Urals prices over the measurement period, which ran from mid-December to mid-January. Russia’s benchmark grade averaged $46.82 a barrel according to ministry figures, a discount of almost $35 a barrel to Brent over the same period.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 34 tankers loaded 24.9 million barrels of Russian crude in the week to Jan. 27, vessel-tracking data and port agent reports show. That’s up by 3.4 million barrels, or 16%, from the previous week. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from Baltic terminals jumped to just a whisker below 2 million barrels a day, its highest since Bloomberg began tracking the flows in detail at the start of 2022, increasing by 19% over the previous week.

Shipments from Novorossiysk in the Black Sea were unchanged from the previous week.

Arctic shipments fell to a nine-week low, with just one Suezmax tanker leaving from Murmansk during the week. All cargoes continue to head to Asia via the Suez Canal, with larger vessels replacing the Aframaxes that were used previously for deliveries from the floating storage units at the port.

Flows from the Pacific regained most of the previous week’s loss, with 10 tankers loading at the region’s three terminals.

Shuttle tankers carrying Sokol crude are now often waiting much longer than they used to before transferring their cargoes to other vessels off the South Korean port of Yeosu, which may slow shipments of the grade. Round trips between the De Kastri loading terminal and Yeosu are currently taking about 22 days, compared with an average of 14 days in the months before the invasion of Ukraine.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Data on crude flows can also be found at {DSET CRUDEJ }. The numbers, which are generated by a bot, may differ from those in this story.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }.

–With assistance from Sherry Su.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.