Falling values are the latest headache for landlords in Europe who need to refinance their debt. It’s a problem for their lenders too.

(Bloomberg) — Falling values are the latest headache for landlords in Europe who need to refinance their debt. It’s a problem for their lenders too.

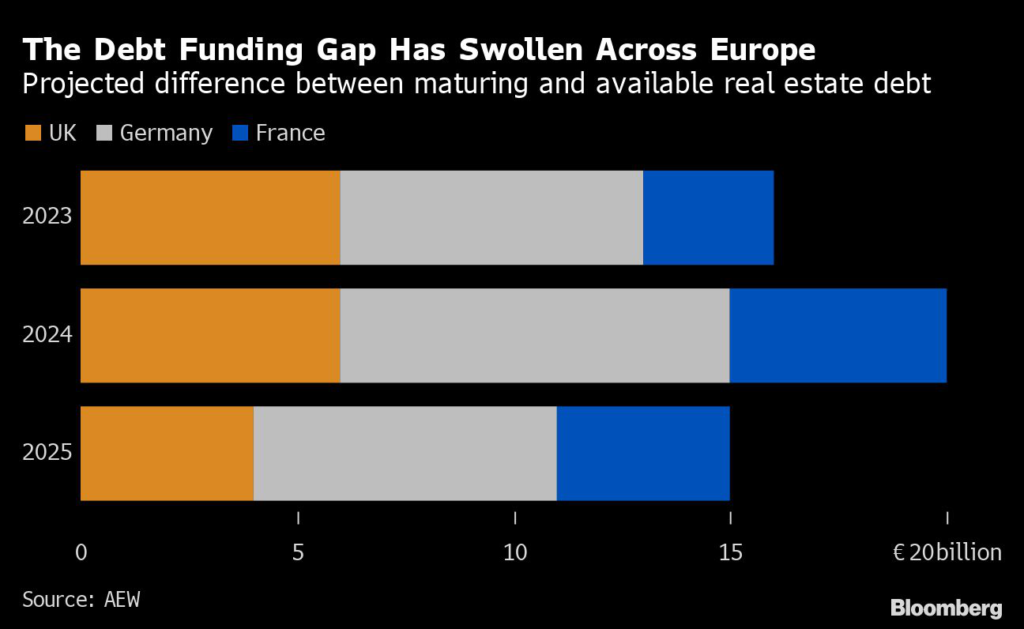

There’s a gap of €51 billion ($55 billion) between the amount owed by commercial property owners across Germany, France and the UK and the credit likely to be available for refinancing when the borrowings mature, according to research by AEW Europe SA.

That includes a shortfall of €32 billion predominantly caused by the decline in prices, an increase of about €8 billion since September, the asset manager said in a report.

Europe’s property boom is over after central banks moved to halt inflation by raising interest rates. Real estate distress levels in the region are already at the highest since 2012, in part because of a decline in liquidity, according to a study by law firm Weil, Gotshal & Manges.

“Lenders won’t have the luxury of low rates allowing them to extend and pretend like in the aftermath of the GFC,” Hans Vrensen, head of research and strategy at AEW Europe, said in an interview. “They will have to be more proactive about restructuring loans. This means that the cyclical adjustment throughout the business might well be quicker this time around.”

Investor Protections

Still, one advantage that many borrowers do have is the erosion of investor protections during quantitative easing mean it’s harder to trigger forced deleveraging.

About 45% of the funding gap is in Germany, 33% in the UK and 22% in France, AEW data show. Germany’s especially vulnerable because the low cost of money drove yields below those of the other countries, making the assets vulnerable to price falls when the market turned.

The remainder of the funding gap comes from landlords having to spend more of the rent being paid for a building on interest costs. That affects the so-called interest coverage ratio that lenders use to calculate how much they’re willing to advance to a borrower.

The combination of price declines, rising debt costs and tightening credit standards mean about a third of all loans in commercial-mortgage backed securities maturing in 2023 and 2024 face high refinancing risks, according to a study published by Scope Ratings on Monday.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.