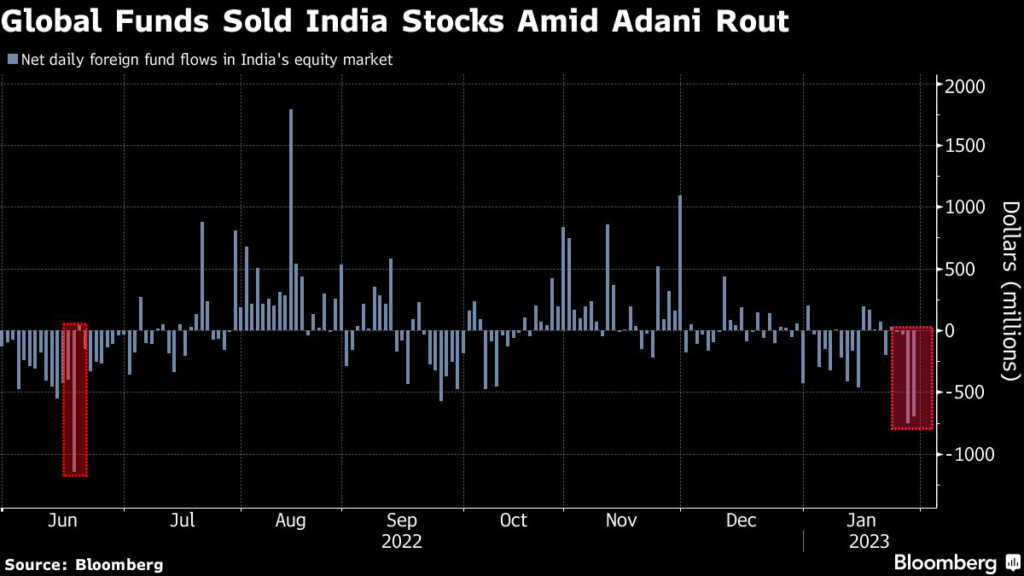

Foreign investors dumped the most Indian shares in two days since June as short seller Hindenburg Research’s scathing report on Adani Group roiled market sentiment.

(Bloomberg) — Foreign investors dumped the most Indian shares in two days since June as short seller Hindenburg Research’s scathing report on Adani Group roiled market sentiment.

Global funds pulled a net $1.45 billion from stocks over Friday and Monday, the biggest two-day selloff since June 17, according to data compiled by Bloomberg. The rout in billionaire Gautam Adani-linked shares was its height during those days even as the conglomerate issued a rebuttal, mounting a furious defense against Hindenburg’s accusations of accounting fraud and market manipulation.

The selling comes ahead of the country’s annual budget presentation on Wednesday and the Federal Reserve’s policy meeting this week.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.