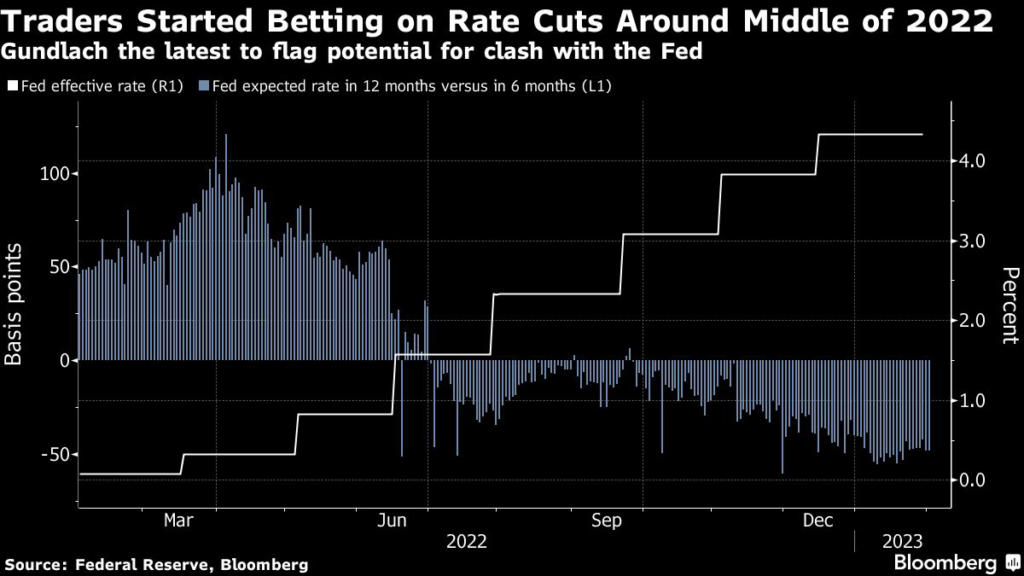

The Federal Reserve will likely push back against suggestions it will soon halt interest-rate increases and then start to ease policy by year’s end, according to DoubleLine Capital LP Chief Investment Officer Jeffrey Gundlach.

(Bloomberg) — The Federal Reserve will likely push back against suggestions it will soon halt interest-rate increases and then start to ease policy by year’s end, according to DoubleLine Capital LP Chief Investment Officer Jeffrey Gundlach.

The US central bank meets Wednesday and is expected to hike its benchmark by 25 basis points, according to a Bloomberg survey of economists. Gundlach’s comments came after BlueBay Asset Management Chief Investment Officer Mark Dowding earlier this week suggesting the market had been too quick to price in a dovish Fed.

Bonds and equities have both rallied strongly to start the year as investors anticipate a substantial slowdown in inflation will spur Fed Chair Jerome Powell to temper his aggressive stance after overseeing the steepest tightening cycle in a generation.

Gundlach said last month that investors should watch the bond market, and not the Fed, to figure out where interest rates are headed. More than half the investors polled by Bloomberg last week agreed.

Bearish Momentum Sweeps Through US Rates Market Just Before Fed

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.