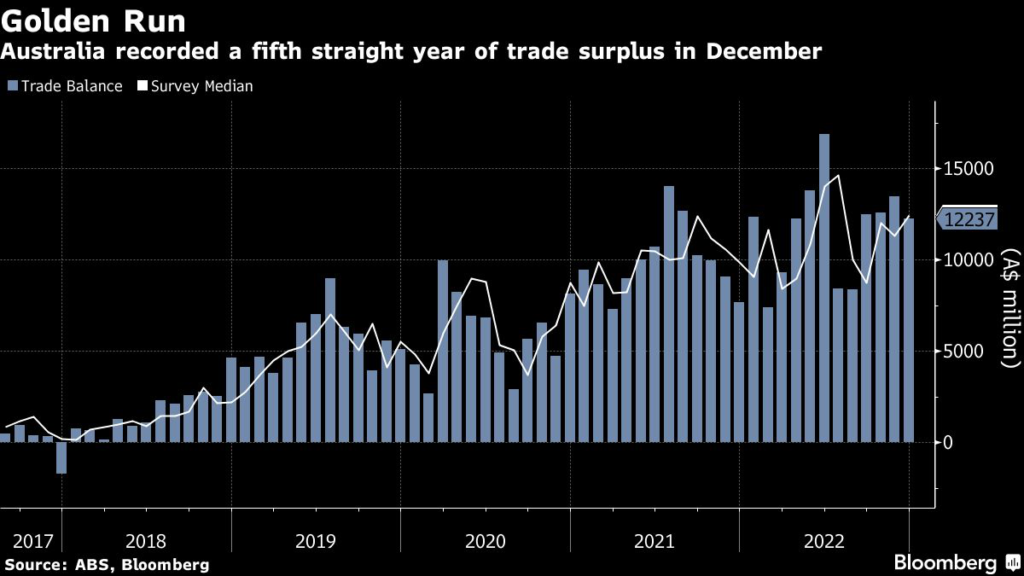

Australia recorded a fifth straight year of trade surpluses, with the outlook poised to further improve on the back of China’s rapid reopening and a thawing of ties between Canberra and Beijing.

(Bloomberg) — Australia recorded a fifth straight year of trade surpluses, with the outlook poised to further improve on the back of China’s rapid reopening and a thawing of ties between Canberra and Beijing.

The windfall came in at A$12.2 billion ($8.4 billion) in December, close to economists’ estimates for a A$12.5 billion surplus, Australian Bureau of Statistics data showed Tuesday. Overall exports declined by 1%, while imports advanced 1% in the month.

Based on the data, economists reckon trade likely added 1-1.7 percentage points to Australia’s gross domestic product in the final three months of 2022.

That should help “offset most of the slowdown in consumption growth and ensure another decent rise in overall output,” said Marcel Thieliant, senior economist at Capital Economics.

Australia has posted monthly trade windfalls since January 2018, underpinned by sales of iron ore and natural gas. The nation is also a major exporter of commodities like wheat that have advanced amid concerns that war-ravaged Ukraine would struggle to ship its harvest.

The export windfall has aided Australia’s budget outlook, with both its debt and deficit position among the best in the developed world.

Today’s report showed the trade surplus narrowed by A$1.2 billion from November and as a result, many monthly export indicators posted declines.

The value of metal ores and minerals — which includes iron ore — slid 3% in the month, while other mineral fuels — which covers liquefied natural gas — declined by 5.6%.

Imports climbed as Australians continued to take advantage of the reopening of borders to head overseas.

China’s earlier than expected scrapping of Covid curbs is likely to further boost exports in upcoming months with analysts expecting demand for everything from goods to services to strengthen.

“Looking into 2023, we expect the trade surplus to remain healthy supported by the earlier reopening of China’s economy and still high commodity prices, albeit off the peak,” said Belinda Allen, an economist at Commonwealth Bank of Australia. She also expects Australia’s education and tourism sectors to be big beneficiaries.

China is Australia’s top trading partner and there are signs of warming diplomatic relations between the two countries with their trade officials meeting for the first time since 2019.

Beijing had imposed trade sanctions on a range of Australian exports in 2020, following a call by then-Prime Minister Scott Morrison for an international investigation into the origins of Covid-19.

–With assistance from Tomoko Sato.

(Adds GDP estimates, comments from economists.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.