Just a day after western powers slapped new sanctions on Russia, top executives from the OPEC+ producers’ oil and gas industry rushed to its biggest potential customer – India.

(Bloomberg) — Just a day after western powers slapped new sanctions on Russia, top executives from the OPEC+ producers’ oil and gas industry rushed to its biggest potential customer – India.

From the head of Rosneft PJSC Igor Sechin to the chairman of Novatek PJSC Leonid Mikhelson, the Russian delegation was out in force in Bengaluru for India Energy Week.

The summit, the nation’s first major event organized under its G-20 presidency, saw delegates from foreign producers rub shoulders with Indian importers as the country highlighted its buying and negotiating power.

Russia, which has plenty of resources including crude oil and natural gas, is increasingly focused on countries like India and China for revenue.

This comes as Europe and the US turn their backs on the nation’s energy shipments following its invasion of Ukraine.

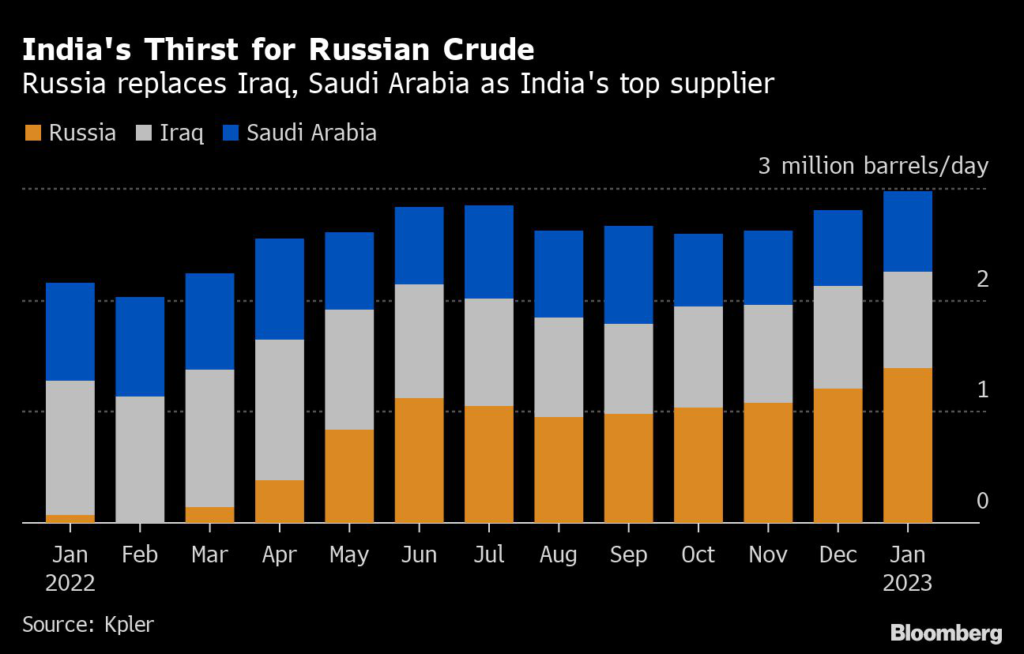

Russia has quickly risen from a very small presence in early 2022 to become India’s largest crude seller, with volumes climbing further after the $60-a-barrel price cap on Russian shipments was implemented in early December.

India is also benefiting as it buys the oil at steep discounts compared to other varieties, and is often offered cargoes on flexible payment terms with shipping and insurance coverage.

The European Union ban on seaborne Russian fuel shipments that took effect on Sunday, coupled with earlier restrictions on the bloc’s crude purchases, give more impetus for Moscow to ramp up the flows to India.

On a panel alongside India’s oil minister Hardeep Singh Puri and OPEC Secretary General Haitham al-Ghais on Monday, Rosneft Chief Executive Officer Sechin was beaming, saying Russia had notched a “psychological victory” over the West by surviving a raft of sanctions.

Oil prices in London surged to almost $130 — about 60% higher than current prices — shortly after Russia’s attack on Ukraine early last year.

US natural gas prices soared to a record in August on concerns of a global energy crisis, before erasing those gains by the end of the year. Restrictions by EU on imports of Russian crude and fuel were put in place in retaliation to the war.

Novatek’s chairman Mikhelson hosted a rare briefing with local and international media on Monday, boasting that the company doesn’t have any issues selling all its liquefied natural gas cargoes, whether through one-off spot deals or long-term contracts.

Novatek, Russia’s largest independent natural gas producer, is also open to selling its shipments to India in rupees, he said.

The top executives of Novatek and Rosneft also met with Indian Prime Minister Narendra Modi.

Apart from those high-profile appearances, Russians could be seen across the conference venue, including the attendance of firms such as Lukoil PJSC.

Much of the chatter among refiners was that while the Russian presence may not be a coincidence, it was good timing as the nation attempts to find new outlets for its oil products in the wake of fresh sanctions.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.