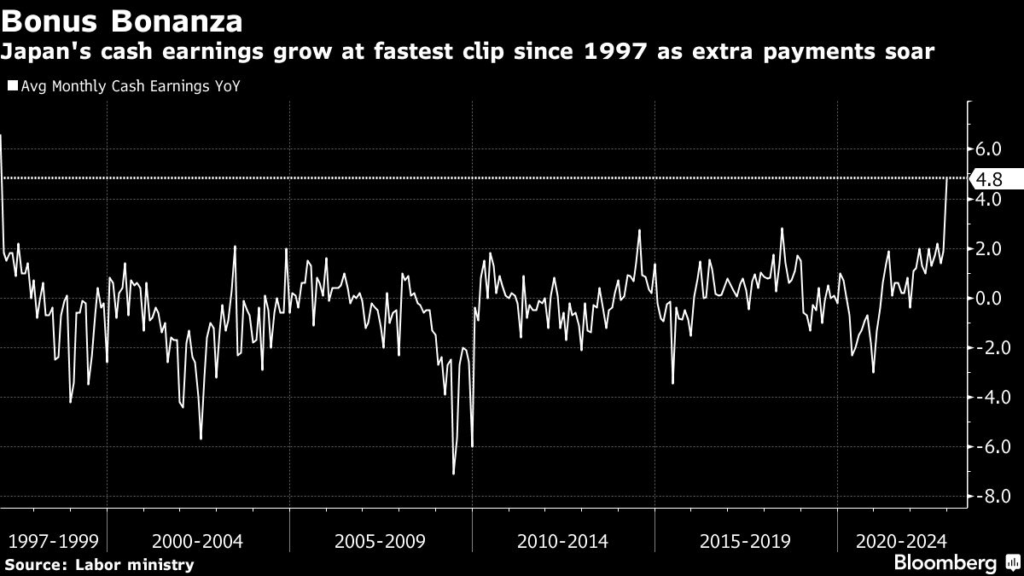

Japanese workers’ nominal wages in December rose at the fastest pace since 1997, an acceleration in gains that may fuel speculation the central bank will consider shifting policy after Governor Haruhiko Kuroda steps down in April.

(Bloomberg) — Japanese workers’ nominal wages in December rose at the fastest pace since 1997, an acceleration in gains that may fuel speculation the central bank will consider shifting policy after Governor Haruhiko Kuroda steps down in April.

Nominal cash earnings for Japan’s workers jumped 4.8% from a year earlier in December, the labor ministry reported Tuesday. Hefty increases in winter bonuses boosted pay packets well beyond a 2.5% growth estimate by economists.

With developments in wages closely linked to the possibility of policy change at the Bank of Japan, the unexpectedly large gain may stoke market bets that the central bank will adjust or back away from its stimulus program under a new governor.

Read More: BOJ’s Policy Path Hinges on Japan’s Complex Wage Dynamics

Signs of bigger increases in pay may also provide some positive news for Prime Minister Fumio Kishida whose public support remains at low levels amid ongoing resignations affecting his cabinet.

The yen firmed a touch after the data, but the initial movement suggested investors were still reluctant to read too much into numbers that only provide a snapshot of one month’s wages.

“The nominal wage growth is a positive development. Not only bonuses but regular pay is also rising,” said Tsuyoshi Ueno, senior economist at NLI Research Institute. “If robust wage growth continues, that will make it easier for the BOJ to proceed with a shrinking of monetary stimulus.”

Still, the outcome of spring wage negotiations between companies and unions was the key pay factor for the BOJ, he added. Initial pay round results from Rengo, Japan’s largest union federation, are expected in March.

The latest monthly data was boosted by December bonuses that were 7.6% bigger than a year earlier. A measure of scheduled pay rose 1.9%, offering a figure closer to the income trend of wages outside bonuses, and well below the 3% the central bank and economists say is needed to support stable 2% inflation in Japan. But even that increase was the biggest since 1997.

Real wages also edged up for the first time since March, ekeing out a 0.1% gain, a figure that shows the pay gains in Japan are still far from providing households with extra spending power after accounting for inflation.

Kishida has repeatedly urged business leaders to raise pay faster than prices so that people’s real spending power increases.

Separate figures showed household spending fell 2.1% in real terms in December from the previous month to take it 1.3% below last year’s level, an indication that price growth is weighing more than expected on consumption.

Inflation figures for December show price growth at 4%, a figure the BOJ says will cool in the coming months, partly influenced by the latest round of government measures that include a subsidy aimed at cutting household electricity bills by a fifth.

“Companies are increasingly trying to compensate employees for ongoing price increases,” said Ayako Fujita, Japan Chief Economist at JPMorgan Securities Japan Co., flagging what she sees as a clear change in momentum.

Fujita expects base pay gains of 1.5% and overall increases of 3% from the spring wage negotiations.

“Today’s result is likely to fuel speculation over the chances of yield curve control adjustments, especially among foreign investors,” she added, referring to the BOJ’s stimulus framework.

Speculation over the direction of monetary policy continues to simmer as the government prepares to make its nomination for Kuroda’s replacement later this month.

A Nikkei report Monday said the government had approached Deputy Governor Masayoshi Amamiya to become BOJ chief. Economists and investors see Amamiya as the front-runner closest to being a candidate of continuity.

Government officials denied the report was based on facts.

–With assistance from Isabel Reynolds.

(Adds household spending figures for December)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.