Australian Treasurer Jim Chalmers said “all options are on the table” when it comes to a decision on whether to reappoint Reserve Bank Governor Philip Lowe, as pressure builds over rapidly rising interest rates.

(Bloomberg) — Australian Treasurer Jim Chalmers said “all options are on the table” when it comes to a decision on whether to reappoint Reserve Bank Governor Philip Lowe, as pressure builds over rapidly rising interest rates.

“When the time comes, I’ll do the usual consultation with my colleagues and we’ll come to a view,” Chalmers said Wednesday, responding to a barrage of reporters’ questions in Canberra after the RBA hiked for a ninth straight meeting and signaled more to come.

Lowe’s term expires in September.

“We’ve got a Reserve Bank review that I’ll receive next month and respond to after that,” Chalmers said. “That will obviously be a factor in my thinking.”

Chalmers’ comments came as four lawmakers from his ruling Labor party questioned the governor’s future and after the Greens’ treasury spokesman urged the treasurer to reverse Tuesday’s hike and demanded Lowe resign.

Prior to the central bank’s first meeting of the year this week, Sydney’s Daily Telegraph newspaper described Lowe, 61, as “a dead man walking.”

The RBA, like other global central banks, is ratcheting up rates to try to rein in the hottest inflation in decades.

While tightening cycles are typically unpopular, a prolonged period of very low borrowing costs and soaring house prices has left Australians heavily indebted.

That leaves them highly exposed to increased mortgage repayments, particularly as most borrowers are on variable loans.

The governor’s two predecessors had their seven-year terms extended by a further three years.

But reappointing Lowe holds little upside for the government given his status is increasingly toxic politically.

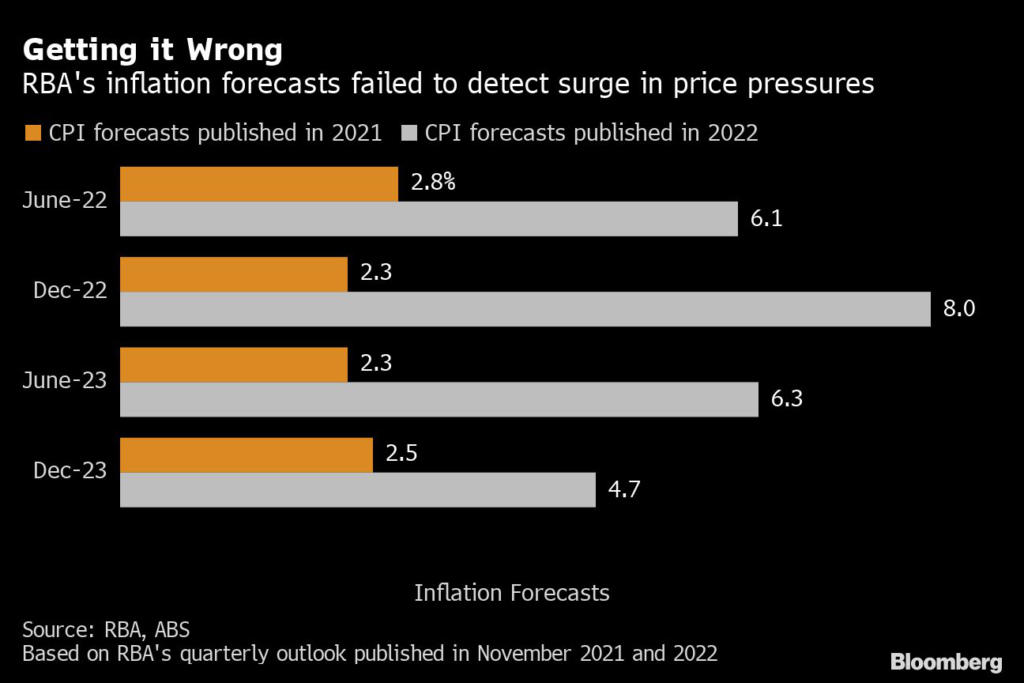

The RBA’s 3.25 percentage points of rate increases since May 2022 carry an extra sting for Lowe as during the pandemic he signaled he didn’t expect to hike before 2024.

That encouraged borrowers to enter the housing market when the cash rate was a record-low 0.1% in expectation of no increases for a while.

The rapid acceleration of inflation after the pandemic forced him to abandon that.

Under pressure from senators during testimony late last year the governor apologized to borrowers who were misled by his guidance.

Lowe’s earlier failure to achieve the RBA’s 2-3% inflation target prior to the pandemic, the RBA’s bungled exit from its yield target and other struggles prompted Chalmers to announce an independent review of the central bank.

It’s due to report in March.

Contacted for this story, the RBA declined to comment. Instead, it pointed to Lowe’s previous remarks that he would like to stay in the role. The governor has also said he would perfectly understand if the government opted to appoint someone else to replace him.

Lowe has faced unprecedented scrutiny during this tightening cycle.

He has a television cameraman permanently stationed outside his home in Sydney’s eastern suburbs and photographers trailing him.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.