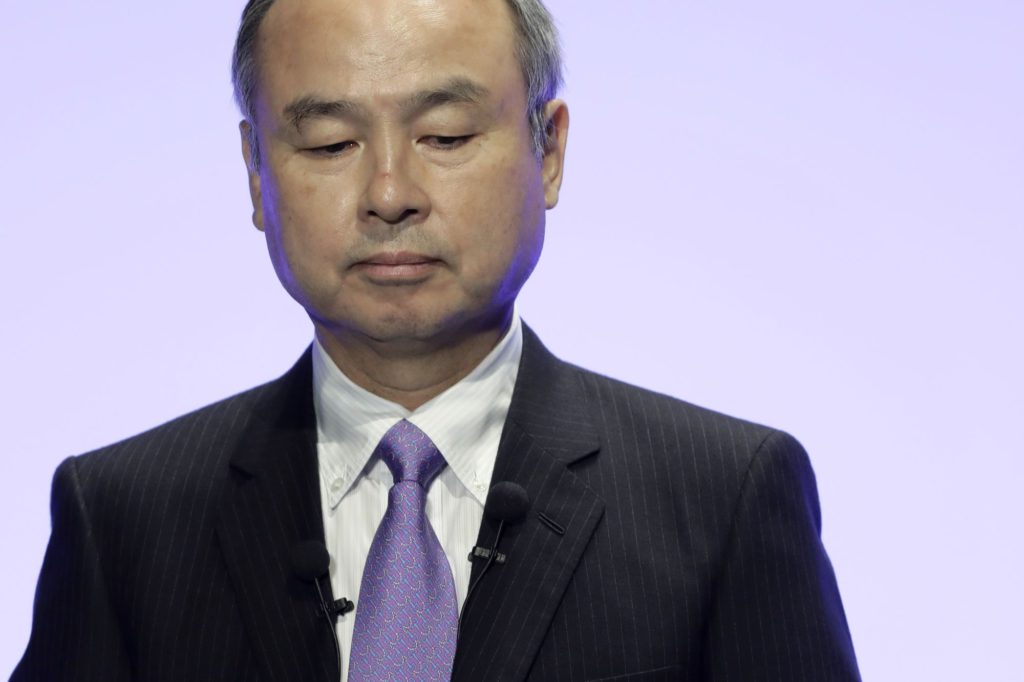

Masayoshi Son is now personally on the hook for about $5.1 billion on side deals he set up at SoftBank Group Corp. to boost his compensation, as losses mounted at its core Vision Fund venture capital arm.

(Bloomberg) — Masayoshi Son is now personally on the hook for about $5.1 billion on side deals he set up at SoftBank Group Corp.

to boost his compensation, as losses mounted at its core Vision Fund venture capital arm.

Son, whose stake in SoftBank grew in recent months, also owns portions of the company’s key investment vehicles.

While these holdings have sparked controversy due to corporate governance concerns, the Japanese billionaire has denied any conflict of interest.

His unrealized losses widened roughly $400 million from three months before.

The founder and chief executive of SoftBank was down $4.7 billion on the same side deals through the September quarter.

Compensation has long been a contentious issue at SoftBank. Japanese companies pay some of the lowest executive salaries in the world, reflecting a culture where job-hopping by managers is still infrequent.

Son himself has kept his pay at 100 million yen, now roughly $760,000 — a rounding error in the US where CEOs routinely make more than $100 million.

As SoftBank grew into a global investor, Son argued the company couldn’t keep talent unless executives were allowed to cut side deals that tied compensation to the company’s performance.

That’s exposed him further to the current market downturn.

The Vision Fund unit posted a $5 billion loss in its fourth straight quarter in the red, sinking SoftBank’s shares Wednesday in their biggest drop in almost three months.

Son owns more than a third of the company, according to Bloomberg calculations based on company filings.

The global tech investor was hit by continued mark downs in its investments in unlisted startups, which outweighed gains in its public holdings.

Chief Financial Officer Yoshimitsu Goto said they applied “extremely strict” standards in writing down investment losses. SoftBank had invested in 472 companies through its venture capital arm by December.

Portfolio losses ratcheted up Son’s deficit to about $2.9 billion from his Vision Fund 2 interest, and $344 million at the Latin America fund, according to disclosures for the December quarter.

His remaining deficit at SB Northstar was 246.1 billion yen ($1.85 billion). The debt totaled $5.1 billion according to Bloomberg calculations based on company disclosures.

The 65-year-old billionaire holds 17.25% of a vehicle set up under SoftBank’s Vision Fund 2 for its unlisted holdings, as well as 17.25% of a unit within the company’s Latin America fund, which also invests in startups.

He has a 33% stake in SB Northstar, a vehicle set up at the company to trade stocks and derivatives.

There is no immediate deadline for repayment and the value of Son’s positions could improve in the future, and for SB Northstar, Son has already deposited some cash and other assets.

The founder would pay his share of any “unfunded repayment obligations” at the end of the fund’s life, which runs 12 years with a two-year extension.

Son’s net worth stood at $12.3 billion after Tuesday’s close, after adjusting for his deficit from his interests in SB Northstar, Vision Fund 2 and the Latin America fund, according to calculations by Bloomberg Billionaires Index.

(Updates with closing share price in sixth paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.