Inflation that is proving increasing stubborn will prompt the Federal Reserve to raise interest rates to an even higher peak level and hold them there through the year, according to economists surveyed by Bloomberg this month.

(Bloomberg) — Inflation that is proving increasing stubborn will prompt the Federal Reserve to raise interest rates to an even higher peak level and hold them there through the year, according to economists surveyed by Bloomberg this month.

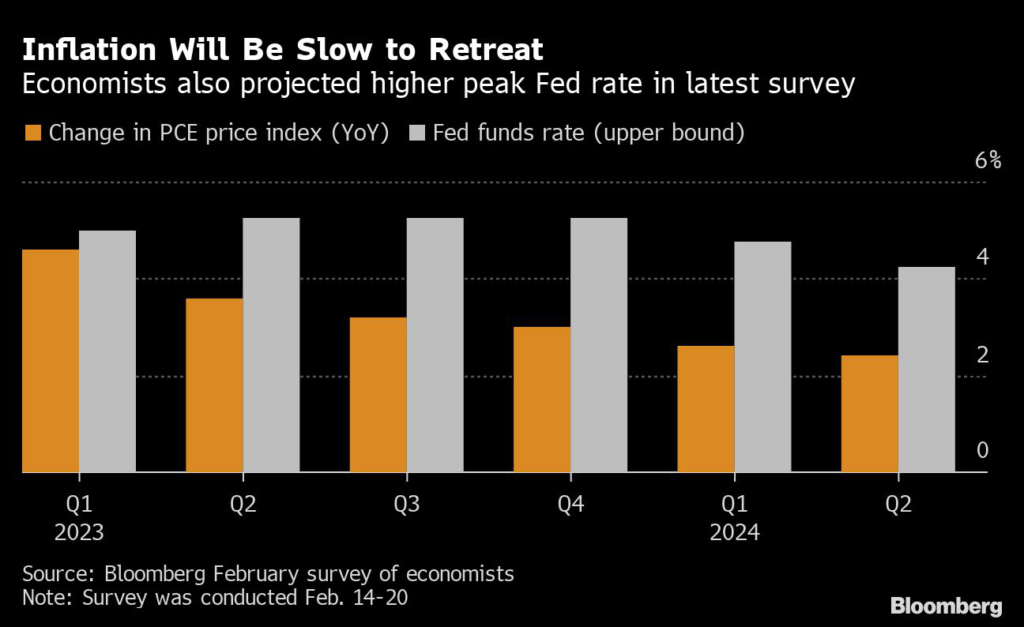

Forecasters boosted their projections for the Fed’s preferred inflation gauge — the personal consumption expenditures price index — for every quarter through the first half of next year. The metric is now seen averaging 2.4% on an annual basis in mid-2024 compared to 2.3% last month. They see a similar sluggishness in the subsiding of the consumer price index.

That’s leading to expectations of a higher federal funds rate, with quarter-point rate hikes in March and May to reach a peak of 5.25%. Economists see the central bank standing pat for the remainder of 2023. Last month, survey respondents projected a terminal rate of 5%.

The survey was conducted from Feb. 14-20, starting when the January CPI was released and showed annual inflation came in higher than expected. Reports the following day showed retail sales rose last month by the most in nearly two years, and separate measures of manufacturing also came in better than forecast.

It all adds up to an economy running too hot for the Fed’s liking, underscored by a tight labor market. Policymakers have responded by conveying their intention to take rates even higher than previously expected, which traders are now starting to price in.

While economists have pointed to risks that such a hawkish policy will trigger a recession, they now appear somewhat more sanguine — odds of a downturn in the next year dropped in February for the second time since May 2021. However, they still see a 60% chance of a recession.

“The economy is probably on course for positive growth this year, but likely interrupted by a relatively short and mild contraction,” said Bill Adams, chief economist at Comerica Inc.

The survey corroborates his projection — gross domestic product is seen rising an average 0.8% this year, but will decline slightly in the second and third quarters.

A resilient job market will support the economy overall, and economists revised up their payrolls forecasts through the first quarter of next year. Unemployment is still seen climbing but by less than economists expected last month. They expect the jobless rate to peak at 4.7% early next year, down from January’s 4.9% projection.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.