Markets may have overshot in recent days when placing bets on the peak for European Central Bank interest rates, according to Governing Council member Francois Villeroy de Galhau.

(Bloomberg) — Markets may have overshot in recent days when placing bets on the peak for European Central Bank interest rates, according to Governing Council member Francois Villeroy de Galhau.

The ECB is “in no way” obliged to raise borrowing costs at every meeting between now and September, with the deposit rate already at a level that restricts the euro-zone economy, the Bank of France Governor told the Les Echos newspaper. The Bank of France confirmed Villeroy’s comments to Bloomberg.

His pushback follows remarks late last week to Bloomberg by ECB Executive Board member Isabel Schnabel, who said officials are “far from claiming victory” over inflation and that investors may be underestimating price pressures. That pushed wagers on the peak in the deposit rate, currently 2.5%, to 3.75% for the first time.

It’s not the first time the French central banker has set out how he sees policy evolving over coming months. In a speech on Friday just after Schnabel’s comment were published, Villeroy said that once the ECB has hiked by 50 basis points in March, there will be less “monetary urgency.” Officials will then decide their next steps based on a close analysis of economic evidence and data, he said.

“There’s been an excess of volatility on expectations for the terminal rate,” Villeroy said. “In other words, markets have overreacted a little since Thursday.”

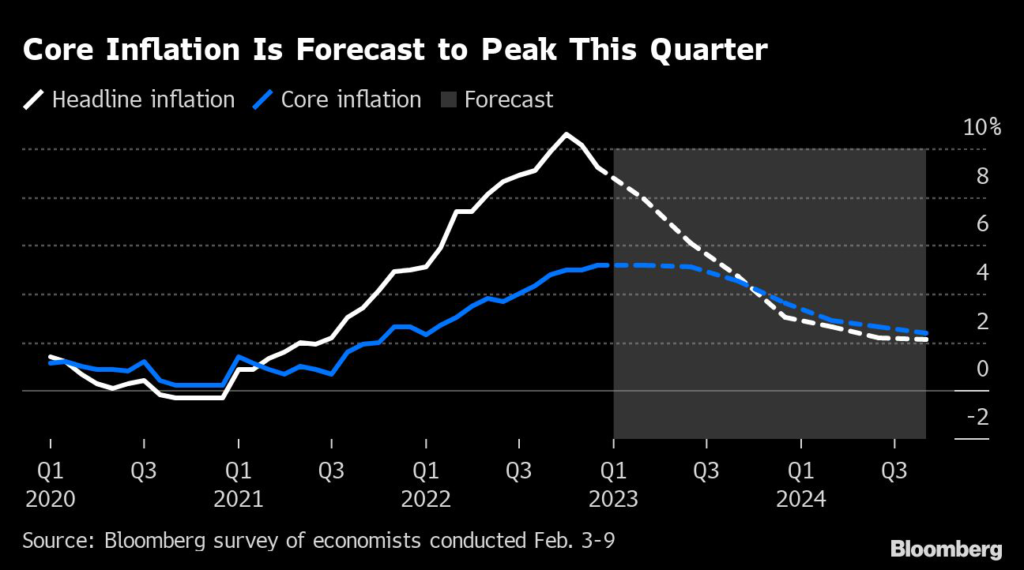

Policymakers are wary of easing off too soon in their battle with inflation that, while receding, remains closer to its double-digit peak than the ECB’s 2% goal. Even as the headline number drops, stubborn underlying price pressures are the focus of many ECB officials. Core inflation held at a record in January.

The recent hawkish comments by Schnabel and other Governing Council members have prompted economists at Goldman Sachs, Berenberg and Deutsche Bank to lift their forecasts for the terminal rate.

Deutsche Bank was the latest to do so, predicting the monetary-tightening cycle will stop at 3.75% in June, with the 20-nation euro area’s economy proving more resilient than many feared after Russia invaded Ukraine.

In further evidence of that, data Wednesday showed Germany’s business outlook improved for a fifth month. That followed a surprisingly strong improvement in private activity in the euro region this month, according to a survey of purchasing managers released a day earlier.

At 3.5%, Goldman Sachs sees a slightly lower end-point for rates than Deutsche, while market bets imply an ECB peak rate of 3.76% by October. Officials have all but promised another 50 basis-point move in March.

Villeroy said the ECB will have to weigh judgment, real data and forecasts in plotting the path ahead. There are already signs of disagreement: Unlike his French counterpart, Bundesbank President Joachim Nagel reckons borrowing costs haven’t reached restrictive levels yet.

The ECB should stabilize rates “when we have a clear turnaround in underlying inflation,” Villeroy said.

–With assistance from James Hirai and Libby Cherry.

(Updates with latest market pricing in 10th paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.