Sanguine stock investors are at risk of being rocked by volatility during the rest of 2023 as concerns about a recession intensify, Goldman Sachs Group Inc. strategists say.

(Bloomberg) — Sanguine stock investors are at risk of being rocked by volatility during the rest of 2023 as concerns about a recession intensify, Goldman Sachs Group Inc.

strategists say.

Stress in the banking sector and weaker economic data have increased the potential for bigger moves in the second quarter, the team led by Christian Mueller-Glissmann wrote in a note.

The strategists said a Goldman model assessing a combination of macro-economic factors, market indicators and broader uncertainties signals a 54% chance of high volatility for the S&P 500, against a 39% chance that moves will be milder.

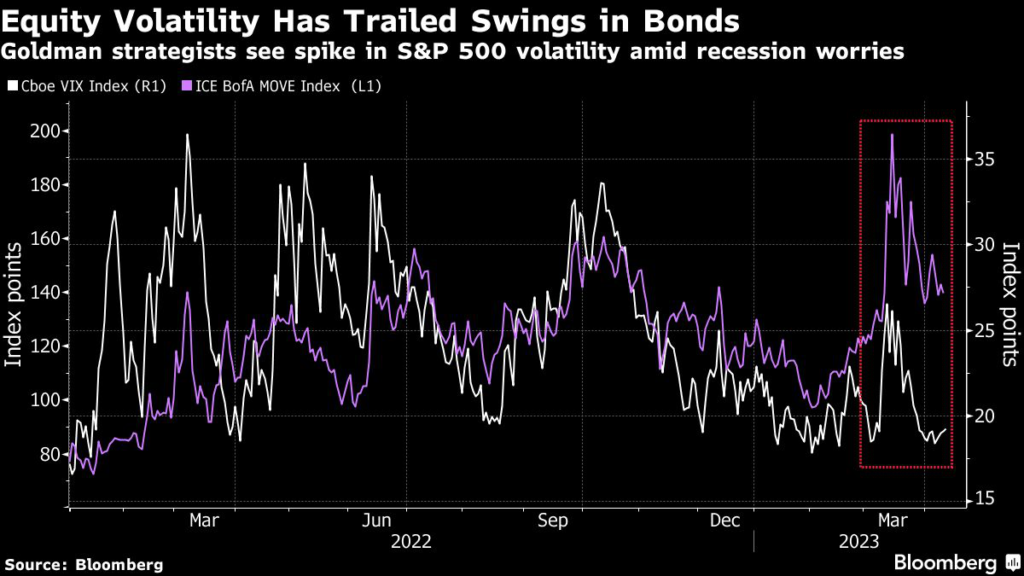

While bond-market volatility has spiked this year, with yields fluctuating wildly as investors priced the likelihood of an economic contraction, equities have resembled oases of calm by comparison.

Stock traders have focused instead on bets that slowing growth could prompt the Federal Reserve to call an end to its interest-rate tightening campaign.

Mueller-Glissmann in February said he preferred non-US assets over American equities, correctly forecasting a period of underperformance in the S&P 500.

For the remainder of 2023, “with both growth and inflation expected to decline, volatility across assets is likely to be driven more by growth rather than inflation volatility,” the strategist wrote in the note.

In such an environment, the Goldman team prefer equity derivatives such as shorter-dated put spreads, S&P 500 longer-dated collars and long forward vol strategies as a method of hedging against stock declines.

(Adds more context on contrast between bond and equity markets this year.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.