Tata Consultancy Services Ltd.’s quarterly profit missed analysts’ estimates as cautious clients curtailed technology spending to prepare for a cooling economy.

(Bloomberg) — Tata Consultancy Services Ltd.’s quarterly profit missed analysts’ estimates as cautious clients curtailed technology spending to prepare for a cooling economy.

Net income rose 15% to 113.9 billion rupees ($1.4 billion) in the fourth quarter through March, TCS said in a statement Wednesday. Analysts estimated 115.3 billion rupees on average. Sales climbed 17% to 591.6 billion rupees.

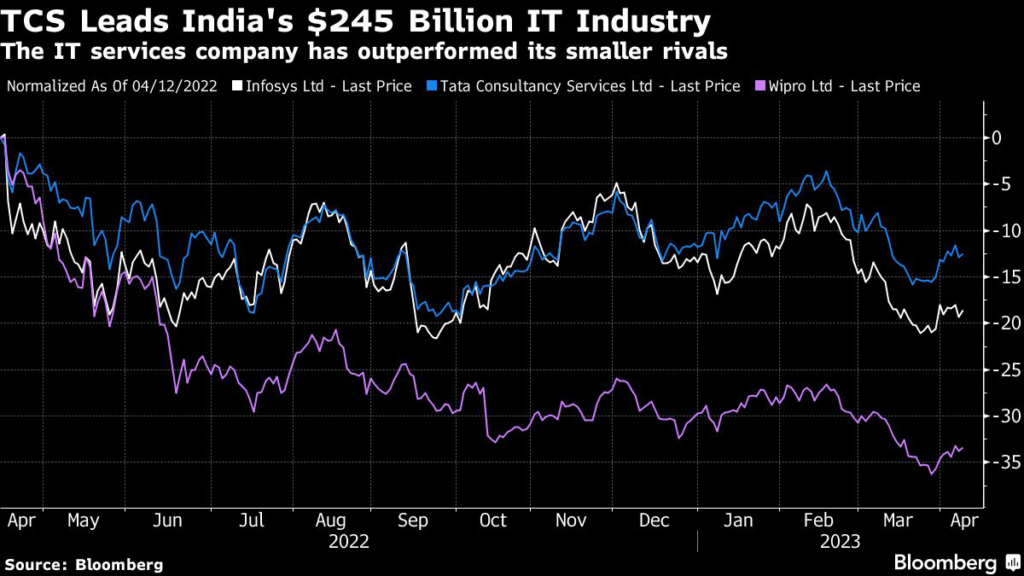

India’s showpiece $245 billion software services sector, led by TCS, swelled during the peak of global Covid-19 infections as client firms in Europe and North America invested in technology to better accommodate staff and customers working from home. That boom is now cooling off as more people resume pre-pandemic activities and return to the office.

Chief Executive Officer Rajesh Gopinathan said the company was closely monitoring clients’ business sentiment.

“Many of the the longer-term projects are still on track. It’s more the discretionary projects which have been deferred or put on hold,” Gopinathan told a news conference. “We have seen nothing that indicates that the structural story on technology is in any form impacted.”

Despite mounting economic challenges, Mumbai-based TCS has won some large contracts in recent months, including a deal worth more than $700 million, its largest in the UK in three years, with an insurance services provider.

In a surprise announcement last month, CEO Gopinathan said he would step down from his post and depart from the company in September. On Wednesday, TCS clarified that CEO designate K. Krithivasan, who currently leads its banking and financial services business, will take over from June 1. Gopinanthan will stay at the company for the transition.

(Updates with CEO’s comments in fifth paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.