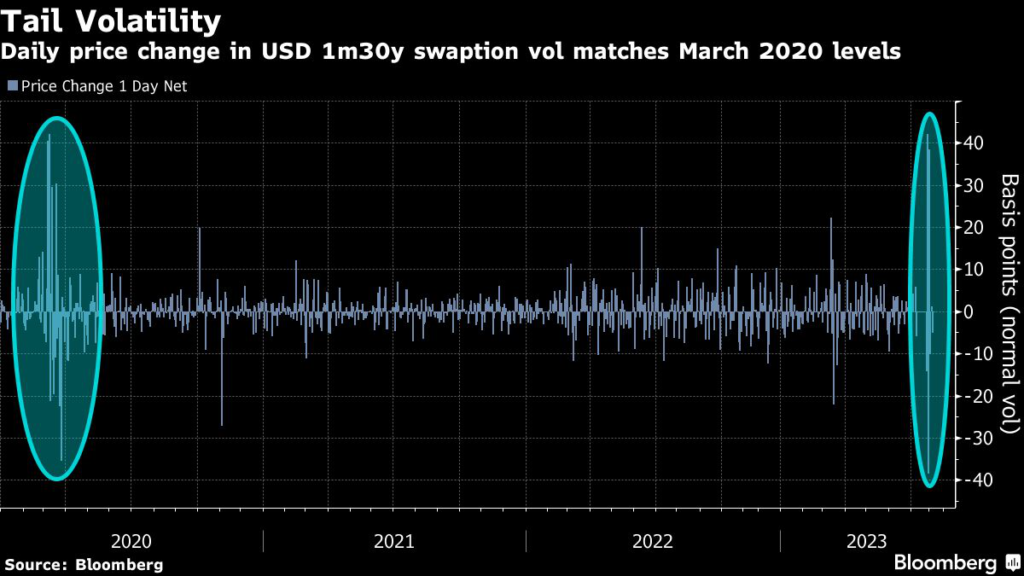

A build-up of short positions in long-dated Treasuries has sent ripples through some measures of interest-rate volatility, where daily moves are rivaling those of the March 2020 liquidity crisis.

(Bloomberg) — A build-up of short positions in long-dated Treasuries has sent ripples through some measures of interest-rate volatility, where daily moves are rivaling those of the March 2020 liquidity crisis.

This week’s gyrations in one-month 30-year swaption volatility — a measure of how much long-term rates are implied to move on one-month horizon — dwarf anything that’s occurred during the past three years.

In other words, traders are unnerved by the sudden spike in 30-year Treasury yields to 4.42%, a level last seen in 2011, and the failure of dip-buying to contain it.

“New short risk is driving the cheapening with extreme addition to the short side seen in 30y,” Citi strategists Ed Acton and Bill O’Donnell said in a note, referring to the bank’s positioning data model.

Positioning appears short across all horizons, particularly in the 30-year sector of the Treasuries curve, they said.

JPMorgan Chase & Co. strategists also point to positioning indicators for the surge in long-end Treasury yields, downplaying factors such as official selling of Treasuries.

Exposure in their weekly Treasury Client Survey “extended once again, nearing its longest levels observed earlier this summer,” strategists including Jay Barry said in a Thursday note.

Traders Show Dip-Buying Appetite as US Yields Threaten Break-Out

Such a fast build-up of short positions leaves open the potential for covering flows to unleash a rally.

Many short positions in Treasury 10-year note futures, which traded at 109-03+ Thursday, the lowest price since October, would likely be covered at around 109-28, the Citi strategists said. Friday’s rally stalled just above there, at 109-28+.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.