Investors pointing the finger at foreign central banks for the recent upheaval in long-term Treasury bonds are making a mistake, JPMorgan Chase & Co. says.

(Bloomberg) — Investors pointing the finger at foreign central banks for the recent upheaval in long-term Treasury bonds are making a mistake, JPMorgan Chase & Co.

says.

The conclusion came as speculation mounted that some countries would be dumping Treasuries to get their hands on dollars to defend their own currencies. Thirty-year US yields hit the highest since 2011 this week as the greenback strengthened.

Read: China Told State Banks to Escalate Yuan Intervention

JPMorgan strategists including Jay Barry said bonds due in 20 and 30 years account for less than 5% of foreign central banks’ Treasury holdings.

In comparison, about 40% of their holdings are concentrated in notes maturing in three years or less.

“With a significant share of official holdings concentrated at the front end, we do not think the move in long-end yields to new highs for the cycle is being driven by official shedding of Treasuries,” the strategists wrote.

Unlike foreign private investors, central banks prefer holding short-term notes in their foreign reserves because these securities can be more easily liquidated in times of financial stress, according to the strategists.

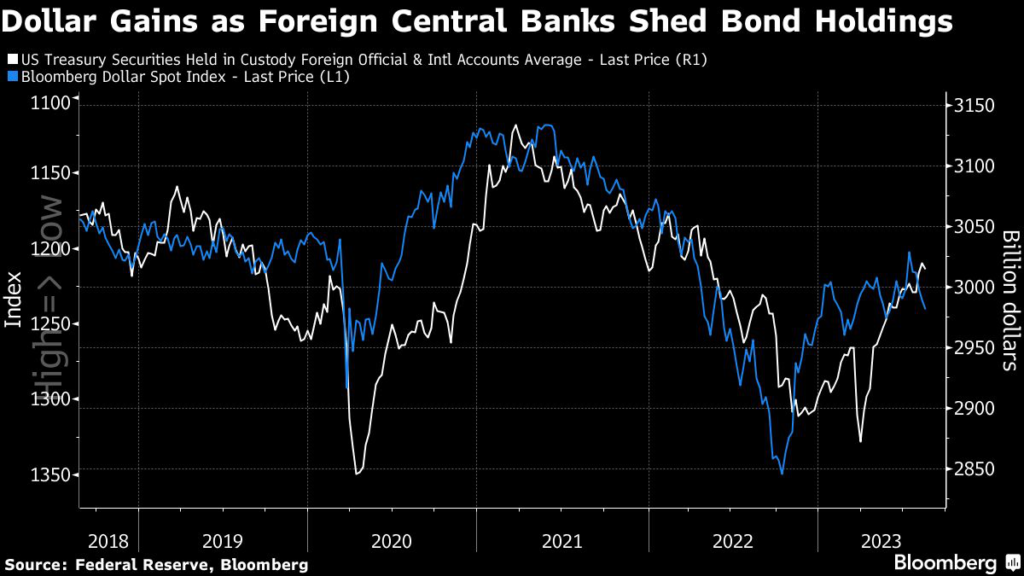

Barry and his colleagues acknowledged that the dollar’s movement has a close relationship with the official holdings of Treasuries.

The greenback’s rally in late 2022 coincided with foreign central banks selling Treasuries as part of their currency intervention.

But so far, the Federal Reserve’s weekly data on custody holdings of Treasuries – a proxy for foreign officials’ holdings — has barely budged.

So if it’s not foreign central banks, what’s behind the Treasury selloff?

The strategists suggest that investors capitulating on their long positions are probably to blame.

They pointed to their recent survey showed that investors’ net long positions are near historic highs.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.