Bank profits in Europe likely reached their highest point since the financial crisis this year, climbing in lockstep with interest rates. As the economic outlook darkens amid unfolding geopolitical crises, the focus this earnings season could now turn to margin pressure and signs of souring loans.

(Bloomberg) — Bank profits in Europe likely reached their highest point since the financial crisis this year, climbing in lockstep with interest rates. As the economic outlook darkens amid unfolding geopolitical crises, the focus this earnings season could now turn to margin pressure and signs of souring loans.

“Banks are generating peak earnings. The third quarter will be a chance to take their pulse and see how this very positive situation is normalizing, for example because they’re passing on higher rates to clients,” said Alexandra Annecke, a senior portfolio manager at Union Investment in Frankfurt.

Investors will be watching for forward-looking comments on greater competition for deposits and mortgages across the region, which has been partly driven by central bank rates soaring from almost zero to the highest in decades to curb inflation.

Also on the radar are wars in Israel and Ukraine, China’s economic woes and more efforts to impose windfall taxes, as seen in Italy, Sweden and the Netherlands this year. Provisions for bad debt, particularly for loans backing commercial real estate, will be of interest too.

Barclays Plc and UniCredit SpA report on Tuesday, followed by the likes of Deutsche Bank AG, Lloyds Banking Group Plc, Banco Santander SA, Standard Chartered Plc, BNP Paribas SA and NatWest Group Plc. After that, HSBC Holdings Plc updates markets next week and UBS Group AG is due on Nov. 7.

Outlook Darkens

The Israel-Hamas war has put higher energy prices on top of investors’ minds again, less than two years after Russia’s invasion of Ukraine raised the threat of oil supply shocks.

“Higher inflation could lead to higher wage growth and this could mean cost growth comes in higher than expected for FY24,” RBC analyst Benjamin Toms said, adding that higher-for-longer interest rates could also hit asset quality and lending volumes at the banks. Parts of investment banking could also decline, because uncertainty “can kill IPOs and dealmaking,” Toms said.

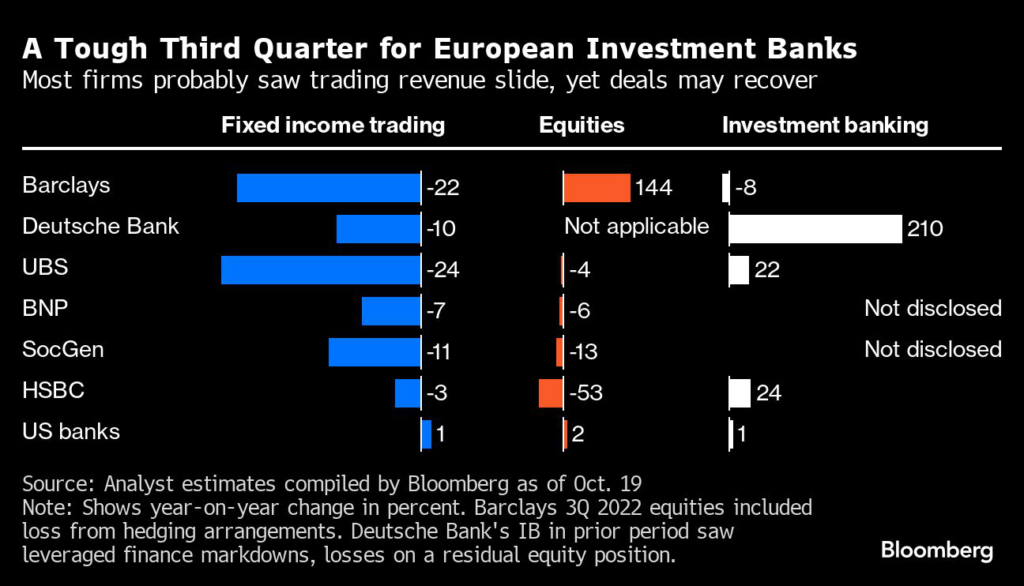

Fixed-income traders, on the other hand, could get a revenue boost from increased volatility, similar to moves seen in the wake of the Ukraine invasion. Revenues in the third quarter are expected to have declined in Europe, underperforming US peers.

Read More: UBS Bans Work Travel for Mideast Staff as Israel Conflict Rages

Most big European banks are expected to stash more money to cover credit losses than they did a year ago. Yet bankers have been relatively sanguine about the quality of their loan books.

Deutsche Bank Chief Executive Officer Christian Sewing told Bloomberg TV on Oct. 13 “there is a lot of resiliency in the portfolio.” Earlier this month, Bettina Orlopp, the finance chief of smaller German rival Commerzbank AG, made similar comments while saying that credit provisions will probably rise next year.

Listen to More: Deutsche Bank CEO Talks Geopolitics, Economy

Regulators, though, have warned of the effects of potentially higher-for-longer interest rates on credit quality.

“When you have these types of structural changes underway, these geopolitical shocks, energy transition, digitalization, we need to be humble and be aware that our models might not be as effective in identifying the main pressure points as we would like them to be,” Andrea Enria, the European Central Bank’s top oversight official, said at a conference in October.

Lenders’ so-far benign, yet narrowly disclosed, exposures to commercial real estate are sure to come up on analyst calls too. The ECB asked property valuers to explain how they compile estimates over concerns that banks have been too slow to mark down the value of their commercial real estate loans, Bloomberg has reported.

What Bloomberg Intelligence Says:

Strong 1H earnings — with most lenders beating consensus for revenue and cost of risk — extended a wave of estimate upgrades for Europe’s largest banks, which have outstripped downgrades for almost three years. Yet they may lose momentum through 2H and into 2024, with the outlook increasingly bleak for 2024 estimates and beyond.

— Philip Richards, senior banking analyst

Wall Street’s five big banks have just posted a seventh straight quarter of declines in investment banking fees. That doesn’t bode well for their European peers.

Still, some firms may have small areas of optimism. At Deutsche Bank, such revenue is expected to rebound from the third quarter of 2022, when it suffered markdowns in leveraged finance and losses on a residual equity position.

Revenue from trading stocks and bonds is expected to decline at most European banks, analyst estimates compiled by Bloomberg show. A notable exception is Barclays, where the equities business is seen more than doubling from the prior-year quarter after an infamous blunder in which it over-issued certain securities.

UBS’s Mammoth Task

UBS Chief Executive Officer Sergio Ermotti, meanwhile, faces the daunting task of integrating Credit Suisse in one of the biggest bank deals ever. He’ll be quizzed on how his wealth-management giant is winding down assets and implementing over $10 billion in cost savings, including job cuts.

Ermotti last month said he’s seeing “good momentum” in regaining funds that clients pulled from Credit Suisse before its emergency takeover in March.

Investors will also be hoping to get more color on Ermotti’s three-year growth strategy, due to be outlined in February, which is expected to detail the Swiss bank’s expansion plans in the US.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.