BENGALURU (Reuters) -India’s Titan missed first-quarter profit estimates on Friday as higher gold prices hindered demand in its mainstay jewellery segment.

The Tata group-owned company reported a 5% fall in consolidated profit to 7.15 billion rupees ($85.4 million) in the quarter ended June 30, from 7.56 billion rupees an year ago.

Analysts’ on average expected a profit of 7.65 billion rupees, as per LSEG data.

Gold prices have been on the rise since the last financial year, dampening demand for jewellery in India, the world’s second-largest gold consumer, with many retailers offering significant discounts to attract customers.

Additionally, fewer wedding days during the quarter, increasing competition from regional players, and heatwaves across the country have also stifled demand for gold jewellery.

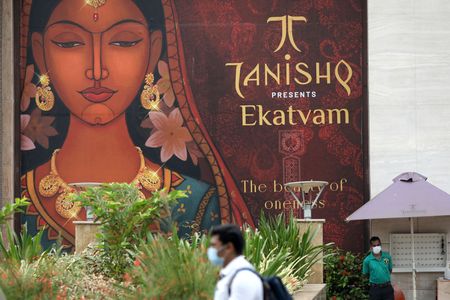

Still, Titan’s jewellery business, which houses brands like Tanishq and CaratLane and accounts for 88% of overall revenue, reported a 10% rise in revenue.

The company said domestic growth for jewellery was largely due to higher selling prices, whereas buyer growth was in the low single-digit percentage range.

Titan’s watches and wearables segment, which contributes 8% to the total revenue, reported a 12% growth in revenue.

While overall sales jumped 13% to 122.23 billion rupees, it grew at its slowest pace in four quarters.

Meanwhile, raw material costs jumped 43% during the quarter due to high bullion prices, hurting margins.

As a result, Titan’s earnings before interest and tax (EBIT) margin contracted to 9.7% from 10% a year ago.

The company’s shares are down nearly 6% so far this year, compared to a 14% gain in the benchmark Nifty 50 index

($1 = 83.7250 Indian rupees)

(Reporting by Ashna Teresa Britto in Bengaluru; Editing by Sonia Cheema)