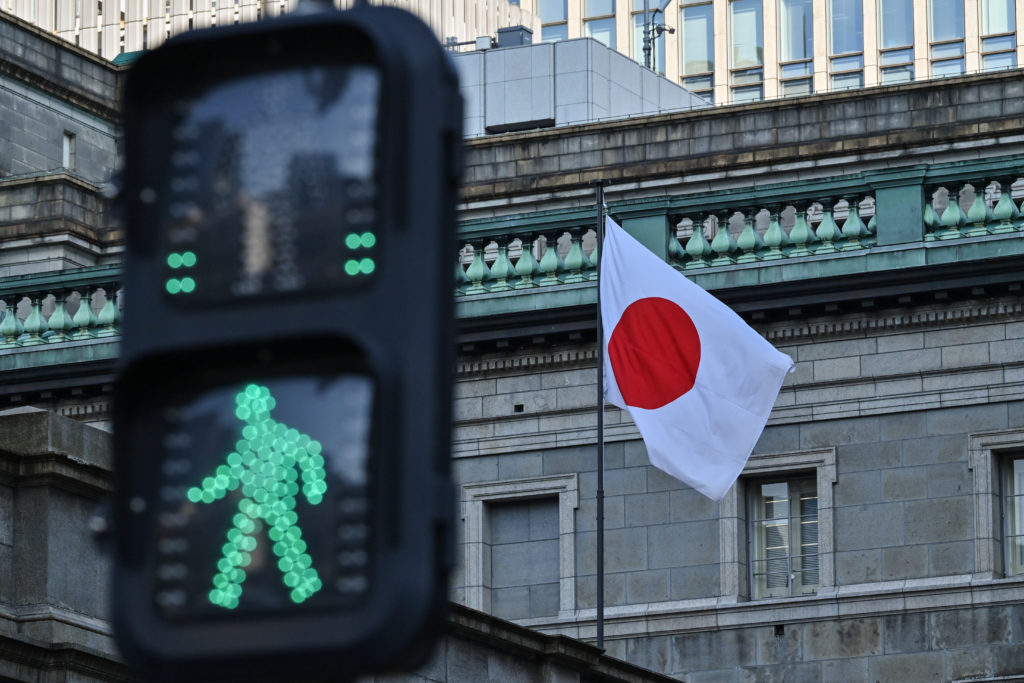

Global stocks diverged on Friday as investors weighed corporate earnings, economic data and President Donald Trump’s policies.Meanwhile the US dollar lost more than one percent against the euro and pound following the US president’s comments about not wanting to impose tariffs on China and calling for lower interest rates.The S&P 500 edged higher to set another record but all of Wall Street’s indices slid into the red after a US consumer sentiment survey came in lower than expected.”It is fair to say that there is a festering sense that the market may be due for a consolidation period given the scope of recent gains,” said Briefing.com analyst Patrick O’Hare, pointing to a six percent gain by the S&P 500 since the beginning of last week and a similar rise in the Nasdaq.”Those are big moves in front of a big week next week that will feature earnings reports from Apple, Meta Platforms, Microsoft, Tesla and Amazon.com” as well as an interest rate meeting by the US Federal Reserve and the release of the Fed’s preferred inflation gauge, he added.Wall Street’s major indices were still poised to end the week with solid gains, thanks in no small part to comments and actions by Trump since his return to the White House on Monday.In Asian trading, Hong Kong gained nearly two percent and Shanghai also advanced following Trump’s more friendly comments with regard to China.In a speech via video link Thursday at the World Economic Forum in Davos, Trump pushed for lower interest rates and said he would cut taxes for companies investing in the United States while imposing tariffs on those who do not.He also said in a separate interview that he would “rather not” impose tariffs on China and signalled openness at negotiating a trade deal with Beijing. “Clearly these are off-the-cuff remarks but it has left the overnight market feeling like there’s a scenario where China escapes the worst of the tariff regime,” said Jim Reid, managing director at Deutsche Bank.The comments also saw the greenback take a hit.”President Trump’s wish to see lower interest rates led to a drop and one-month low in the US dollar,” said Axel Rudolph at online trading platform IG.”This benefitted the gold price which rallied to within a whisker of its all-time high,” he added.In Japan, Tokyo’s stock market dropped and the yen rallied after the Bank of Japan lifted borrowing costs to their highest level since 2008 and flagged further increases in the pipeline. Moody’s Analytics said “the weak yen is a key reason” for the hike, along with a run of forecast-beating inflation reports.The yen has come under pressure against the dollar in recent months after the US Federal Reserve dialled back its expectations for rate cuts this year, and amid concerns that Trump’s policies would reignite inflation.In Europe, both London and Frankfurt stocks hit fresh record highs before turning lower. Paris ended the day with a gain, led by luxury stocks after British fashion house Burberry showed signs of recovery.- Key figures around 1630 GMT -New York – Dow: DOWN 0.1 percent at 44,511.43 pointsNew York – S&P 500: FLAT at 6,120.11New York – Nasdaq Composite: FLAT at 20,052.63London – FTSE 100: DOWN 0.7 percent at 8,502.35 (close)Paris – CAC 40: UP 0.4 percent at 7,927.62 (close)Frankfurt – DAX: DOWN less than 0.1 percent at 21,394.93 (close)Tokyo – Nikkei 225: DOWN 0.1 percent at 39,931.98 (close)Hong Kong – Hang Seng Index: UP 1.9 percent at 20,066.19 (close)Shanghai – Composite: UP 0.7 percent at 3,252.63 (close)Dollar/yen: DOWN at 155.61 yen from 156.03 yen on ThursdayEuro/dollar: UP at $1.0514 from $1.0415Pound/dollar: UP at $1.2490 from $1.2352Euro/pound: down at 84.20 pence from 84.31 penceWest Texas Intermediate: DOWN 0.2 percent at $74.46 per barrelBrent North Sea Crude: FLAT at $78.29 per barrelburs-rl/gv

Fri, 24 Jan 2025 17:11:13 GMT