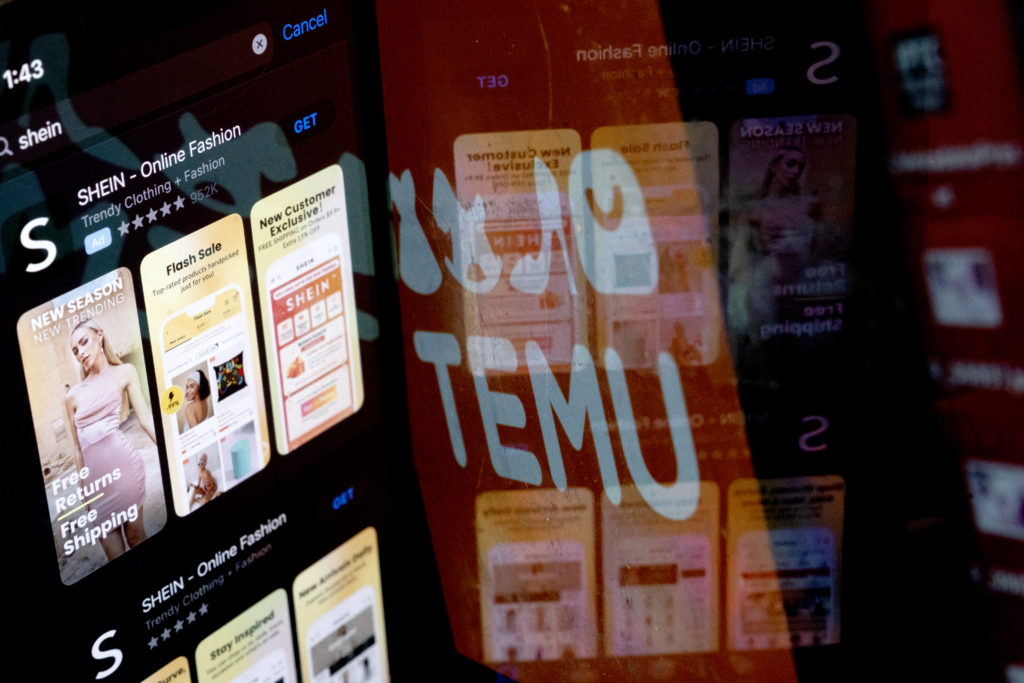

Shares in Google parent Alphabet slumped on Wednesday as its earnings disappointed investors and it was ensnared in rising trade tensions.Meanwhile, Chinese e-commerce firms took a hit from news that the US Postal Service was suspending inbound parcels from China and Hong Kong, a move that followed tit-for-tat tariffs hikes by Washington and Beijing. The USPS later reversed its decision, but the European Commission said it would seek to impose new fees on e-commerce imports.Shares in Alphabet slumped more than eight percent at the open of trading, with lower-than-expected revenue growth in its cloud division raising questions about its ability to compete with rivals in the heated AI infrastructure market.Alphabet also announced plans to invest approximately $75 billion in capital expenditures in 2025, a figure that surprised analysts and highlighted the mounting costs of AI development.”Investors were also unhappy about its capital expenditures, something that China’s cut-price, AI assistant DeepSeek, has thrown into sharp relief,” said David Morrison, senior market analyst at Trade Nation.The tech sector has already been roiled by the unveiling of DeepSeek, stoking concerns that the eye-watering investments made in AI in recent years may not ever return profits.”All this comes after China has said it will launch an antitrust probe into Google as part of its retaliation against Trump’s fresh tariffs,” he added.Tensions between the United States and China have soared in recent days as the world’s two largest economies slapped a volley of import tariffs on each other.Analysts noted that China’s tariff response this week was relatively modest, providing some hope that a full-blown crisis could be avoided.”Everything seems to be in limbo on the tariff front, subject to change for better or worse,” said Briefing.com analyst Patrick O’Hare.”The market is trying to hold it together, offering some grace that there won’t be a worst-case tariff scenario that invites stagflation, yet it is fair to say that it is dismayed by the uncertainty all the tariff talk has generated,” he added.But “the problem with trade wars is they can escalate quickly, leading to potential issues such as inflation, job losses and even recession”, said Kate Marshall, lead investment analyst at Hargreaves Lansdown. Hong Kong’s stock market closed down nearly one percent, with e-commerce giant JD.com sinking almost four percent and rival Alibaba also falling.Shanghai dropped after it returned from a week-long break, while Tokyo reversed earlier losses. Amid uncertainty, gold hit a fresh peak of $2,877 an ounce as investors rushed into the haven metal.”The $2,900 level is now in sight for gold, as the metal’s impressive rally goes on,” said Chris Beauchamp, Chief Market Analyst at online trading platform IG. “Safe haven buying, central bank purchases and continuing softness in the dollar have made life much more amenable for the commodity, and if tariffs rear their head again we should see the metal make fresh gains,” he added.In other company news, shares in Japan’s Nissan fell around five percent following reports that the carmaker had decided to withdraw from merger talks with rival Honda.Shares in Honda soared more than eight percent by the close.- Key figures around 1630 GMT -New York – Dow: UP 0.1 percent at 44,607.62 pointsNew York – S&P 500: DOWN 0.1 percent at 6,030.92New York – Nasdaq Composite: DOWN 0.4 percent at 19,577.02London – FTSE 100: UP 0.6 percent at 8,623.29 (close) Paris – CAC 40: DOWN 0.2 percent at 7,891.68 (close)Frankfurt – DAX: UP 0.4 percent at 21,585.93 (close)Tokyo – Nikkei 225: UP 0.1 percent to 38,831.48 (close)Hong Kong – Hang Seng Index: DOWN 0.9 percent to 20,597.09 (close)Shanghai – Composite: DOWN 0.7 percent to 3,229.49 (close)Euro/dollar: UP at $1.0422 from $1.0383 on TuesdayPound/dollar: UP at $1.2519 from $1.2480Dollar/yen: DOWN at 152.20 yen from 154.32 yenEuro/pound: UP at 83.23 pence from 83.16 penceWest Texas Intermediate: DOWN 2.1 percent at $71.19 per barrelBrent North Sea Crude: DOWN 2.0 percent at $74.71 per barrelburs-rl/cw

Wed, 05 Feb 2025 16:56:09 GMT