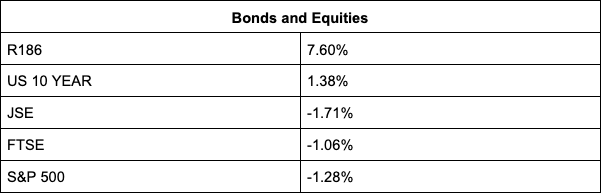

The JSE hung on to the 70,000-point mark by its teeth, losing 1.57% to end the day at 70,087.63 points as omicron fears and year-end volatility ignited a global market selloff.

Bloomberg reports as Europe’s biggest nations brace for more curbs to fight fresh waves of Covid-19 infections, the World Economic Forum postponed its annual Davos meeting, slated for mid-January, for a second year as the virus sweeps across Switzerland and the globe.

Back home, President Cyril Ramaphosa returned to work after recovering from Covid-19 and will chair the final Cabinet meeting of the year on 22 December.

As with any risk-off movement in the markets that could impact the global recovery, commodities were again the hardest hit, with Brent crude losing almost 5% to last trade under $70 a barrel at $69.43.

Palladium took a 2.71% punch to last trade at $1,740/oz, while platinum was selling for 1.38% less at $929.50 and gold for 0.23% less at $1,793.80/oz.

Implats lead the losses with a 5.49% slump, with Alphamin (-4.82%), Sasol (-4.11%), Gold Fields (-3.95%), DRDGold (-3.23%), Sibanye-Stillwater (-3.16%) and Exxaro (-3.06%) following suit.

African Rainbow Minerals was down 2.86% after an announcement by Angloplat (-2.73%) that it was set to offload its 49% ownership of Bokoni mine to ARM.

Healthcare and hotel stocks also felt the Covid brunt, with Aspen Pharmacare (-3.28%), Mediclinic (-3.13%), Tsogo Sun Gaming (-1.31%) and Sun International (-1.17%) all bleeding.

Ascendis Health slumped 7.32% after it was compelled by a court order to hold its AGM today.

Steinhoff was down 4.87% as investors took profits.

Textainer (+7.20%) and Karoo (+3.00%) lead the gainers as investors saw value in transport stocks.

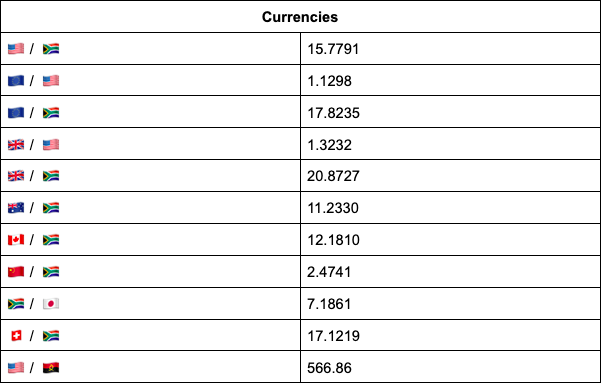

On the currency front, the rand staged a pre-Christmas rally as the dollar, alongside other developing currencies, lost its footing as omicron spooked markets.

“The US dollar has slipped back to the 1.13-level against the euro after starting the day around the 1.1250 level. This has given breathing room for EM currencies to strengthen against the greenback in the wake of the selling-off that is happening in other markets,” comments TreasuryONE.

The rand, which hit R15.73 in intraday trade before settling to last change hands at R15.76 against the US dollar, and the Mexican peso (Mex$20.74) were the two biggest emerging market gainers against the US unit.

The rand has continued its retreat from the R16.20-levels of last week, and with the trend now firmly in the local unit’s favour, it is not beyond the realm of possibility that the rand will test the R15.50s sooner rather than later, says TreasuryONE.

“However, the risk-averse nature that is starting to spread due to the omicron variant has started to infiltrate the global equity market and could bring a premature halt to the rand rally.”

Indicators as at 17:00

Source: TreasuryONE