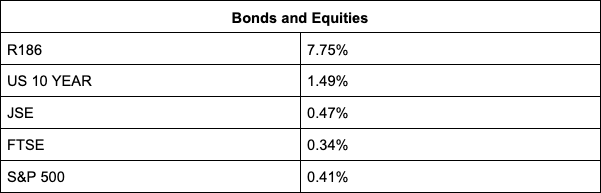

The JSE has filled its Christmas stocking with a further 0.46% gain to 71,684.10 points on a dose of positive Tencent news for heavyweights Naspers and Prosus and amid investor optimism that omicron may be less severe than previously thought.

Bloomberg reports Tencent surged 4.2% after the Chinese tech giant, in which Naspers (+1.09%) and Prosus (+3.02%) has a 29% exposure, in an unexpected move announced it plans to distribute more than $16bn of JD.com shares as a one-time dividend.

According to the report the payout stirred speculation that Tencent may be preparing to pare its holdings in a plethora of companies, including some of China’s biggest tech names, as it pivots to focus on overseas growth and new arenas such as the metaverse.

Another bourse heavyweight, Grindrod Shipping jumped 5.55% following an update on its share buybacks, while Anglo American (+1.02%) and BHP (+0.77%) offered support.

Steinhoff gained another 2.23% as it continues to attract investor interest following two big settlement agreements.

Among the losers were Aspen Pharmacare (-2.59%), Thungela Resources (-3.05%), Montauk Renewables (-0.95%), Vivo Energy (-1.79%) and Sasol (-0.72%).

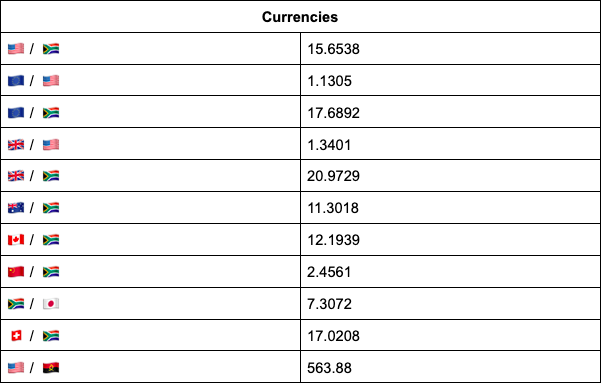

In the currency markets, the rand traded a little bit like a rollercoaster in a 10 cent range in thin liquidity conditions for most of the day, reports TreasuryONE.

However, the unit has fought back, breaking below the R15.65-level against the US dollar to last trade at R15.63, “with current momentum being in the rand’s favour”.

The primary movers today were a surge in the Turkish lira and improved investor appetite for riskier assets as omicron fears recede.

Reuters reports gains in the local currency were also supported by the South African health regulator’s approval of the use of the Johnson & Johnson’s vaccine for a second dose or booster, which could shore up protection against the omicron variant.

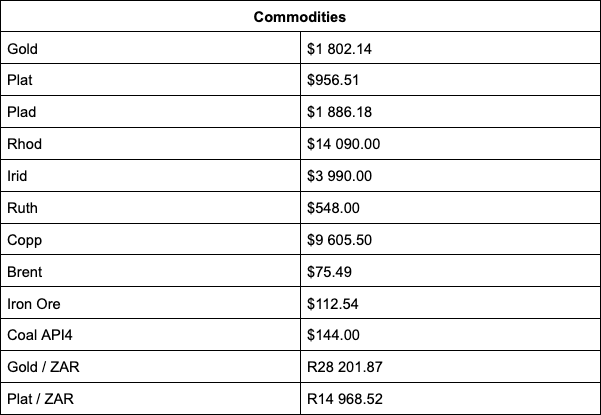

Commodities were subdued with gold lingering above the $1,800-level an ounce, with platinum trading at $956 and palladium at $1,884/oz.

Brent Crude moved higher to sell at $75.40 a barrel.

“A further boon for risky assets could be seen in the early trading performance of the US equity indices, with both the Dow and S&P 500 trading higher in early morning trade,” says TreasuryONE, adding that with low liquidity conditions and the rand having a little momentum, the unit may just extend its gains.

Indicators as at 17:00

Source: TreasuryONE