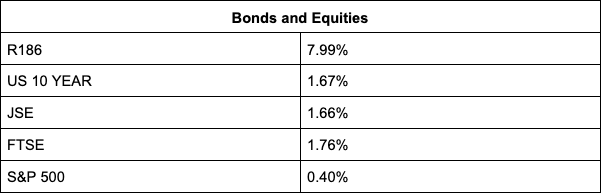

The JSE stormed to a new record above 75,000 points as it tracked gains in global stocks and investors piled into heavyweight value stocks across the board despite persistent fears over the spread of the omicron Covid variant.

The FTSE/JSE Africa All Share Index ended the second trading day of the year up 1.80% at 75,046.46 points, with the rand tripping over a stronger dollar.

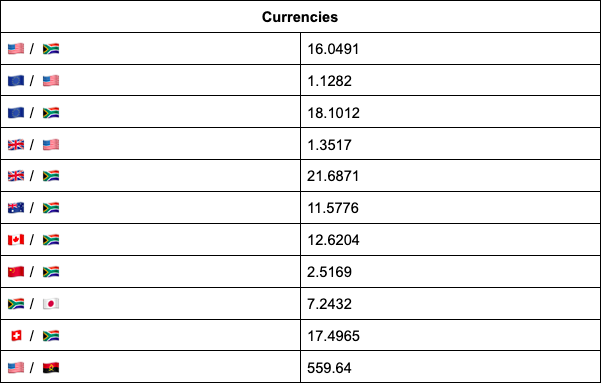

“With the new omicron virus hitting record levels of cases in the US, we have seen a bit of ‘risk-off’ in the market, with the rand slipping past the R16.00-level to trade at R16.05 against the US dollar at the end of local market trade,” comments TreasuryONE.

“Risk is definitely on the safe-haven side, and as we head into the FOMC minutes and non-farm payrolls later on in the week, it will be interesting to see whether the US dollar can hold on to its gains or extend them.

“We have seen the US dollar trading a little bit stronger in the face of the renewed virus worries, and this has caused EMs to weaken further.

With the current sentiment tilted towards risk-off, it will be no surprise if the rand tested weaker in the trading sessions to come as we head into the event risk of the week,” the forex trading house said in its daily market update.

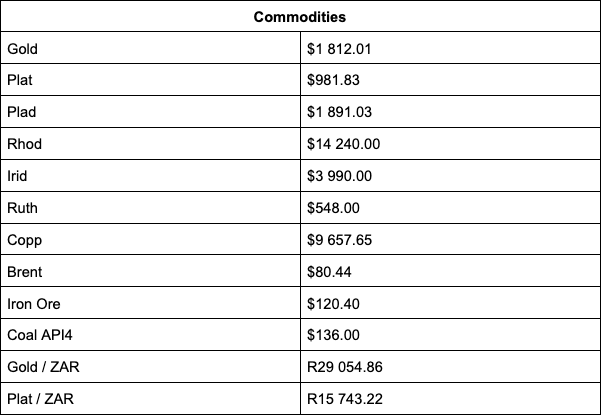

Commodities, however, turned losses into gains, with both platinum and palladium gaining more than 2% on the day to last trade at $980 and $1,890/oz respectively.

Gold was trading at $1,811, while Brent Crude pushed past $80 a barrel to last sell for $80.44.

Commodity counters Implats (+4.78%), Sibanye-Stillwater (+4.25%), Anglo American (+4.22%) and ArcelorMittal (+4.08%) were among the top gainers.

Thungela Resources jumped 4.32%, Glencore 3.73% and Exxaro 2.92% amid a surge in coal prices due to supply concerns as Indonesia, the world’s biggest coal exporter by far, considers banning exports in favour of domestic supply.

Rand-hedge heavyweights Richemont, Naspers, British American Tobacco added support, gaining 3.06%, 2.43% and 1.96% respectively.

Aspen Pharmacare gained a healthy 6.32%.

The gains follow a solid year for local investors, with the All Share index offering a return of 29%.

On the losing end, Karoo weakened 2.97% on profit-taking, Sappi sagged 3.14% and Telkom 3.00%.

Sasol failed to cash in on the boiling oil price, slipping 0.62%.

Indicators as at 17:00

Source: TreasuryONE