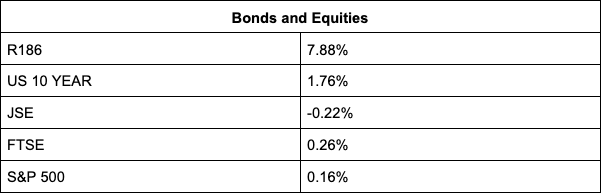

The JSE retreated for a second day, giving up more than a 1,000 points from its all-time high of 75,060.92 points reached on Wednesday after the US Federal Reserve spoilt the party with its hawkish monetary policy stance.

Asset manager Ninety One (-6.28%) led the losses in a mostly positive financial services performance. All the banks gained, with Standard Bank adding 0.99%, Absa 0.59%, FirstRand 0.29%, Capitec 0.12% and Discovery 0.41%. Nedbank was up 0.17% in brisk trade to the value of more than R87m as the bank refuted claims of wrongdoing after the state capture inquiry recommended that authorities investigate the bank and its employees for their alleged role in a “corrupt” contract involving Airports Company SA and the Gupta-linked Regiments Capital.

Investec (-1.08%), Sygnia (-0.96%) and Coronation (-0.45%) were on the losing end, contributing to the 0.30% dip in the All Share index to end the week on 73,939.71 points.

Health stocks were also bruised, with Aspen Pharmacare (-1.41%), Life Healthcare (-1.21), Netcare (-1.22%), Dis-chem (-1.40%) and Clicks (-0.83%) losing. Mediclinic was the exception, gaining 0.35%.

Mobile operators also slipped, with MTN leading the slide with a 2.71% loss, followed by Telkom (-2.18%) and Vodacom (-1.77%).

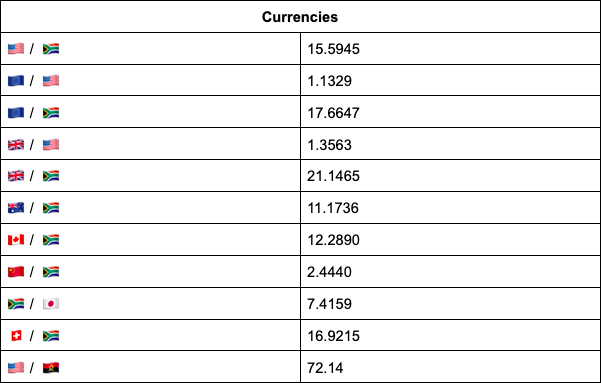

On the forex front, the rand broke below the R15.60-level against the US dollar on bets that the SA Reserve Bank may hike interest rates at the end of this month and again in March. For TreasuryONE the local currency has been surprising in its resilience given the Fed’s hawkish tone and the global reaction to the omicron variant.

“Today we saw the US non-farm payroll number come out well below expectations (199k vs 447k). Despite the major miss, other indicators like the unemployment rate and hourly earnings were well above expectations. This led to a muted response from the markets, with the US dollar trading steadily in a narrow band,” comments the forex trading house.

Sentiment is currently favouring emerging market currencies. “It will be no surprise for the rand to test the R15.50 level,” says TreasuryONE. The unit was last changing hands 1% firmer at R15.58/$.

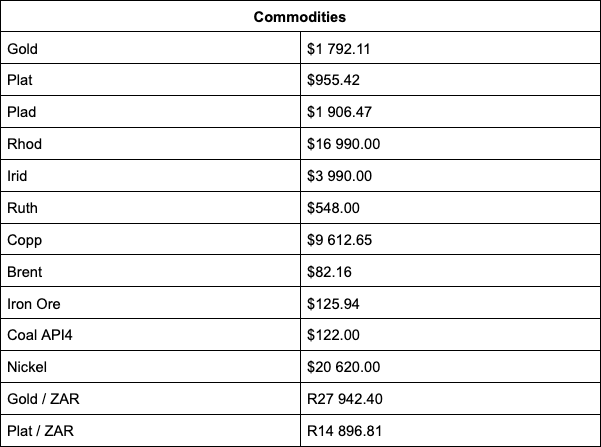

Commodities had a reasonably flat day, with palladium the only major mover gaining 2% to $1,906/oz. Gold ended the local market trade relatively flat at $1,790/oz and platinum at $955. Commodity gainers included Anglo American (+1.77%), RBPlat (+1.38%), Northam (+1.35%), Glencore (+1.29%) and BHP (+1.05%).

Aluminium products maker Hulamin, which specialises in rolled aluminium products, including for Elon Musk’s Tesla electric vehicles, added 5.66% as it continues to benefit from the skyhigh metals price amid a supply shortage.

Gemfields gained 7.67% after the gemstone supplier updated the market on the proposed sale of its interest in Sedibelo Platinum Mines, which owns and operates the Pilanesberg Platinum Mines in South Africa’s Bushveld Igneous Complex.

Sasol slipped 0.80% despite Brent crude selling for $82 a barrel.

Indicators as at 17:00

Source: TreasuryONE