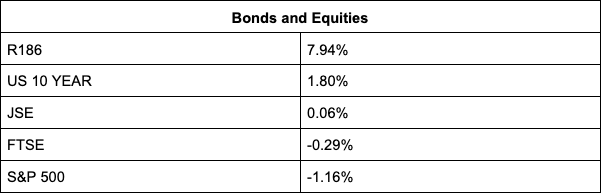

The JSE started the week where it left off on Friday, slipping another 0.15% to 73,830.47 points amid a rout in alternative energy and high-valued tech counters.

This is well off its all-time high of 75,060.92 points reached on 5 January but still higher than the 73,786.45-point close on the last day of trade of 2021.

Montauk Renewables (-4.86%) bled the most, with Renergen giving up 1.30%.

On the tech board Bytes Technology shed 4.37%, with Naspers and Prosus, which has exposure to Tencent, slipping 0.62% and 0.19% respectively.

This despite a 2.3% gain in the Chinese tech giant on reports that it is nearing a deal to acquire Chinese gaming handset maker Black Shark, a move that could help further its ambitions for the metaverse.

In a recent earnings call, Tencent President Martin Lau called the metaverse “a real opportunity” though he cautioned that the concept may take longer than expected to bring into reality, reports Bloomberg.

Naspers, which is likely to be the largest local victim of China’s crackdown on technology companies, fell 18% last year, its biggest single-year drop in more than a decade and a half, reports BusinessLive.

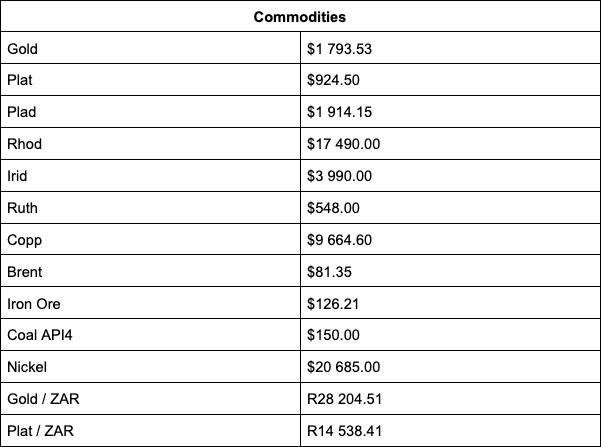

Commodity counters were mixed amid a flat to negative metals price performance, with platinum losing almost 3% to $925/oz, while gold and palladium were trading flat at $1,794/oz and $1,908/oz respectively.

Sasol surged 3.50% to come within a month-high as it finally caught up to the bubbling Brent crude price, which held firm above the $80 a barrel to trade at $81.48 at local markets close.

Tin producer Aphamin slumped 4%, steelmaker ArcelorMittal 3.85%, Alglo American 1.93% and Kumba Iron Ore 1.78%.

On the upside, Sibanye-Gold gained 4.18%, South32 2.93% and African Rainbow Minerals 2.04%.

AB Inbev added 3.46% to its recent upswing after the company announced a surprise push into the world of biotech.

Steinhoff gained 1.80% after announcing that US-based Mattress Firm has applied for a proposed initial public offering as part of a possible listing on the New York Stock Exchange.

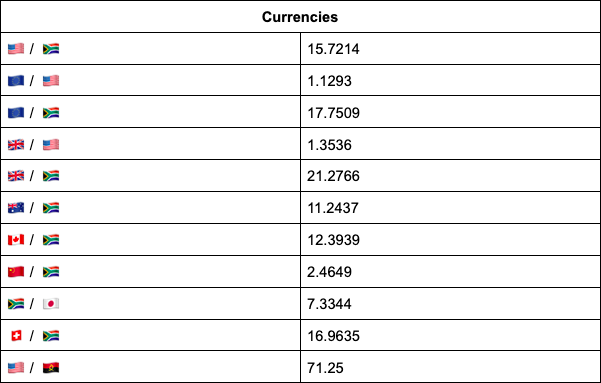

On the forex front, the rand gave up some ground as a stronger US dollar started to flex its muscle, weighing on emerging market currencies.

“The fact that the rand rebounded a little was almost expected after the way the local unit rallied last week on the back of little positive EM news flow or events. The rand has since broken back above R15.70 and seems very comfortable in the broader current range of R15.50 to R16.00,” comments TreasuryONE.

According to the forex trading house today has seen some ‘risk-off’ in the equity markets, with most of the major US equity markets down by close to 1% on the day.

“Whether we are starting to see global uncertainty due to the tightening of the Fed policy and the worry of inflation frightening the markets remains to be seen, but 2022 could be a rollercoaster. Things to look out for this week are the Fed Chair Powells testimony tomorrow and the US CPI print on Wednesday.”

Indicators as at 17:00

Source: TreasuryONE