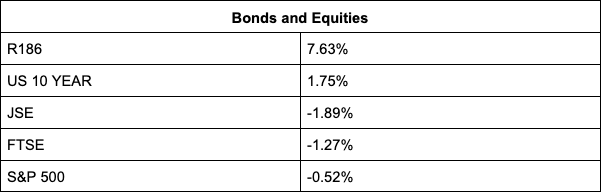

The JSE tracked its global peers lower as investors took profit and treaded cautiously ahead of imminent US interest rate hikes.

A no-mercy approach from China in its fight against corruption and Big Tech also weighed down local tech heavyweights, with a 7.33% slump in Bytes Technology, 2.93% in Naspers and 2.53% in Prosus helping to drag the JSE All Share index down 1.83% to 74,834.52 points from a record high of 76,233.26 points reached in the previous session.

Adding to the gloom was a 4.37% drop in deal-seeker BHP, luxury goods group Richemont (-3.71%), and vehicle retail and rental group Motus (-4.40%). Last year Motus gained a whopping 105%.

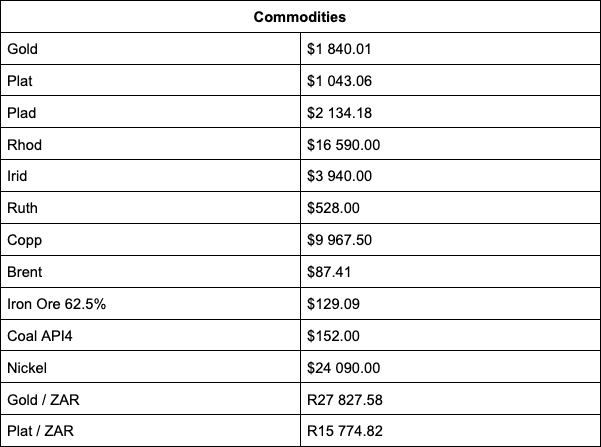

On the commodities front, palladium had a strong day, trading up 3% at $2,125, while platinum gained over 1% at $1,050, gold traded flat at $1,840 and copper broke above $10,000 a ton. This despite, commodity counters were among the biggest losers, with African Rainbow Minerals (-9.72%) leading the losses. ArcelorMittal (-5.41%), DRDGold (-4.35%), Anglo American (-3.21%), South32 (-3.19%) and Angloplat (-2.96%) followed suit.

Sasol slipped 0.60% as Brent crude traded just below $88 a barrel.

On the upside, tin producer Alphamin rallied another 12.50% after gaining 14.29% in the previous session on record high tin prices.

Retailers also staged a good performance, with Mr Price gaining 3.5%, The Foschini Group adding 4.19% and Truworths 1.07% after the trio all released upbeat trade updates. Spar (+2.16%) and Shoprite (+1.52%) also gained. Woolworths bucked the trend, losing 3.65%.

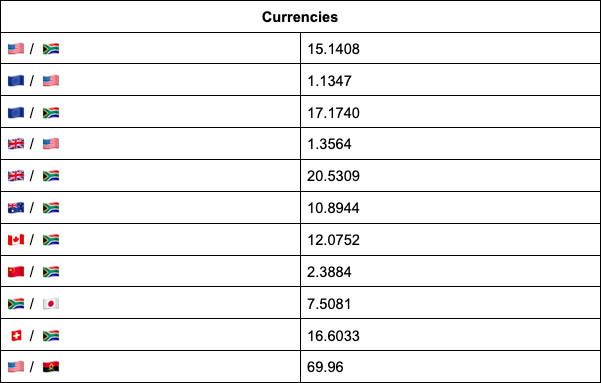

On the forex front, the rand rallied for a third straight day, breaking below the R15.10-level against the US dollar to last trade 0.93% firmer at R15.07/$ as the greenback slipped and traders bet on a local interest rate hike next week.

Also supporting the rand was South Africa getting an R11bn booster shot from the World Bank to fight COVID-19.

“We have had two rallies for a stronger rand since November 2021, and we have been trading in a downward trend since the high of R16.35. Some rotation out of the US into emerging markets helped the rand. Next week’s FOMC from the US and the local MPC will be key. We could also possibly see strong demand for USD heading into the month-end,” comments TreasuryONE.

Indicators as at 17:00

Source: TreasuryONE