The JSE tanked 3.57% to 72,164.02 points, a level last seen in almost a month, as risk-off sentiment dominated global markets amid rate hike jitters and growing political tensions in the Ukraine.

Bloomberg reports Russia’s troop buildup on the Ukraine border is now being cited by strategists as one of the main threats to global markets, even though President Vladimir Putin has repeatedly said he currently has no plans to attack.

Russia’s local markets took a beating, with the ruble tumbling as much as 2.8% against the dollar and leading declines in emerging markets.

In a bid to stem the drop, the central bank announced it would pause purchases of hard currency for its reserves, Bloomberg reports.

The negative sentiment spilled over to the rand, which came within touching distance of the R15.40-level after starting the day at around R15.10 against the US dollar.

At last count the local unit was trading 1.71% weaker at R15.36/$. “Last week, we spoke about the volume of foreigners entering the South African equity space, which was one of the root causes of the rand strength.

Today we saw a reversal in fortunes in the local equity market, with the JSE down more than 3%,” comments TreasuryONE.

The rand’s move was also exacerbated by the US dollar ending the session on the front foot.

“Across the EM chart, we have seen much of the same, with all of the rand’s peer currencies also giving up some ground today,” according to the forex trading house.

The US Federal Reserve is expected to signal its first interest rate hike in four years, paving the way for the first of a series of increases as early as March as the Fed tries to tame inflation.

Locally, market players have priced in a 25-basis-point hike on Thursday. TreasuryONE comments: “The market will take a closer look at the tone of which Fed Chair Jerome Powell speaks on Wednesday and whether the current expectation on when the Fed will start to tighten is still possible.”

Commodities stocks got hammered as analysts warned that any disruption to flows of metals, including palladium, nickel and aluminium could propel prices sharply higher, according to Bloomberg.

At the close of local markets, metal prices were a sea of red, with palladium the only major metal in the green, trading 1% up at $2,150/oz. Gold and platinum were quoted at $1,833 and platinum at $1,015/oz from an opening of $1,837.51 and $1,033.01 respectively.

The biggest commodity losers were Kumba Iron Ore (-8.73%), Sibanye-Stillwater (-8.21%), Northam (-7.14%), African Rainbow Minerals (-6.03%), Implats (-5.84%) and Anglo American (-5.62%).

Sibanye-Stillwater also ditched its $1bn acquisition of the Santa Rita nickel and Serrote copper mines in Brazil, walking away from assets that were key to its expansion into battery metals.

Burdened by the omicron surge in Australia, JSE-listed diversified miners South32 (-4.81%) and BHP (-2.94%) added to the commodities rout.

South32, which released a quarterly report, has cut its annual manganese ore output outlook from Australia, partly due to labour constraints, and said additional COVID-19 curbs in New South Wales could further impact labour availability in the first-half of 2022.

In turn BHP warned that 2022 copper production will be towards the lower end of its forecast and cut its annual metallurgical coal output outlook, partly due to labour constraints from COVID-19.

Sasol slumped 5.83% after Brent crude turned south.

“We did see Brent starting the day on the front foot with a run at the $90-a-barrel level looking to be odds on. However, after the opening bell in the US market, we have seen Brent joining most of the other metals in the red and is currently trading at $86.65,” comments TreasuryONE.

Heavyweight tech stocks also felt the brunt, with Prosus losing 2.57%, Naspers 2.63%, Multichoice 3.76% and MTN 4.17%.

Vodacom was down 0.52% in choppy trade, underperforming gains in parent Vodafone after the telecommunications group said it was exploring mergers with its key UK and Italian units.

The axe also fell on retail and bank stocks, with Richemont (-5.43%) and FirstRand (-2.74%) leading the losses respectively.

“US equity markets are also a sea of red, with the Dow Jones and the S&P 500 trading almost 2% lower since the opening bell. It seems that ‘risk-off’ is currently the central theme in the market, which does not bode well for risky assets like the rand in the short term,” warns TreasuryONE.

Steinhoff slipped 6.18% after the Western Cape High Court approved the embattled furniture retailer’s bid to have its R25bn settlement proposal made final and binding.

On the upside, tin producer Alphamin extended its robust run, adding another whopping 26.10%.

Other spots of green included RCL (+5.66%), British American Tobacco (+2.11%), Santam (+1.59%) and Dis-Chem (+1.13%).

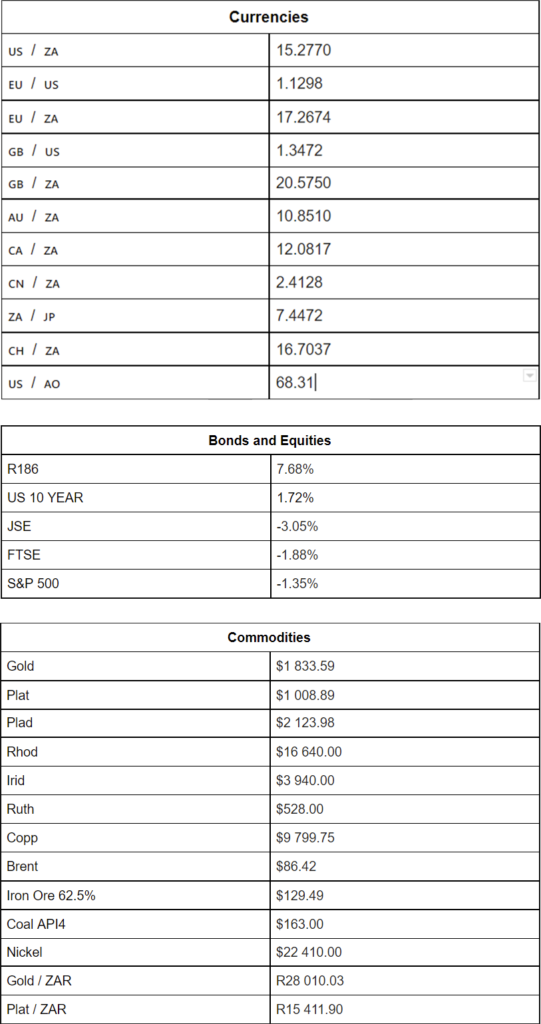

Indicators as at 17:00

Source: TreasuryONE