(Bloomberg) — Losses are mounting for investors who rode the once-hot trend of piling into stocks being pumped on social media platforms like Twitter and Reddit.

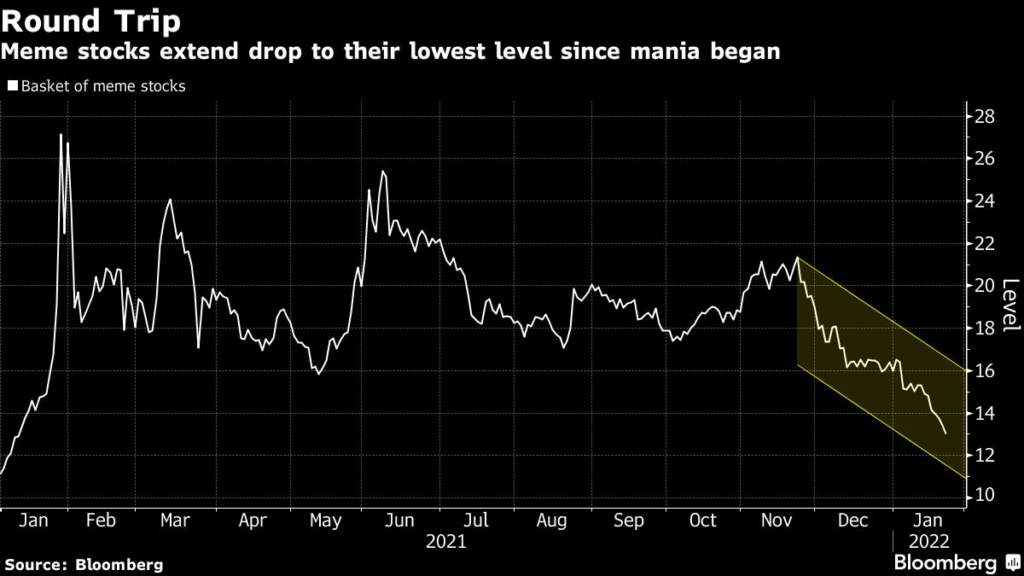

AMC Entertainment Holdings Inc. and GameStop Corp. tumbled Monday, bringing losses over the past two months to more than 50%, as investors dump the formerly high-flying meme stocks and companies that went public by merging with blank-check firms. A basket of 37 meme stocks tracked by Bloomberg fell 2.9% Monday, extending a now seven-day slide that has wiped out 15% of its value.

The companies that surged at the start of last year as their tickers populated forums like Reddit’s WallStreetBets and the trader chatroom Stocktwits have spiraled as investors bail on money-losing bets and riskier investments like cryptocurrencies.

Companies that went public by merging with special-purpose acquisition companies, known as SPACs, have been in a free-fall over the past 11 months. The De-SPAC Index, which tracks 25 companies, is down 65% from a February 2021 high, shedding more than a quarter of its value since the beginning of January alone.

(Updates share movement throughout for market close.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.