The JSE composed itself after a brutal global stock market selloff in the previous session as investors grappled with the triple whammy of imminent interest rate hikes, monetary policy tightening and increasing tensions between US and Russia over a possible invasion of Ukraine.

According to Bloomberg global equities at one point wiped almost $3 trillion, with the S&P 500 down more than 10% from a record high, before a dramatic reversal saw major US benchmarks end in the green.

But the historical rebound was short-lived as US stocks plunged anew this afternoon as the US Federal Reserve and the threat of war stoked volatility, according to Bloomberg.

“Equity markets remain under substantial pressure as the major stock exchanges in the US all opened up firmly in the red, with tech stocks leading the sell-off. It follows the risk-off sentiment seen during the Asian markets where the Shanghai index closed over 2% down,” according to TreasuryONE.

According to the Bloomberg report Goldman Sachs strategists warned that sharp monetary tightening to tame inflation could eventually have knock-on effects on economic activity, hurting stocks. The Fed is on Wednesday expected to point toward a rate hike in March.

The JSE, however, held its ground, gaining 0.21% to 72,314.81 points, as it received support from heavyweight commodity counters amid a mixed showing in metal prices. Platinum and palladium moved asymmetrically, with platinum the last trading down 1.06% at $1,021.54/oz “after markets turned bullish towards the demand for the metal”, and palladium gaining 1.24% to last trade at $2,175.07/oz, comments TreasuryONE. Gold has been relatively flat, trading 0.01% higher at $1,843.48/oz.

Angloplat led the gains, adding 3.84%, with Sibanye-Stillwater (+3.59%), Northam (+3.35%), Implats (+3.06%), Gold Fields (+ 2.91%) and Anglogold (+ 2.53%) following suit.

Sasol surged 3.68% after posting a 31% rise in revenue for the first half of fiscal 2022 as it benefited from higher crude oil and chemicals prices, refining margins and increased demand following the easing of Covid-19 lockdown restrictions. Brent Crude was still trading over $86 a barrel at local market close.

Motus also lent support with a 4.67% jump after the vehicle retail and rental group said in a trade update it expects interim profits (HEPS) for the six months to end-December 2021 to be between 45% and 55% higher despite global supply chain disruptions continuing to impact the delivery of vehicles and parts, with substantial increases in freight and logistics costs negatively impacting operating margins. The group said it will consider an interim dividend at its February Board meeting ahead of the release of the result on 22 February. The stock more than doubled in price last year.

Vodacom (+2.91%) and Multichoice (+2.52%) also added weight.

On the downside, curbing further gains in the All Share index, were tin producer Alphamin (-7.67%) which succumbed to profit-taking after a three-day winning streak and tech heavyweights Naspers (-3.77%), Bytes (-6.24%) and Prosus (-4.12%).

Steinhoff slipped 5.94% as the embattled retailer gears to start paying out investor claims following a court stamp on its R25bn settlement offer. Other retailers also on the receiving end were Truworths (-3.76%) and Pick n Pay (-3.24%)

On the forex front, the rand has been tracking within a narrow range for most of the day as traders await the start of the FOMC meeting tonight. “After giving up most of the gains from Friday, we are settling just around the 100-day moving average of R15.31. Other emerging markets have been on the back foot as well, with the rand still the strongest at the moment,” says TreasuryONE.

“For now, we expect the dollar to remain on the front foot until Fed chair Powell speaks tomorrow, leaving the rand to tread water at the same time.”

The local unit was last trading slightly firmer at R15.26 against the greenback.

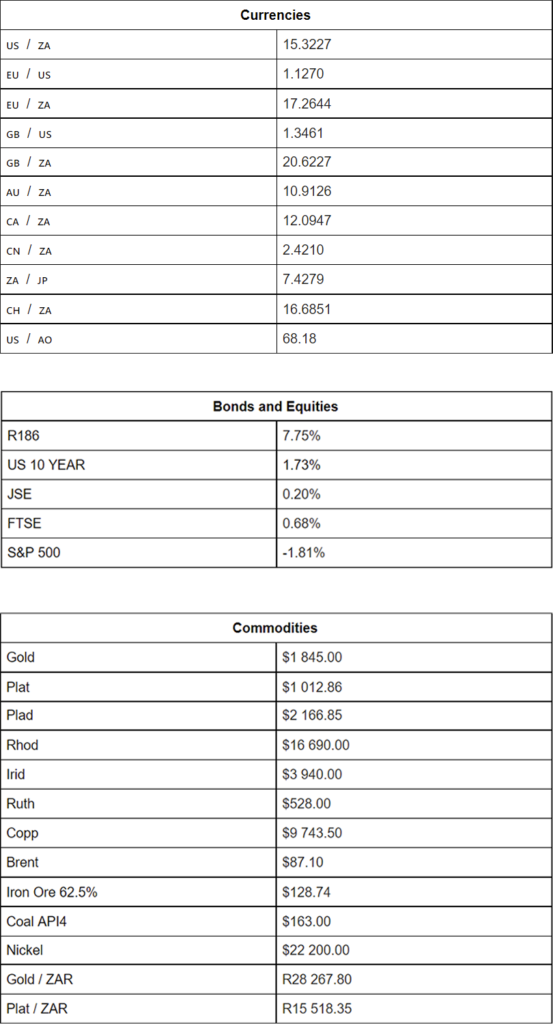

Indicators as at 17:00

Source: TreasuryONE