The JSE staged a strong comeback as investors fled to safe-haven commodities as tensions mounted in the Russia-Ukraine standoff, with the US urging citizens to “consider departing now”.

Sasol was a star performer, gaining 7.24% as Brent hit $90 for the first time since October 2014.

Bloomberg reports prices moved on supply jitters and mounting concern over a possible Russian attack on Ukraine, with US President Joe Biden saying he’d consider sanctioning Vladimir Putin if the Russian leader orders an invasion.

Precious metals traded mostly on the front foot, bar gold which has slipped on a banana peel in late afternoon trade, comments TreasuryONE.

The yellow metal was last trading 0.87% weaker at $1,832.12/oz, while palladium leaped 7.63% to $2,370.50/oz and platinum bounced 1.89% to $1,049.50/oz. At the end of the local market close platinum was trading $10 higher at $1,059.

“Platinum and palladium are normally sentiment-driven commodities, and the recent gain shows that markets are bullish on economies going forward,” says TreasuryONE.

Commodity stocks followed the move higher, with Angloplat up 6.29%, Sibanye-Stillwater 6.27%, Implats 5.98%, Kumba Iron Ore 4.60%, Northam 4.26% and Anglo 4.12%.

Harmony was an exception, losing 2.63% after the gold miner warned it would produce less gold than forecast for the 2022 financial year following damage this month to six kilometres of a conveyor at the firm’s Papua New Guinea mine.

A broader, mixed stock rebound also supported the 2.05% gain in the All Share index to end the day on 73,797.33 points, still some way off the bourse’s all-time high of 76,233.26 points reached last week.

Major movers included commercial landlord Hammerson (+7.98%), MTN (+6.84%) and investment holding company Transaction Capital (+6.15%).

Heavyweight rand-hedges Richemont (+3.63%) and Naspers (+0.83%) also propped up the bourse.

On the downside, private hospital stocks Netcare and Mediclinic lost 3.65% and 2.28% respectively, while drug retailers Clicks (-6.42%) and Dis-Chem (-2.07%) also weighed.

Clicks held its AGM today.

On the forex front, the US dollar was on the front foot for most of the day. This despite, the rand trended down, hitting R15.12 in intra-day trade before trending back up to last trade at R15.22/$.

“The see-saw nature of trading only shows the uncertain nature of the market regarding the FOMC meeting tonight, and we can expect a bit of volatility during and after the announcement tonight, depending on what Fed chair Jerome Powell says.

We do not expect a move on interest rates in this meeting but will look for hints in his comments for a potential hike in March,” comments TreasuryONE.

Source: TreasuryONE

Source: TreasuryONE

“Looking at the USD/ZAR graph, the rand has been trading in an uptrend since the lows we saw in June 2021.

For now, the pivotal support is at R15.07 and resistance at R15.31, which is the blue 100-day moving average. Our expectation is that the support will hold in the short term, and if the Fed remains hawkish on their stance, we could test above the R15.31 level towards R15.50,” says the forex trading house

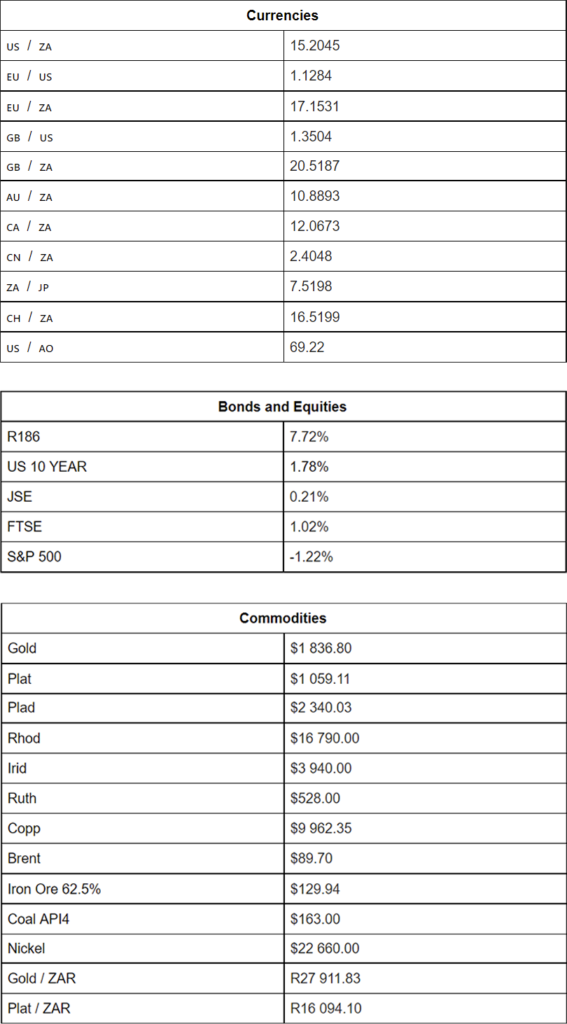

Indicators as at 17:00

Source: TreasuryONE