(Bloomberg) — The post-earnings meltdown in shares of Meta Platforms Inc. aside, Wall Street’s biggest technology companies from Apple Inc. to Microsoft Corp. have reminded investors why the stocks have been favorites for years.

The results reported in the past 10 days surpassed already-high expectations, sending their shares surging despite jitters over the prospect of tighter Federal Reserve monetary policy.

Apple set a record for the biggest single-day increase in market value gain for a U.S. company last week.

What’s more, analysts lifted their earnings estimates on Apple, Microsoft and Google owner Alphabet Inc.

after their results, and similar moves are likely to follow Friday for Amazon.com Inc. Search giant Alphabet posted the strongest revenue growth of the group at 33%, followed by Microsoft and Apple.

“We’re in a environment of supply chain problems, inflation concerns and coming out of a pandemic where people aren’t sitting at home anymore,” Jon Maier, chief investment officer at Global X Management, said in an interview.

“Companies like Apple and Google, they’ve been able to navigate some of these issues and show growth and the market is rewarding them.”

Meanwhile, Facebook parent Meta’s fall from grace — recording the biggest-ever market value loss — showed that investors stand ready to punish these decade-long favorites if they don’t deliver.

The move sent Meta’s valuation cratering to 16 times projected profit, its biggest-ever discount to the Nasdaq 100 Index.

To be sure, investors have to be willing to put up with volatility: Amazon is up 10% in early trading Friday, but that comes a day after it fell 7.8%, and Snap Inc.

is soaring 40% at the open after sinking 24% Thursday.

Here’s a look at how the market has greeted megacap tech earnings:

- Microsoft: Analysts see the company earnings $9.48 a share this year, up 1.5% since the company reported earnings Jan.

25. The stock is up 4% since the results versus a 2.3% gain for the Nasdaq 100. Analysts’ price targets have barely budged, and Wall Street sees the stock gaining 24% over the next year.

- Apple: Brokers have boosted their earnings estimate to $6.06 a share this year, up 5.8% since the earnings Jan.

27. The stock is up 7.6% since then, while analysts’ price targets rose 5%. Wall Street sees the stock gaining 11% over the next year.

- Alphabet: Analysts see the company earnings $124.75 a share this year, up 1% since Tuesday’s earnings.

The stock is up 2.5% since the results, while analysts’ price targets are up 2.7%. Wall Street sees the stock gaining 24% over the next year.

- Meta: Street predictions for 2022 earnings per share have dropped 5.3% since Wednesday’s earnings bombshell, and the price target for the stock has fallen 12%.

Looking on the bright side, after the plunge, analysts now see 41% upside for the stock in the next year, versus 18% previously.

- Amazon: Analysts have already raised their 2022 earnings estimate by 1.3% in the wake of Thursday’s report.

Analysts’ price targets have hardly changed, and Wall Street sees the stock gaining 36% over the next year.

Tech Chart of the Day

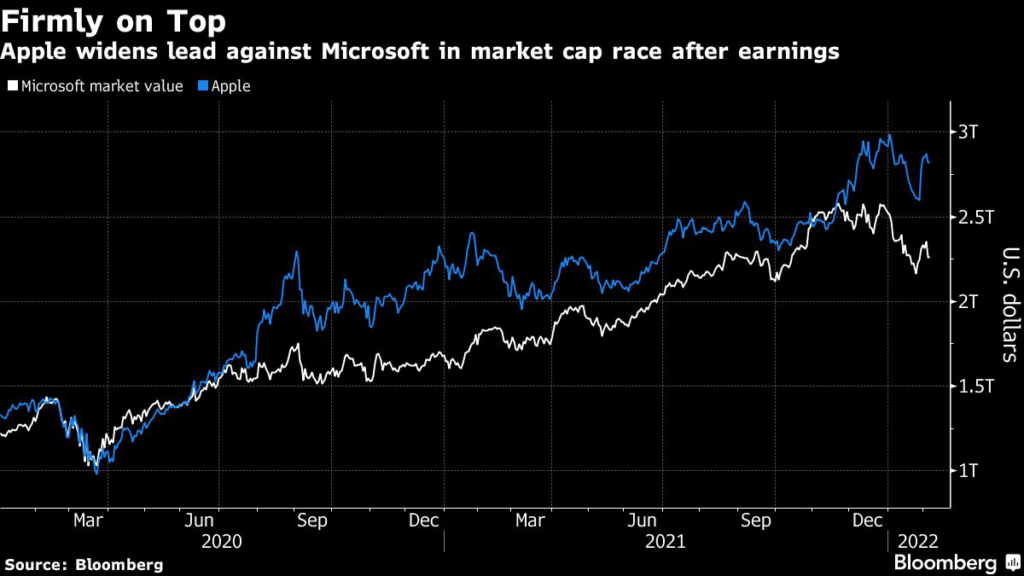

Apple’s blowout quarter followed by a record-setting market value gain late last month has now widened its lead against Microsoft in the race to be the world’s most valuable company.

Microsoft had briefly dethroned Apple in the last quarter of 2021.

Top Tech Stories

- Toshiba is considering changing its plan to split into three companies and may divide into two instead, TV Tokyo reported

- Meta CEO Mark Zuckerberg told employees at a company-wide virtual meeting that it’s important to focus on expanding Facebook’s short-video product

- Snap and Pinterest rallied after their quarterly results eased fears that a slowdown at rival Facebook reflected a broader slump for social media

- Activision Blizzard reported earnings and revenue that missed analysts’ estimates just weeks after Microsoft announced its $69 billion acquisition of the video-game publisher

- Chart patterns for the Nasdaq Golden Dragon China Index are starting to suggest the equity gauge may extend a recent revival

- Saudi Arabia’s sovereign wealth fund deepened its bet on video games, fresh from the face-saving deal that turned around its investment in Activision Blizzard

(Updates prices throughout)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.