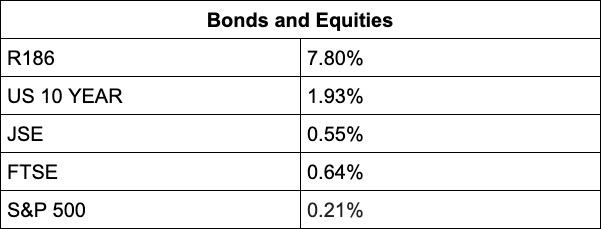

The JSE started the week off on the front foot, gaining 0.63% to 75,679.56 points on the back of stronger high-value and commodity stocks.

Metals prices were mixed – platinum and palladium were trading on the back foot and were last quoted 0.54% lower at $1,021/oz and 1.79% weaker at $2,253/oz respectively.

Gold stood its ground, gaining 0.34% to last trade at $1,814.70/oz. This despite high-value commodity stocks buoying the bourse included Anglo American (+2.21%), Implats (1.20%), BHP (+2.37%), Sibanye-Stillwater (+0.10%) and Gold Fields (+1.04%).

Platinum peers Angloplat (+1.84%) and RBPlat (+0.20%) also gained. African Rainbow Minerals was an exception, losing 0.93%.

Bloomberg reports that oil took a breather from a rally that pushed it into overbought territory, with futures in New York falling as much as 1.7% as diplomats prepare to return to Vienna to resume Iran nuclear negotiations, which are viewed as a path to restore the nation’s sanctioned oil to global markets.

Sasol slipped 1.96%, while Thungela Resources surged 4.40%.

Adding support were rand-hedges Prosus (+0.73%) and Richemont (+0.41%), food group RCL (+4.07%), private hospital group Mediclinic (+3.50%) and financial services counters Investec (+2.98%) and Liberty (2.90%).

Weighing on the downside was Telkom, tripping 7.06% after the telecoms firm said it grew its mobile base by just 10% year on year in the third quarter of its financial year to 16.4 million – the prepaid base climbed by 12% and post-paid by 1.8%.

Still reeling from the listeriosis crisis, Tiger Brands lost 2.87%, while PSG slumped 4.00%, Momentum Metropolitan 3.07% and Naspers 0.17%.

Growthpoint, South Africa’s biggest listed property company, lost 0.57%. The group announced that it teamed up with BlackBrick Hotels and office parks developer Setso Property Fund to convert a luxury office park into swanky apartments.

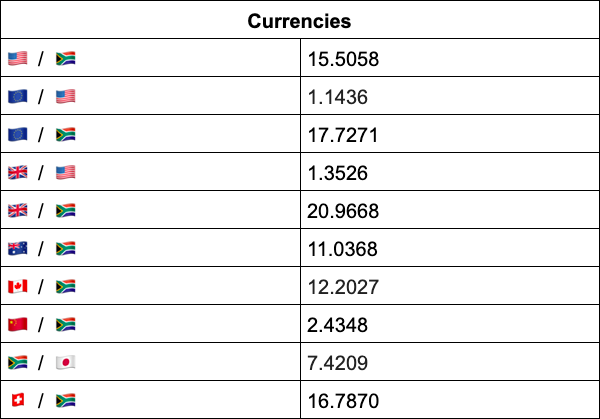

On the forex front, the rand traded slightly weaker at R15.50 against the US dollar “on what we feel is mainly on the back of a weaker Yuan fixing”, comments TreasuryONE.

“Volatility across the currency market has died down a bit after the payroll numbers on Friday, and focus now turns to the much-debated inflation topic when we have CPI in the US on Thursday.”

Indicators as at 17:00

Source: TreasuryONE