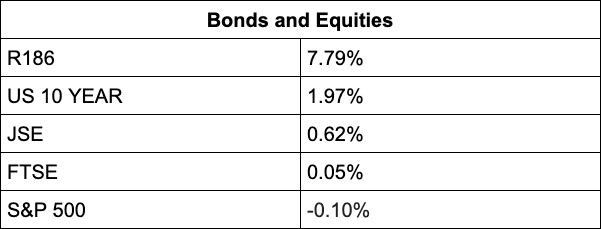

The JSE is showing that share investing is not a sprint as it continued its marathon run, adding 0.54% to breach 76,000 points. The last time the JSE was trading above this level was almost three weeks ago when it hit an all-time high of 76,233.26 points. The gains were broad based.

RCL Foods soared, adding another 11.51% to its 4.07% gain in the previous session after the foods and logistics group said it expects half-year profits to be up to 27% higher compared with the previous comparable six months to end-December.

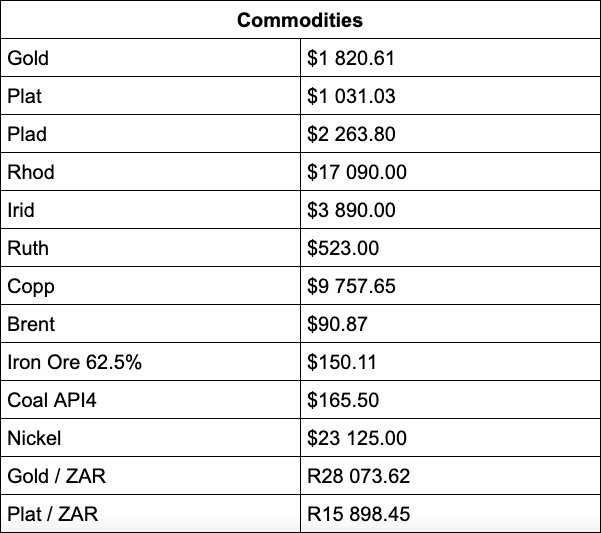

South32 surged 4.59%, hitting an all-time high as commodity prices continue to perform strongly and the diversified miner’s production levels for several businesses keep rising. South32 produces among others aluminium, bauxite, metallurgical coal, lead, nickel, manganese, silver and zinc, and will soon also have exposure to copper.

A late rally in commodities – gold has climbed back above the $1,820-level and was last trading 0.40% higher at $1,827.85, while platinum (+0.73%) and palladium (+0.44%) were last trading at $1,032.00 and $2,279.57 per ounce respectively – also boosted Eastplats (+11.36%), Gemfields (+10.14%), Gold Fields (+3.60%), Anglogold (+3.49%) and Kumba Iron Ore (+2.58%).

Top-value mining counters Anglo American (+1.53%), BHP (+0.55%) and Glencore (+0.78%) also lent support, while Jubilee Metals jumped 8.13% after posting solid operations in its second half trade update.

Coming to the party were Sappi (+3.78%), Old Mutual (+3.62%), Remgro (+3.22%) and British American Tobacco (+1.87%).

Leading the downside were tech heavies Naspers (-1.19%) and Prosus (-1.79%), Sasol (-0.39%) which tracked the oil price (last quoted at $90.80 a barrel) lower, high-end luxury goods group Richemont (-1.79%) and CarTrack owner Karooo (-3.63%). Sasol also cautioned in a trade update that operational challenges impacting its interim performance could see headline earnings per share drop by as much as 26% when it reports its results later this month.

Alphamin slumped 10.53% as investors took profits after the tin maker’s recent robust run.

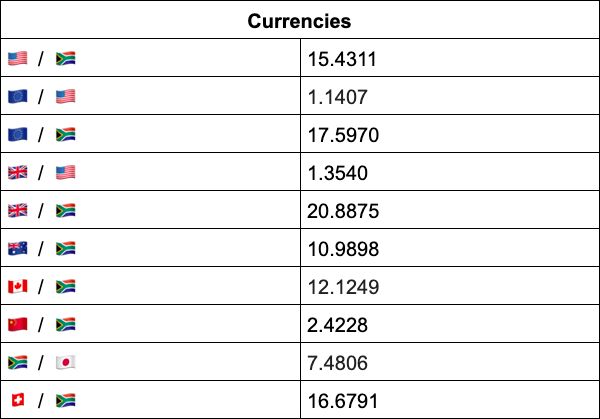

On the forex front, the rand raced to R15.35 against the US dollar in after-market trade, reaffirming “our belief that the rand is trading in an R15.10 – R15.60 range”, comments TreasuryONE.

“The US dollar flirting with the 1.1400-level against the euro in early trade caused a little bit of a fright in EM currencies. It has since gone back to the 1.1420 level, which has calmed markets slightly.

The rand edging toward the R15.60-level but backtracking as the dollar subsided gives an indication of what the rand will do given any noteworthy US dollar strength, says TreasuryONE. “With the US CPI number coming in later this week, it is a thing to keep in the back of our minds,” cautions the forex trading house.

Indicators as at 17:00

Source: TreasuryONE