(Bloomberg) — How exposed to Chinese stocks is your portfolio? The answer could be: more than you think.

An indexing boom that’s gone on for over a decade has coincided with China’s emergence as the world’s second-biggest economy, a confluence that’s driven trillions of dollars into its burgeoning equity market — often via passive funds.

These products track gauges like the MSCI Emerging Markets Index, where the weighting for mainland- and Hong Kong-based stocks has doubled in 10 years to about 35%. Or the MSCI Asia Pacific Index, where their shares account for over a quarter of the market value of all members.

In other words, the passive era has put untold billions at the mercy of Beijing’s zeal for reform.

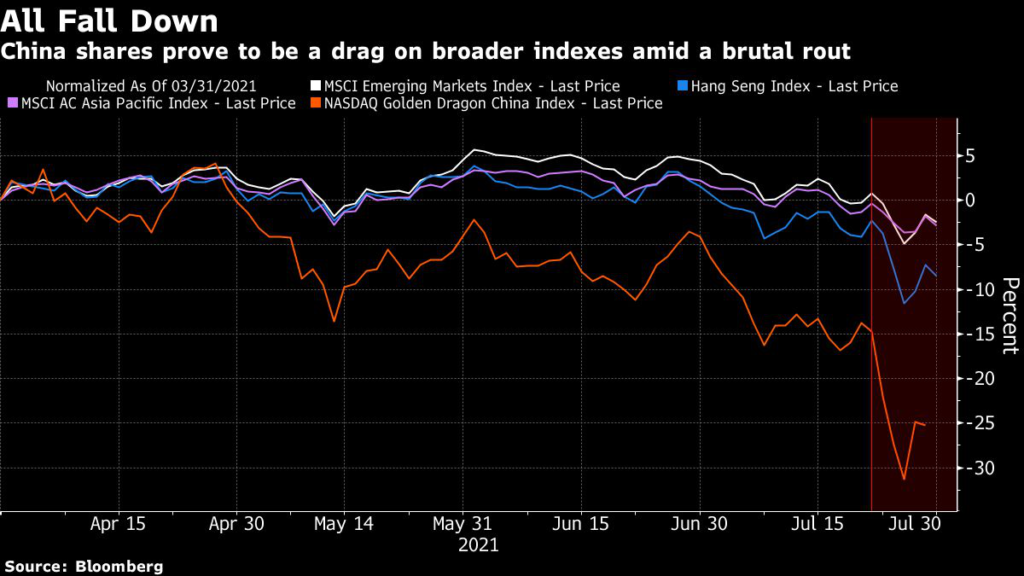

Investors are now getting a reminder of just what that means. A government crackdown on sectors ranging from education to technology wiped out about $1 trillion off Chinese shares listed on the mainland, in Hong Kong and the U.S. over the past week.

As losses mounted, investors exited. They’ve pulled $4.9 billion from China-focused equity ETFs in 2021, the highest net outflows in the world, according to data compiled by Bloomberg.

Yet to be completely insulated would mean ditching all manner of broader index vehicles, and that’s reopening the debate about the inclusion and weighting of Chinese securities in major gauges.

“If you’re a passive investor and you want something that’s a reliable rate of return, something steady and unsexy to play one of the major markets in the world, the risk that a portion of that portfolio goes to zero by government edict overnight — it’s just really risky,” said Soren Aandahl, Texas-based founder of short-selling firm Blue Orca Capital.

“If people that are constructing passive indexes are doing their job properly, they’re going to have to price the risk premium of what just happened going forward.”

‘National Team’

In fact, index providers have grappled with the issue for years.

The risk of the Xi Jinping-led government’s heavy hand is well known, yet many global investors want exposure to the world’s second-largest equity market and its fast-growing economy.

So the likes of MSCI Inc., FTSE Russell and S&P Dow Jones Indices LLC spent years gradually increasing the presence of Chinese stocks in their gauges.

The process was fraught with delays amid concerns over things like capital controls and transparency, issues which persist in a market where a “national team” of state-backed funds still intervenes when needed.

Spokespersons for FTSE and S&P declined to comment on what the latest turmoil might mean for China’s presence in indexes.

An MSCI spokesperson said that it’s “hard to foresee the impact of the ongoing market actions as market volatility always exists.” The firm monitors regulatory changes “that may have an impact on the accessibility of markets and investability of securities included in its indexes.”

Bloomberg LP, the parent of Bloomberg News, competes with these firms to offer indexing and financial data.

Advantage Active

At Goldman Sachs Group Inc., the past week has left some clients wondering if the country’s stock market has become too dangerous. “‘Uninvestable’ has featured in many of our recent conversations with clients regarding investing in Chinese stocks,” the bank’s strategists wrote in a note.

Meanwhile BlackRock Investment Institute strategists have recently started to treat China’s market in its own category, outside of both emerging and developed markets.

Of course, to experienced emerging-market investors, volatility fueled by the Chinese government is nothing new.

Some fund managers point out that Beijing tends to be “anti-cycle,” stepping up policy action when the macro environment appears to be improving.

The implication is you can avoid the worst losses, if you are prepared or can move fast. That hands a potential advantage to active managers.

Famed thematic investor Cathie Wood is the perfect example. Her firm, New York-based Ark Investment Management, slashed its exposure to Chinese tech companies before the worst of the rout.

“What has happened in China validates the need for active management more than ever,” Cesar Perez Ruiz, chief investment officer at Pictet Wealth Management in Geneva, said in an email. Stock pickers “will be able to quantify the regulatory risk and be able to extract further value out of it,” he said.

By ditching the index, investors can instead focus on companies — often smaller — where industry policies are more supportive.

There was evidence of that this week, as traders loaded up on semiconductor and electric-vehicle maker stocks such as Semiconductor Manufacturing International Corp. and BYD Co.

Ride the Storm

For China bulls, there’s another way to view the recent turbulence.

The policies unveiled in recent weeks aim for greater access to education, more competition and improved workers’ rights, and aren’t a complete surprise given the Communist Party’s goals of better social and economic outcomes under the latest Five-Year Plan.

They could ultimately help strengthen the economy, and lead to a stronger market — which a broad passive strategy would be well-placed to capture.

However it’s clear the pace of regulatory change has caught investors off guard. That will force many to take a closer look at just how exposed they might be to future shocks.

“We believe a thoughtful and thorough re-evaluation is warranted before any portfolio decisions,” said Vivian Lin Thurston, portfolio manager at William Blair Investment Management. “Especially given the meaningful implications of this development on global investments in China overall.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.