The JSE slumped 0.81% to 75,765.16 points as a slide in JSE heavyweights Naspers and Prosus wreaked havoc and investors monitored developments in the Russia Ukraine standoff.

Naspers and Prosus, which has a 12% weighting in the bourse, got hammered 4.61% and 3.44% respectively after India banned 54 apps of Chinese origin citing security concerns, including Sea’s marquee game Free Fire. Tencent, in which the JSE-listed pair have a 29% exposure, is Sea’s largest shareholder.

Bloomberg reports however, that while Tencent is the biggest shareholder, it has adopted much the same hands-off approach it takes with other investees in China. In January, the WeChat operator revealed it was cutting its stake in Sea to 18.7% from 21.3%, while taking its voting rights eventually to under 10%.

Free Fire, the battle royale shooter often compared with PUBG, is among the world’s most popular mobile games with more than a billion downloads on Google Play and the highest grossing mobile game in India in the third quarter of 2021, according to Bloomberg.

Adding to the gloom was a spectacular 18.74% slide in construction and engineering group Aveng following a profit warning. At one stage the shares were changing hands 35% weaker after Aveng cautioned that headline earnings per share is expected to be up to 95% lower in the six months to end-December 2021 compared to the previous comparable period as Covid-19, the July riots, a steel industry strike and a global shortage of semiconductors impacted operations.

Dis-chem dipped 2.99% after the pharmacy group posted revenue growth of 15.3% to R12.7bn in the 21 weeks from 1 September 2021 to 26 January 2022. It said as a result of the less severe Omicron-variant fourth wave, sales growth of preventative healthcare products, including vitamins and nutraceuticals were muted during December and January.

The group also said that following six months of high demand for vaccinations, it has seen subdued vaccination demand since early December 2021, and notwithstanding booster eligibility, it expects vaccination demand to remain muted. During the 21-week period, Dis-Chem administered 895,000 Covid-19 vaccine doses, contributing R341m to retail revenue, with approximately 50% of this contribution coming from standalone mass sites. Excluding vaccine contribution, retail revenue increased by 12%.

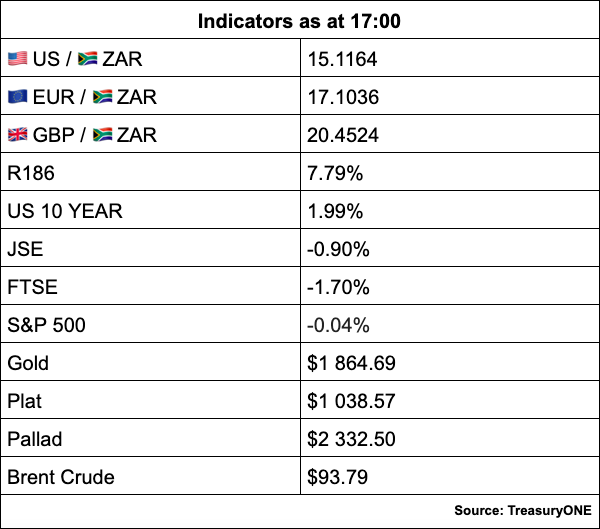

Commodity counters were among the biggest winners as investors rushed to take cover in precious and industrial metals amid escalating geopolitical tensions over Ukraine. Gold regained momentum in afternoon trade after sliding a little on the Fed comments and US dollar strength, with the yellow metal last trading at $1,865 per ounce.

Platinum and palladium also pushed higher – closing local trade at $1,035 and $2,336 respectively.

Gold Fields gained 10.96%, Anglogold 8.33%, Harmony 6.36%, Sibanye-Stillwater 4.76% and Implats 1.94%. Anglo American was down 0.48%.

Sasol surged 4.07% as Brent Crude traded at a multi-year high of $96.16 before retreating to last trade at $94.20, with the commodity still “under pressure as the Russia/Ukraine conflict weighs heavily on the price”, comments TreasuryONE.

On the forex front, the rand flirted with the R15.10-level against the US dollar despite the dollar-boosting comments by Federal Reserve Bank member James Bullard that the Fed should front-load hikes to keep its credibility. “With the Fed affirming its hawkish stance, we could see a situation where the US dollar pushes stronger and starts impacting risky assets like the rand. So far, EM currencies have surprised with their resilience. Still, with the Russia/Ukraine conflict on the forefront, and hawkish Fed commentary doing the rounds, EM currencies could start finding gains harder and harder to come by,” says TreasuryONE.